On 12 December 2019, the evening of the general election, Seven Investment Management held its staff Christmas party. Chief strategist Terence Moll and the senior investment heads were humming and hawing about whether to interrupt the festivities and send people back to the office to keep an eye on things but, in the end, they didn’t see any way to profit from the result.

In Moll’s experience it is incredibly difficult to make money from macro calls. “Elections and such are profoundly unpredictable,” he says.

“First, you have to forecast what the result of the election will be. Second, you have to forecast how markets will respond to it. The first of those is difficult and the second tends to be very, very difficult.”

The initial market reaction is usually knee-jerk. Sterling skyrocketed to $1.35 against the dollar the day after Boris Johnson’s landslide victory, but a week later it had dropped back to $1.30.

“Elections, macro stuff, Middle Eastern wars and whatever else might lead directions in markets over one, two or three months, but if you look at markets over 12 or 24 months, usually you can’t see them anymore,” he says. “Over 10 years, you really can’t see them. So, in my experience you’re normally best off just ignoring them.”

Lucky dip

An exception to the rule is buying on the dip, says Moll. 7IM took the plunge and bought 2% of the S&P 500 on 12 December 2018 during one of the year’s worst sell-offs. The index fell another 10% in the 12 days after “and we did sweat a bit”, he recalls, but eventually the team made their money back.

7IM’s 20-odd portfolios are informed by both strategic asset allocation and tactical asset allocation calls.

Moll, who joined 7IM in September 2018 from Coutts, where he was head of investment strategy, says the asset allocation process has not changed much since the wealth manager’s merger with Scottish firm Tcam in July 2018. But he says there has been “more turnover than usual” in the portfolios since Q3 2018, when the new management team slotted into place.

“All portfolios should basically be cousins of each other, and they had become too distant. They were second or third cousins. We thought, if we have a clear house view, we want to see this house view reflected in all portfolios.”

The strategic asset allocation serves as the long-term benchmark across the full range of asset classes in the funds and gets reviewed once a year at the end of June.

Meanwhile, tactical asset allocation is reviewed more frequently, on a quarterly basis. Decisions are driven by the six-person strong strategy team who “obsess” over the minutiae of each portfolio and meet twice a week to think about what the investment team should be doing.

Changes must be first approved by the tactical asset allocation committee, made up of 7IM’s entire investment and risk teams, and then receive a rubber stamp from the wealth manager’s senior investment trio: Moll, CIO Martyn Surguy and head of portfolio management Haig Bathgate.

Punchy plays

At the end of their last round of heated discussions on where markets are and careful consideration of the firm’s internal quant models, and the probability of a US recession – which Moll currently puts at zero – the team ended up with a slight overweight toward equities. “That’s just how it is sometimes,” he says.

Tactically, its largest equity position is in US stocks, though recently the team has been expressing this through a “punchy” thematic healthcare play. Healthcare stocks make up 5% of the Balanced fund, so “in risk terms it’s our biggest single position”.

Long term, Moll thinks the prospects for the sector remain strong. The world is getting older by about three months every year as people live longer and have fewer children, which means they will be spending more money on healthcare, drugs, insurance and nursing homes.

Big pharma companies have been increasingly buying up biotech firms, which Moll views as an added bonus. The team had contemplated building a basket of biotech stocks but settled on owning the Alliance Bernstein International Healthcare fund, which has decent exposure to the sector, instead.

“Over three to five years, we’re not in the business of trying to pick winning stocks.”

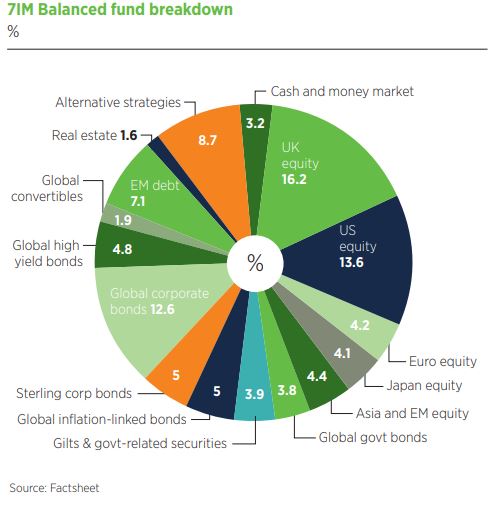

UK equities remain the single biggest position in the Balanced portfolio, at 16.2%, and Adventurous portfolio, 23%, which reflects the fact “clients want to see it there”.

But from a tactical position 7IM is “aggressively neutral” on UK equities, having closed out its underweight position in the middle of last year around the time Boris Johnson became prime minister.

UK stocks appear relatively fair valued to inexpensive, but the political unknowns are undeniable.

If the UK manages to successfully negotiate a trade deal with the EU in the next 12 months, as Johnson has promised, “it will be a miracle. It’s not an overwhelmingly positive case but it’s not a negative case either.”

Bonds and beyond

On bonds the team is still underweight, with developed market government bonds and corporate debt making up just 12.7% and 17.6% of the Balanced portfolio at the end of December. Though Moll says they did top up their US 10-year position in December when yields were up to 2%.

Moll suspects rates will remain “incredibly low for a very, very long time. Basically, until the last baby boomer has gone into a nursing home”. On the other hand, he doesn’t think there’s going to be a huge selloff anytime soon.

Emerging market debt is an exception and one of the few areas of the market where 7IM prefers bonds to equities. The Balanced fund’s tactical asset allocation weighting is twice as high as the starting strategic asset allocation position.

Absolute return funds have also been playing more of a key role in certain portfolios. 7IM has its own dedicated absolute return fund, featuring a pair of funds from Crispin Odey’s fund house.

“The guy’s a bit of a lunatic but he’s very smart,” says Moll. “Some of his ideas work out incredibly well but you need to be pretty brave to go along with them.”

Moll likes Odey Absolute Return Equity in particular. The strategy falls “somewhere between deep value and value”, he says, and is managed in a more stable way than other funds in the sector. The £584.4m fund was nicely positioned for the last general election, gaining 7% the week after Boris Johnson achieved a landslide election result.