We began 2021 in lockdown, witnessed the rollout of various Covid-19 vaccines, England made it to the final of the UEFA European Football Championship and now people are even getting their boosters. This year has been a lot better than 2020 on many counts.

Each quarter, Bonhill Intelligence tracks the forward-looking investment attitudes of UK fund selectors, and over the past year we have noted some interesting shifts. Here we have highlighted some of the more interesting data.

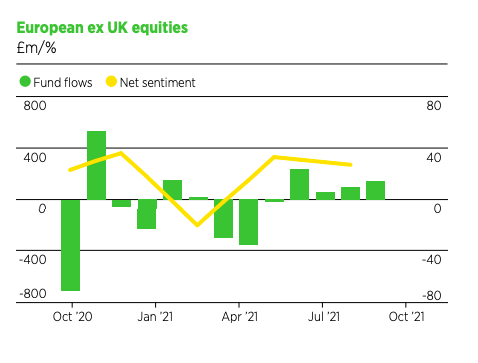

European equities ‘one to watch’

Over the past 12 months there has been a swing in opinion when it comes to European equities. Back in March, our respondents lost interest in this asset class, and it moved into the red for the first time in months.

Then, between April and June, we saw net outflows, with the sector losing more than £600m.

In recent months, however, demand for European equities is back. Not only is this asset class now a firm favourite among our UK audience but there have also been significant net inflows. We believe this will be one to watch in 2022.

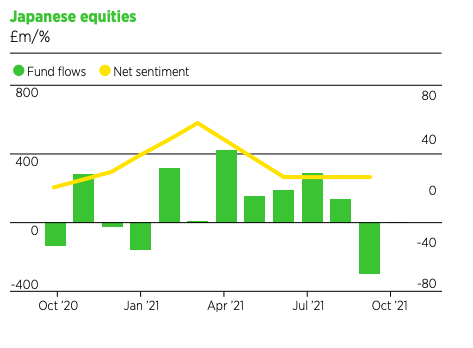

Sentiment toward Japan sours

There has also been a significant shift in demand for Japanese equities. In March, around 50% of UK respondents said they were planning on increasing their allocation to this asset class. Indeed, since then, between April and August there were significant net inflows.

Despite this, demand among our UK audience fell slightly, though there are still more buyers than sellers about.

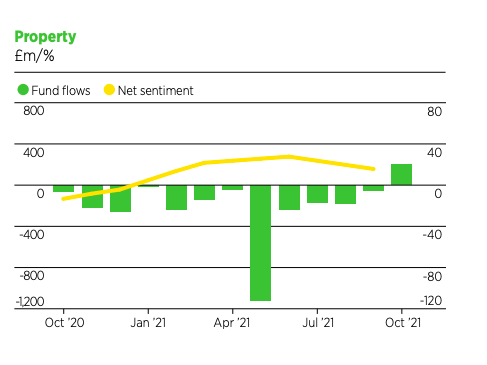

Investors warm toward property

Bonhill Intelligence has reported on the ever-changing attitudes towards property over the past couple of years and this year was no different.

Despite significant net outflows throughout much of 2021 – £2.2bn between January and September – our UK respondents reported a slight uptick in demand, with flows increasing in October.

In March, more than a quarter of UK investors were looking to increase their allocation to property. However, this spike appears to be an anomaly, with the net sentiment soon returning to settle at quietly net positive.

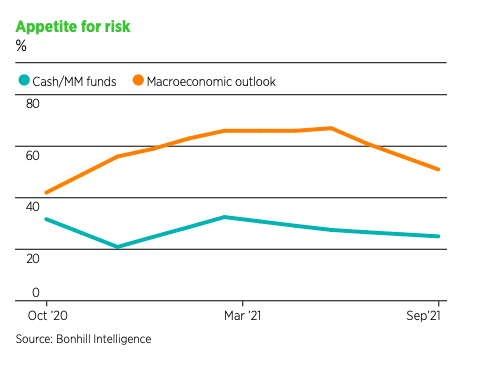

Appetite for risk

Finally, UK fund selectors’ appetite for risk changed in 2021. Looking at the macroeconomic outlook, in the past three months there has been a significant dip in the number of optimists. Despite this, more than half (51.1%) maintain a positive macroeconomic outlook.

This positivity is reflected in investors’ allocation to cash and money market funds. Despite the slight uptick in cash allocations between January and March, since then there has been a steady decline.

This move away from cash suggests investors are looking to take on more risk and, as we head into the New Year, their outlook remains largely positive. We hope 2022 will follow a similar trend.

If you would like to discuss this data or subscribe to our quarterly report, please contact lottie.mcgurk@bonhillplc.com