A diary scheduling tool that facilitates meetings between fund managers and fund buyers has been met with a tentative response from the industry.

Pueblo was launched on Tuesday by veteran former fund manager Ole Rollag, founder of several businesses including Morano, a fund and investor matchmaking service.

It claims to allow global professional investors to see which managers are visiting their area and request meetings, information or other follow-up activity.

Managers upload information onto the platform which is curated for the fund buyer’s individual needs based on factors such as asset class, fund size and structure.

Rollag said the service will eliminate the need for fund selectors to trawl through the “tsunami of emails and inbound calls they receive every day from unknown and uncurated managers”.

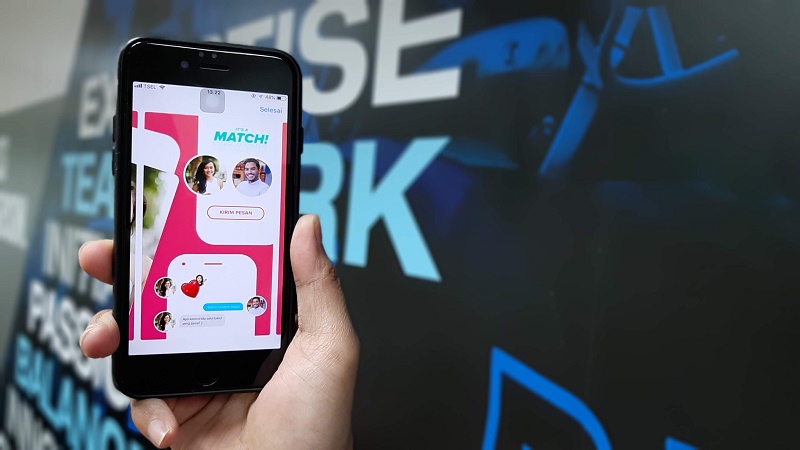

Tinder for investors

Rollag told Portfolio Adviser the biggest problem with the asset allocation model is on one side there are some 40,000 professional allocators and on the other, thousands of managers, making it a “very large field” to play.

“We thought, why not make it a Tinder-like experience where you can get more information? Or you can swipe left, ‘No thanks, I can’t meet, I don’t need to meet’, or go into a scheduler and book a meeting. That should be really helpful for the allocator to manage their day.”

Whitechurch Securities head of investment Amanda Tovey said the volume of meeting requests from managers ramps up at certain times of the year such as in the autumn. Scheduling them is a manual task dependent on who in the team is available on the day and whether it’s a fund Whitechurch holds or something it would like to find out more about.

Tovey said the tool could potentially help manage meetings but the team would still need to look at how it fits in with their individual diaries.

“The tool seems very defined in that it will provide a date/time with little leeway. We find if we liaise with the sales team directly to establish a time and day that suits everyone; it works well. Although I can see [Pueblo] being of use when looking at new funds where perhaps there is no existing relationship.”

AJ Bell head of active portfolios Ryan Hughes said an increasing number of fund managers, particularly from overseas, are making contact to push their products, meaning the team has to cherry pick where it sees value spending time.

“We operate with a small team, identify what we need and research it. This means we are very specific about what meetings we want rather than filling our days seeing managers that in reality we have little intention of using.

“[Pueblo] might be a help for some, however at AJ Bell we are lucky in having very good manager access when we need it.”

GDIM investment manager Tom Sparke said often it is the business development or sales representatives who tailor the manager visits to GDIM so that most relevant interactions are arranged.

On Pueblo he added: “I would be concerned if an especially relevant manager was in our region but we were too late to book their time that we may miss out.”

The end of conferences?

Rollag believes Pueblo could threaten the existing conference and events model in the asset management industry.

“It depends on which sector you’re looking at, but for a lot of sectors the conference space is kind of dead, ” he said. “When we talk to the allocators and ask them which conferences are worthwhile, they pick maybe one or two, but they say, ‘I can do my job a lot more effectively reviewing managers at my desk than going to a breakfast to talk to three different managers – I can’t spend my whole day at these events’.”

But Hughes does not see it as a threat to conferences because he views events as a good way of getting access to a number of managers in a short period of time.

“While it may help some fund managers make effective use of their time, the ability for conferences to get high quality investors together in one place remains an attractive way for fund managers to meet prospective investors.”

Similarly, Sparke does not believe events and conferences would be displaced by this sort of tool.

“There is no alternative to meeting numerous managers in one place, which is a very efficient use of research time,” he said.

For now the service is free to use but will become a subscription service paid for by the fund manager in due course.

According to the Pueblo website, 141 fund managers and 267 investors are using the service, with 57 meetings arranged.