Investors put their money to work in 2023, flocking to funds that had attractive growth potential and fleeing from those with less appealing prospects.

Large inflows and outflows of money can have a sizable impact on a fund’s performance – managers who receive a flood of new capital will need to put that money to use by upping their exposure to existing holdings, just as those losing cash will need to sell out of positions to meet redemptions.

Here, we look at the funds that made and lost the most money in 2023. A fund’s performance can also impact its overall worth positively or negatively, but we have ranked them based on flows.

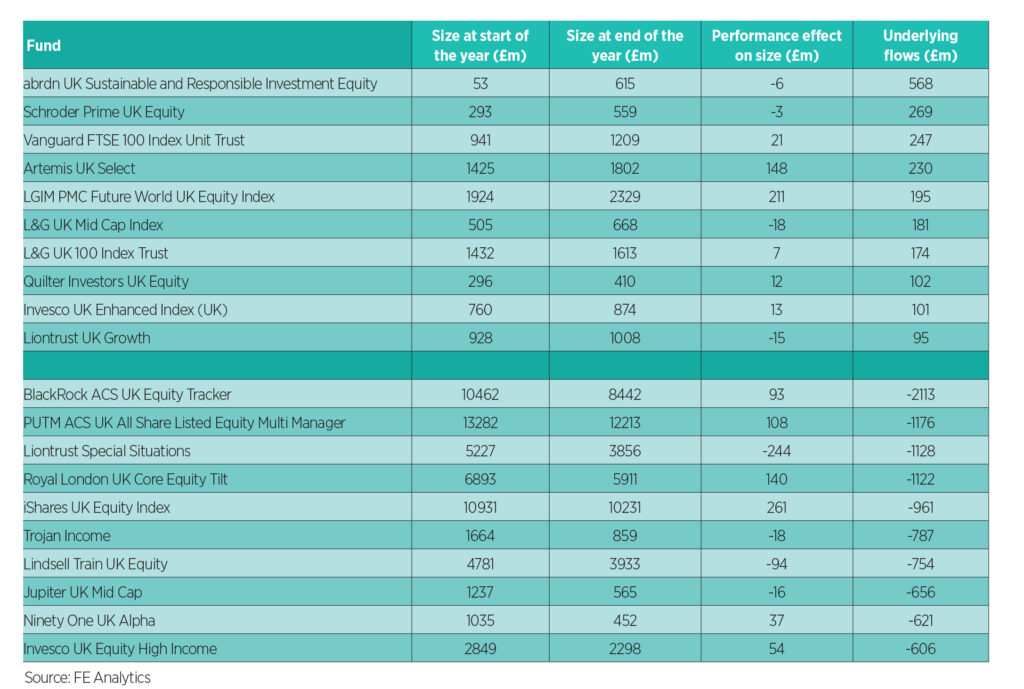

UK funds

Funds investing in the UK have been unpopular for quite some time and 2023 was no exception. The IA UK All Companies sector has not reported positive monthly net inflows since July 2021, during which time the sector has lost £18.8bn of invested capital, according to the Investment Association.

Last year, the 10 funds that lost the most money were hit by a collective loss of £9.9bn, with BlackRock ACS UK Equity Tracker bearing the biggest individual outflow of £2.1bn.

Active managers were also knocked with outflows after investors removed their savings from the likes of Liontrust Special Situations, Royal London UK Core Equity Tilt, Trojan Income and Lindsell Train UK Equity.

IA UK All Companies funds that made and lost the most money in 2023

Nevertheless, these losses were slightly offset by the additional £2.2bn added to the 10 biggest money-making funds in 2023.

The abrdn UK Sustainable and Responsible Investment Equity fund received the greatest inflows, starting the year at £53m and ending 2023 almost 12 times bigger after inflows of £568m.

Despite its swelling size, the fund’s total return of 7.1% in 2023 was 0.3 percentage points short of its peers in the IA UK All Companies sector.

Indeed, this environmental, social and governance (ESG) fund has fallen 14 percentage points behind the peer group’s 28.3% average return since manager Rebecca Maclean took charge in 2020. Over that time, investors could have upped their savings almost three-fold by tracking the FTSE All Share benchmark index.

FundCalibre research director Juliet Schooling Latter highlighted Liontrust Special Situations, managed by the firm’s Economic Advantage team, which is headed up by Anthony Cross and Julian Fosh.

It was hit by outflows of £1.1bn in 2023, yet the AUM of sister portfolio Liontrust UK Growth pushed past the £1bn mark after £95m of fresh capital entered the fund.

Latter noted that both portfolios have been surprisingly resilient considering the headwinds facing UK equities in the years following Brexit.

Having significant exposure to mid and small caps could have left Liontrust Special Situations particularly vulnerable, yet its 107.5% return over the past decade is double that of the 53.6% average gain reported by its peers.

The UK may be unloved by investors, but Latter said its low valuations offer an attractive entry point for those with a more optimistic view of the region’s future.

“Any manager experiencing outflows will have challenges, particularly when they run a larger fund,” she added. “However, the significantly discounted valuation of UK equities at present does appear to be an opportunity for long-term investors – and a multi-cap vehicle like this seems an excellent core option for those who believe now is the time to back the UK.”

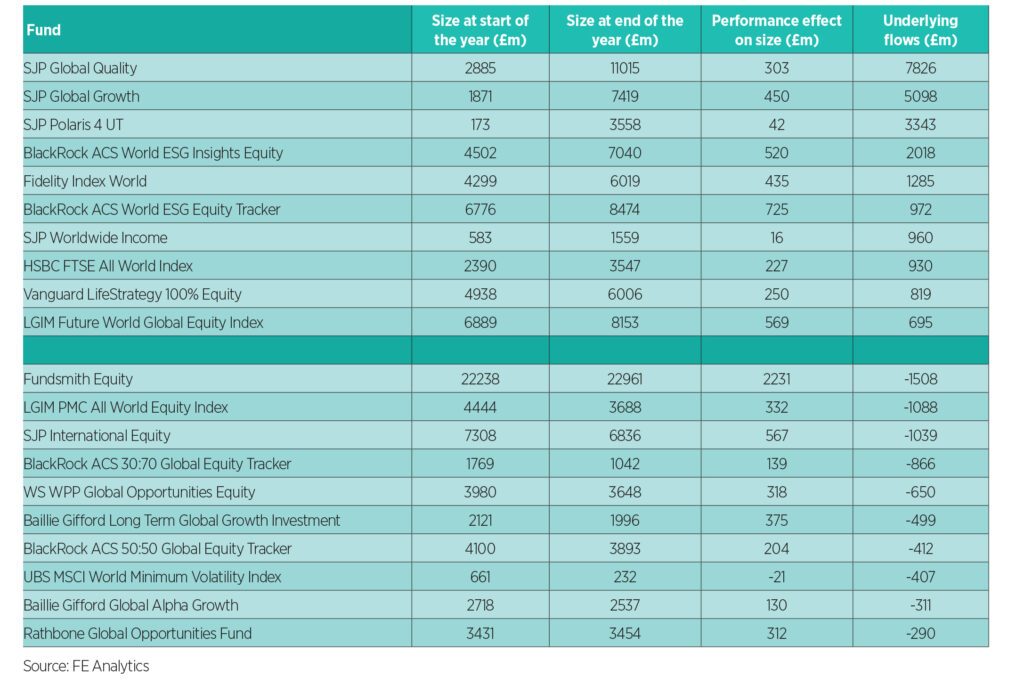

Global funds

Four funds owned by St. James’s Place – SJP Global Quality, SJP Global Growth, SJP Polaris 4 UT and SJP Worldwide Income – were among the funds making the most money in 2023. They collectively received inflows of £17.2bn as investors upped exposure to global assets.

Rob Morgan, chief investment analyst at Charles Stanley, said that the high number of passive funds among the top 10 was telling of investors’ appetite in 2023. After feeling the impact of high inflation and interest rates – not just on equity performance, but personal expenses too – investors were attracted to the straightforwardness and low charges offered by tracker funds.

Morgan added: “The popularity of funds such as Fidelity Index World and HSBC FTSE All World is illustrative of the ongoing migration of investors towards passive investing and away from active management. Both provide simple and low-cost exposure to global equities.

“There’s a healthy, competitive marketplace for passive products and size is a virtue, allowing percentage fees to be cut to the quick to attract even more investors – a virtuous circle.”

IA Global funds that made and lost the most money in 2023

At the opposite end of the spectrum, Fundsmith Equity had the largest outflows after £1.5bn was removed throughout 2023.

Morgan said that investors may have reduced their position in favour of passive funds seeing as global indices such as the MSCI World outperformed Fundsmith Equity for the past three consecutive years.

It became a favourite among investors after its 297.5% return over the past decade placed it well ahead of the 137.8% made by its peers in the IA Global sector, yet better performance by passive funds has taken some of its shine in recent years.

Nevertheless, Fundsmith Equity ended 2023 larger than it started the year despite these outflows. The £1.5bn removed from the fund was offset by the £2.2bn added through the increasing value of its assets. It was up 12.4% in 2023.

With AUM of £23m, Morgan said “modest outflows after many years of net inflows are to be expected” for a fund of its size.

The same could be said for the Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Global Alpha Growth funds, both of which lost £500m and £311m respectively in 2023.

Investors gravitated towards their “outsized post-pandemic performance” in 2020, but returns in the ensuing years have disappointed, according to Morgan. Baillie Gifford Long Term Global Growth Investment and Baillie Gifford Global Alpha Growth are down 22.6% and 6.1% respectively over the past three years while its peers are up 15.1%.

Some of those who were “disillusioned” by 2020’s outperformance reduced their holdings now that returns have normalised, having not realised that the firm’s high-growth approach will go through good and bad cycles before delivering over the long term, Morgan added.

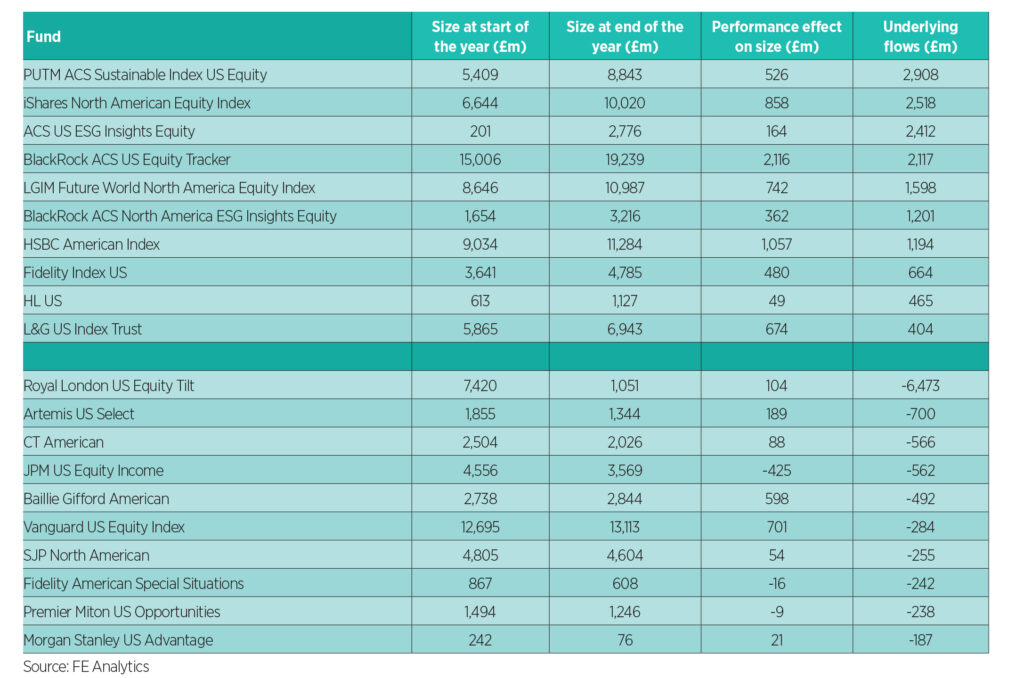

US funds

The US funds making the most money in 2023 were again dominated by passive funds, with the 10 biggest earners raking in £15.5bn throughout the year.

Fairview Investing director Ben Yearsley credited these large inflows to the magnificent seven – Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – which supercharged performance and created interest in the US market.

Despite strong returns from the US (the S&P 500 was up 18.6% in 2023), investors removed £10bn collectively from the 10 biggest losers throughout the year.

Royal London US Equity Tilt was hit the hardest, losing £6.5bn across the year. It went from a £7.4bn fund at the start of 2023 to £1.1bn by year-end.

IA North America funds that made and lost the most money in 2023

Another Baillie Gifford fund – Baillie Gifford American – lost £492m of invested money in 2023, yet returns were up 40.7% last year.

Despite this strong performance, Yearsley said investors are still sceptical of the group’s high-growth strategy, stating: “Whilst growth came back into fashion for some companies and sectors, is Baillie Gifford’s approach going to work in the next decade? It’s certainly got investors thinking and looking for alternatives.”

Yearsley also drew attention to JPM US Equity Income, which suffered £560m in outflows last year. He said this could be linked to the upcoming departure of Clare Hart, who announced her retirement in September.

She has been manager since 2008, during which time the £3.5bn fund made a total return of 519.7%. Under Hart’s management, the fund was the go-to option for investors seeking income from the US, but many alternatives now exist, according to Yearsley.

One of Yearsley’s preferred vehicles is BNY US Equity Income. Its total return of 70.8% over the past decade was 14.1 percentage points higher than JPM US Equity Income’s 56% gain.