Terry Smith has taken another potshot at Unilever, accusing its top brass of engaging in “gin rummy management” and concentrating its efforts on misguided M&A deals instead of getting the company back into shape.

Tensions had already flared between Smith and the consumer goods giant, which owns the Dove soap and Hellmann’s mayonnaise brands, when the Fundsmith founder derided the management team’s obsession with flouting its sustainability credentials at the expense of fundamentals in his annual letter to shareholders.

On Thursday, Smith and head of research Julian Robins had more choice words for Unilever in a “post-mortem” of its failed takeover of Glaxosmithkline’s consumer arm. The day before, Unilever said it would not increase its £50bn bid for the business, following an intense shareholder backlash which saw its shares topple by 12% earlier in the week.

Smith said he was pleased the FTSE 100 firm had listened to reason and refused to up its bid a fourth time – in what he characterised as a “near death experience” for the company.

However, he said its latest M&A failure is indicative of wider issues in how the company is being run. He lambasted management’s unwillingness to engage with shareholders about Unilever’s long-term performance issues and failure to justify its M&A strategy, beyond spouting “corporate gobbledegook”.

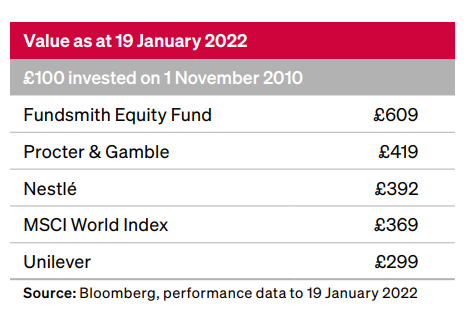

“Unilever’s performance has been poor. It is the worst performer by a considerable margin amongst the multinational FMCG companies we have owned and not just in terms of share price but also in terms of sales growth,” Smith wrote.

“The company would have us ignore this long-term underwhelming performance and talks about sales growth for the nine months ended September 2021 being their fastest for eight years. The irony is that food and refreshment, the business they planned to sell if they were to buy GSK Consumer, outperformed the rest of the business, the one they wanted to materially expand, 2 to 1.”

In the case of its bid to buy GSK Consumer, Smith said Unilever failed to address several “vital” points, including whether the deal would actually create value for shareholders.

“The Unilever management seems to be playing what Warren Buffett lampoons as ‘gin rummy’ management – like a player in the eponymous card game, throwing away their least promising card(s) each round in the hope they will turn over better ones,” said Smith.

“They have already sold the spreads and tea businesses. They have been pursuing a £50bn acquisition and we could have expected further disposals and further major acquisitions if they had acquired GSK Consumer, taking them out of familiar businesses and into a new area where they have very limited expertise (beauty, oral care and OTC health).

“We believe the Unilever management – or someone else if they don’t want the job – should surely focus on getting the operating performance of the existing business to the level it should be before taking on any more challenges.”