Covid-19’s indiscriminate rampage has been a tough test of all wealth managers’ ability to communicate with clients, but it’s one Brown Shipley chief investment officer Toby Vaughan believes his team has passed with flying colours. Vaughan is confident Brown Shipley is meeting this challenge, not least because of changes he made to the investment team since joining in November 2018.

He believes the investment expertise in place has put the company on solid foundations to be able to weather recent volatility, which in turn makes the relationship managers’ job of reassuring clients an easier one.

When Vaughan joined Brown Shipley as CIO from Santander Asset Management he set about growing the investment team with a number of key appointments, and he highlights four.

In January last year, Amrendra Sinha was hired in the newly created role of head of direct equity, followed by the appointment of Morningstar asset allocation strategist Cyrique Bourbon in May. David Scammell, a former Bank of England employee, was appointed in August as fixed income and macro strategist, and in October, Coutts portfolio manager Shanti Kelemen was installed as an investment director.

“We needed to make sure we had resources in these areas rather than multi-tasking across lots of different things,” explains Vaughan.

This hiring process was part of what he terms a structural shift from “just a research team to, ultimately, an investment office”. As part of this, the investment office was divided into four teams dedicated to covering direct equity, strategy, portfolio management and advisory.

Now more important than ever to keep clients informed

The onset of Covid-19 and its associated social-distancing measures enforced by the UK government has meant the Brown Shipley team, like countless others, have taken to their home offices. According to Vaughan, the firm’s relationship managers are really earning their stripes at the moment as the priority of their day-to-day work schedule is to communicate effectively with clients.

“During this period of financial volatility and stress, it’s even more important to keep your clients informed of what’s going on in markets and what our views are,” he emphasises. “That means making sure the messages are all there on portfolio construction, appropriate time horizons and not panicking.”

When talking about investment horizons, Vaughan says it is crucial to stress to clients to keep at least a medium-term view, however difficult that might be right now. Most clients will be aware volatility is part and parcel of the investment process – they should be if the relationship team has done its job properly – but they still need reassuring.

Anecdotally, however, he says the majority of clients have remained calm and there was little, if any, panic selling.

“Ultimately, clients are aware the volatility will come but we have had something very extreme in the short term. We don’t foresee suddenly getting a huge outflow and withdrawals from investments but, obviously, clients are keen to know what’s going on.”

Market needs comfort on monetary, fiscal and public health responses

So how does Vaughan think the recent downturn compares with previous crises?

“This is an extreme, new and difficult set of circumstances to deal with,” he says. “Policymakers are learning as they go. Whereas traditional economic cycles are managed by monetary and fiscal policy, it is increasingly clear that the market needs to get comfort on monetary, fiscal and public health responses.

“A positive sign is they are becoming more certain in their measures to control the virus, and that’s one of the factors required to stabilise markets.”

Vaughan says the speed of the correction took everyone by surprise but the magnitude of the moves across asset classes and the extremity of the valuations were even worse during the 2008 global financial crisis. “The point at which the price to earnings ratios or credit spreads got to in the last crisis was more extreme.”

Equity valuations have become more palatable

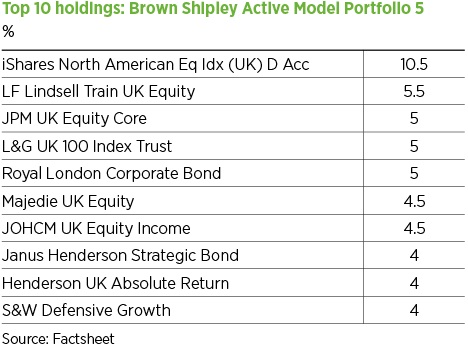

Brown Shipley runs 10 risk-rated funds that are long-only multi-asset portfolios and two income portfolios. Each has an open-architecture approach, meaning the team can pick strategies and managers from across the industry.

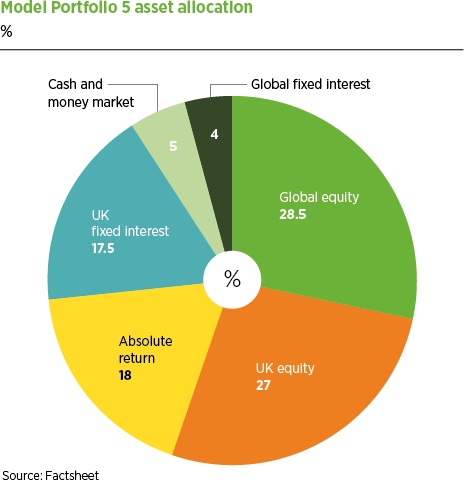

The Balanced Portfolio 5 has the bulk in global equity, followed by UK equity and absolute return (see pie chart below). Its top 10 holdings include Lindsell Train UK Equity Income, Janus Henderson Strategic Bond and Majedie UK Equity.

Before the Covid sell-off one of the main challenges for the team had been that absolute valuations in equities were not compelling, and there was concern that monetary policymakers were running out of tools. That has evolved in the past few weeks, however, as valuations have become slightly more palatable.

“Over the medium term we have a fairly neutral to slightly overweight position on equity markets. We are not looking to panic and reduce any risk exposure from portfolios at the moment.”

Adding diversifying assets to portfolios

But, being mindful of the challenges – the main one being a lack of yield outside equities – the team has been introducing diversifying assets to the portfolio during the past few months.

One example is increasing the allocation to US treasuries – the balanced portfolio has a 4% position – another is an allocation to gold. Within equities the team is trying to be more granular, illustrated by a recently-opened position in the Blackrock World Healthscience Fund.

However, the team does not want to increase risk exposure without a more compelling signal from a valuation perspective, despite prices having come down during the sell-off.

“We’re maintaining our risk levels but bringing in specific diversifiers, which is something that has been useful during this regional volatility,” says Vaughan.

He notes the reality is that while diversifiers are invaluable to the portfolio, these strategies do not fully compensate for the recent equity market moves.

“It’s more about bringing in things to moderate some of the drawdowns we have had. The moves we’ve had in equity markets have dominated that. Diversifiers moderate the size of the sell-off but do not prevent it.”

The investment office’s focus is now on identifying areas that provide compelling opportunities in the medium term. According to Vaughan, this involves analysing at a more granular level within equities and specific areas of credit. “The next phase will be looking at where we want to actually raise our risk assets exposure.”

Better integration with the wider Quintet group

With the investment office of Brown Shipley largely sorted in terms of personnel, Vaughan’s focus for the rest of this year and probably heading into the next is for the company to better integrate within the wider Quintet group.

Brown Shipley was acquired by parent KBL European Private Bankers in 1992, and KBL rebranded to Quintet in January this year. While Brown Shipley has 50 investment specialists and 40 professional advisers located in six offices across the UK, Quintet has around 200 investment specialists and 400 advisers operating in 50 cities across Europe.

“We have got a lot of talent and a lot of resources in the group, and I’m a strong believer that we are better working with our colleagues across the continent and integrating because that brings more intellectual capital to our portfolios at Brown Shipley.”

To aid integration, Vaughan says most of the people in the Brown Shipley investment office are also part of wider group teams and functions.

“Our asset allocation strategist is working with the group asset allocation team, which has daily and weekly calls across the market.

“That group brings its views to the UK in the same way it will bring its views to Holland, for example, or other countries. The team also has a group approach to fund selection.”

But Vaughan is quick to point out while there is a group ethos, the Brown Shipley team puts its own stamp on final portfolios to ensure they are constructed specifically for UK clients.

As well as boosting intellectual capital on the investment team, leveraging off the group has enabled Brown Shipley increase its economies of scale.

“I think it’s important in this industry to have economies of scale, you need it to be able to service your clients better, meet the demands of regulators, competitively position within the industry and have the depth of skill set.

“People often talk about acquisitions but my view is we are part of a group that has economies of scale already.

“I’m happy with how we are growing and how we are reinforcing the team, but we have this opportunity that’s just been there on our doorstep.”