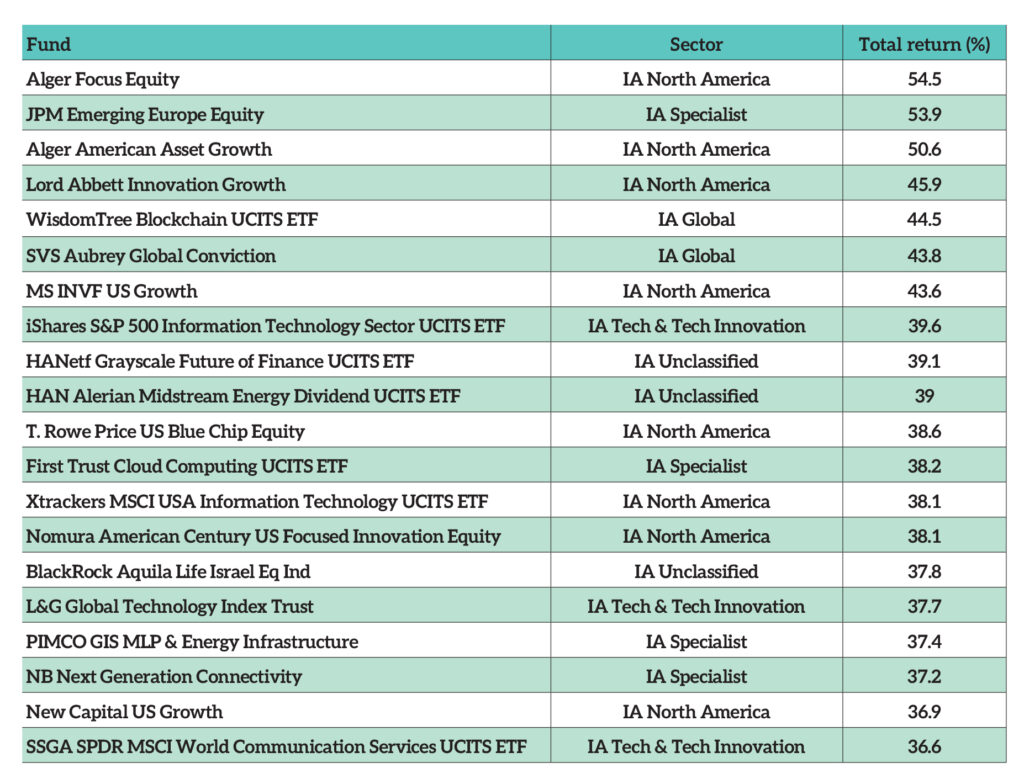

North America was the place to invest in 2024, with the Alger Focus Equity fund making the highest return of any other portfolio throughout the year. It climbed a whopping 54.5% last year by investing in US equities – more than doubling the 22% made by its peers in the IA North America sector and soaring well ahead of the 8.1% reported by the average Investment Association fund.

Managers Ankur Crawford and Patrick Kelly built a concentrated portfolio of just 48 stocks, with much of its allocations focused on five tech companies. Tech behemoths such as Amazon, Microsoft, Nvidia, Meta, and Applovin account for the top 39.1% of the fund and drove most of its performance in 2024, according to its latest annual report.

These thriving tech giants were a source of high returns for many investors in 2024, especially Nvidia. Its soaring share price in recent years has made it a market darling, but Nvidia’s 179.2% increase in 2024 appeared mild compared to Alger Focus Equity’s fifth-largest holding, Applovin.

The mobile marketing technology company’s share price rocketed 751% last year, boosting the fund’s total return well ahead of other IA North America funds.

Alger Focus Equity has been a stand-out winner over the long-term too, boasting to be the fifth best-performing fund in its peer group since launching in 2019. Its total return of 193.7% over the period places it 80.3 percentage points ahead of the sector’s average return of 113.4%.

Other IA North America funds with an overweight in tech – and high allocations to Applovin – were also among the best performing portfolios of 2024. The Alger American Asset Growth and Lord Abbett Innovation Growth funds also delivered supercharged returns last year, climbing 50.6% and 45.9% respectively.

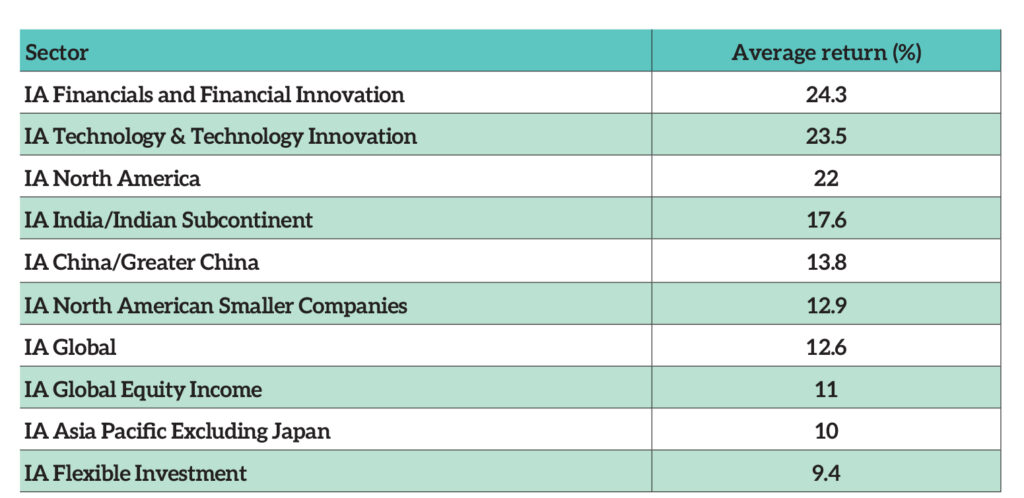

However, while US equity funds may have taken the top spots, it was portfolios in the IA Financials and Financial Innovation sector that delivered the highest returns on average. Funds in this group increased investors’ returns by 24.3% in 2024, whereas IA North America grew them by a slightly milder 22%.

The Janus Henderson Global Financials fund was the best performer in the sector, soaring 34.2% throughout the year, with Xtrackers’ MSCI USA Financials and MSCI World Financials ETFs following closely behind with returns of 22.6% and 29.1% respectively.

The sector benefited from high interest rates, reasonable economic growth and moderating inflation in 2024, as well as a surge in share prices following the re-election of Donald Trump in the US, who pledged to deregulate the sector.

Best performing sectors of 2024

Source: FE fundinfo

Nevertheless, investors did not need to look solely at financial funds or those exposed to tech-heavy US equities for the highest returns. The second-best performing portfolio of the year was dedicated to a more niche corner of the market – European emerging markets.

The JPM Emerging Europe Equity fund soared 53.9% throughout 2024 with a portfolio consisting mostly of Russian equities, which accounted for 67.7% of the fund’s assets.

Fairview Investing director Ben Yearsley speculated that this fund may have been another beneficiary of Trump’s victory, as the president-elect frequently vowed to force a resolution between Russia and Ukraine during his election campaign.

The best performing funds of 2024

Source: FE fundinfo

Another specialist fund to top the charts was the WisdomTree Blockchain ETF, which generated some of the highest returns in the Investment Association universe last year (up 44.5%) by investing in cryptocurrency technologies.

While prone to sharp turns in performance, crypto markets ended 2024 on a high as one of its leading currencies, Bitcoin, surpassed $100,000 for the first time.

This rally was again driven by Trump’s election victory, with the incoming president expected to take a more laxed approach to crypto regulation than the Biden administration. He has already appointed crypto advocates such as Elon Musk, Paul Atkins, and Howard Lutnick to influential positions within his new administration, who could influence Trump’s policy direction.