Still showing up at your old office unannounced? Opining on decisions which are no longer yours to make? Janet Yellen only needs to attend the Christmas party to cap off a trio of David Brent’s antics.

Yellen is the former head of the US Federal Reserve, and now head of the US Treasury. In early May she commented to a reporter that interest rates would have to rise “somewhat” to compensate for the record levels of stimulus which are being used to get the US economy back on its feet.

The comments by Yellen caught the market by surprise and sent technology stocks, which are very sensitive to interest rates, sharply lower. Although she later clarified her remarks and stated her commitment to a Federal Reserve which is governed as an independent body to the Federal government, such a throw away comment goes to show the fragile state that the market is currently in.

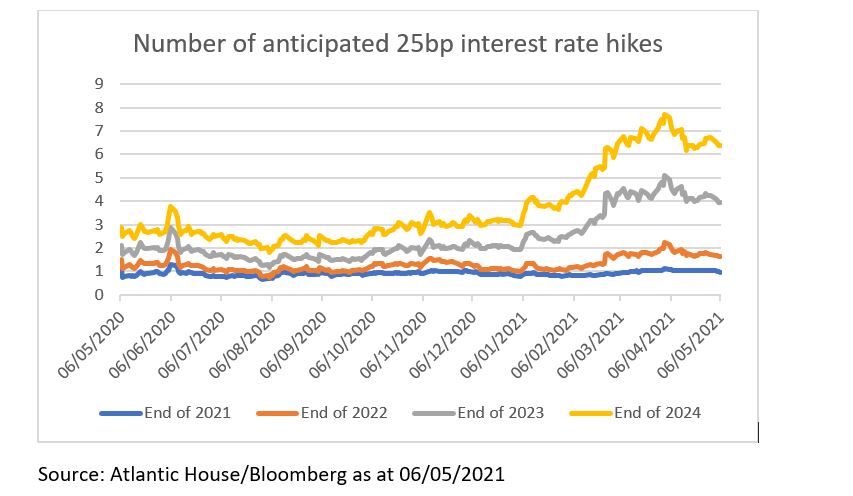

Regardless of whether Yellen should be commenting on the future direction of interest rates anymore, the market agrees with her. In the running of our portfolios, we see the derivative market’s interpretation of where interest rates are heading.

Currently, the expectation is at least one 25 basis point interest rate hike priced into US interest rates by the end of the year, at odds with the consistent message from the Fed of ‘lower for longer’. By 2023 there are four hikes priced in, taking interest rates towards pre-pandemic levels.

A rise in interest rates to pre-pandemic levels are likely to hurt big tech valuations the most, and if those predictions are to be believed then there would likely be a period of significant market turbulence and associated rise in both implied and realised volatility.

This has not passed unnoticed by some investors; recently we have seen a noticeable increase in the number of hedges traded on options exchanges. Many large institutions such as pension schemes and insurance companies have seen a rapid rise in their portfolio as equity markets performed at the beginning of the year, but with the fear that all the ‘good news’ is priced in, demand for put options (options which give the buyers the right to sell at a predefined price) has seen a steady rise. Typically, investors buy put options when they are concerned that the market might fall.

In a recent interview, Robert Kaplan, head of the Dallas Fed, suggested that markets may have come too far too fast by saying that it may be time to slow down the pace of bond buying by the central bank. The ‘tapering’ of these purchases is expected to be the first sign that the US central bank will begin to raise interest rates, moving towards the predictions that the derivative market is making.

The same story translates to the UK. Only last week the Bank of England said it would begin to reduce the scale of purchases that began last year, by the end of 2021. The FTSE, for the first time in a very long time, has outperformed the Nasdaq index since the beginning of 2021. The current rotation from growth oriented tech companies to more traditional ‘value’ stocks seems to be in full swing, but if expectations of future interest rate hikes do come true, then those buying hedges to protect portfolios will be in the right place at the right time. Now could be a good time to look at how diversified your portfolio really is.

Tom Boyle is AH Total Return fund manager at Atlantic House Investments