UK dividends fell 8.4% to £31.4bn in a “weaker than expected” Q3, largely driven by declining pay-outs in the mining sector, according to the Latest UK Dividend Monitor report from Link Group.

Adjusted for the departure of Aussie-headquartered mining giant BHP from the London Stock Exchange back in January, however, UK dividends actually rose 1% year-on-year, with a 49.3% increase worth £2.7bn from the banks and financials sector making the largest positive contribution.

Special dividends were down 43% compared with Q3 2021, slumping to £3.3bn in the third quarter of this year on the back of the end of the boom in metal mining.

The underwhelming quarterly results came in part due to “softness” in consumer basics, while a 21.3% decline in mining pay-outs shaved 7% off the headline growth rate as the sector’s pay-outs fell from record highs.

The report also highlighted the “exceptional” weakness of the pound as a factor, as it “enormously flattered the figures” due to many dividends being declared in dollars.

Dividends had risen to a near record-breaking £37bn in Q2.

Ian Stokes, managing director for corporate markets UK & Europe at Link Group, said: “The economic backdrop in the UK and for the wider world has deteriorated markedly in the last three months. The sharp increase in bond yields has huge implications for asset prices, asset allocation, personal finances, and government deficits. For the first time in more than a decade, the UK 10-year gilt yield has risen above the yield on UK equities, even if only briefly. Suddenly income investors have more choice.

“Nevertheless, the high yield of the UK stock market signifies that more of the value of UK equities is grounded in the stream of dividends it provides. Although this also reflects a lower growth profile for UK Plc than, say US Inc, it also makes capital values less sensitive to rising longer term bond yields. Moreover, we do expect UK companies to continue to deliver dividend growth over the medium and long term, which provides a level of insulation against the rising cost of living.”

Optimism for 2023

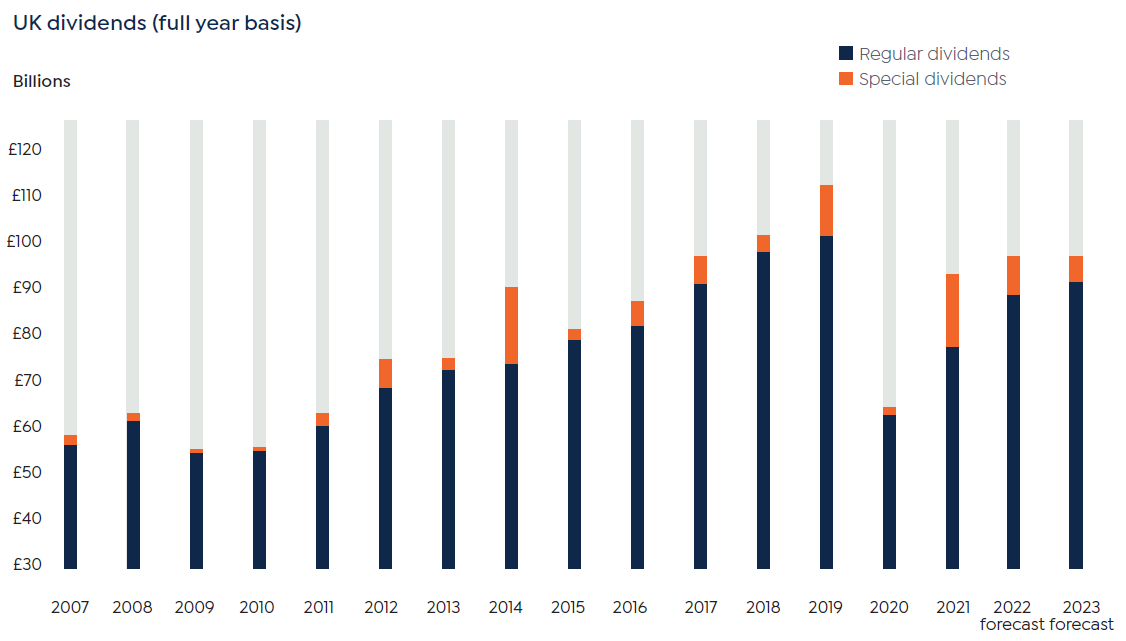

Link Group’s provisional forecast for 2023 does offer some optimism for the dividends outlook in spite of the continuing fall for mining sector pay-outs, which are the largest contributor to UK dividends.

Stokes said: “There is a lot of noise complicating the dividend picture this year. On the plus side there is the short-term exchange rate boost and the tail end of the post-pandemic dividend bounce-back. On the negative side we have the departure of a very large dividend payer in BHP. Behind all that we have normal cyclical swings in mining, energy and finance. All these factors influence our forecasts.

“For 2023, we expect a further reduction in mining dividends and likely lower one-off special dividends, but outside the mining sector there is still room for pay-outs to rise, even with a weakening economy. Our provisional 2023 forecast suggests a slight drop in headline dividends to £96bn and a slight increase in the underlying total to £89bn. This implies no change in our expectation that UK pay-outs will only regain their pre-pandemic highs some time in 2025,” Stokes added.

David Smith, fund manager of Henderson High Income Trust, said: “While the economic outlook is particularly uncertain and will likely put pressure on corporate profits, history shows that dividend income is much less volatile than profits over time, so long as balance sheets are strong and dividend cover is robust. Thankfully, UK corporates strengthened balance sheets and reset pay-out ratios during the pandemic.

“This gives us confidence that overall dividend payments next year will prove resilient and although mining sector dividends will reduce, reflecting the fall in underlying commodity prices, there will be growth elsewhere, especially in financials and energy, to offset this. We do not believe that the 10-year government bond yield rising above the FTSE All Share is a cause for concern as with the exception of the last decade, equities have yielded less than bonds given they offer investors the prospects of income growth over the long term, vital in an inflationary environment.”