Since its launch in 2017, Tellworth Investments has been making a big splash. Set up by veteran Schroders duo Paul Marriage and John Warren, the London boutique has attracted an ever-expanding fanbase of fund buyers attracted by its long/short and small-cap focus, and last year, the firm welcomed Neil Woodford protégé Mark Barnett to its ranks, who has recently launched a UK equity income fund.

Seb Jory (pictured) is perhaps one of the outfit’s lesser-known names but his low volatility Tellworth UK Select Fund has been quietly shooting the lights out.

Jory joined Tellworth at the start of 2018 from Liberum, where he was head of strategy and stock selection. When he and co-manager Warren bought the fund out of the ashes of the Sanditon collapse, it was nothing to write home about.

“The fund was run in a very different way. It was more directional,” Jory reflects. “Our intention was to take all of that out and make it about stockpicking.”

Despite many absolute return funds claiming to be an “all-weather” solution, their track records suggest otherwise, which is why many investors view the sector as a “basket case”, according to Jory.

“We saw an opportunity to do something that was genuinely market neutral, giving investors what they want, which is capital protection. Bond-like almost.

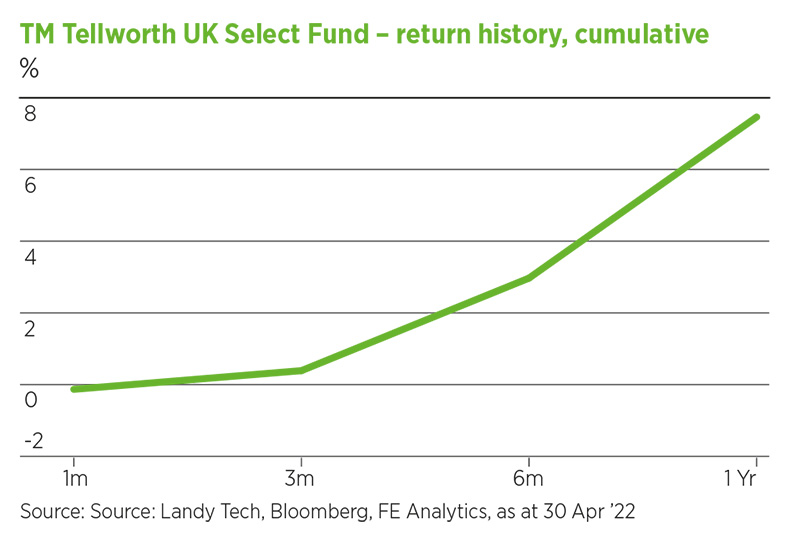

“Since the pair took over the long/short equity fund in December 2019, it has returned close to 30%, four times higher than the IA Targeted Absolute Return average. Assets in the fund are at £121.4m and Tim Russell, who ran the fund at Sanditon, remains an investor and “supporter”.

The fund has managed to achieve this with incredibly low volatility, an impressive feat considering the market twists and turns since the pandemic. It targets volatility of 5-7% per year, however, Jory says in practice it has been more balanced and hedged than predicted.

“The models tell us to expect 1-2% volatility a month and we just haven’t seen that. It’s had a lot thrown at it,” he says.

“You would hope that there’s no two-year period again where you get a global virus and a war and all sorts of other stuff. And so, we’re happy that under those extremes, we’ve come under on the volatility.”

Get the balance right

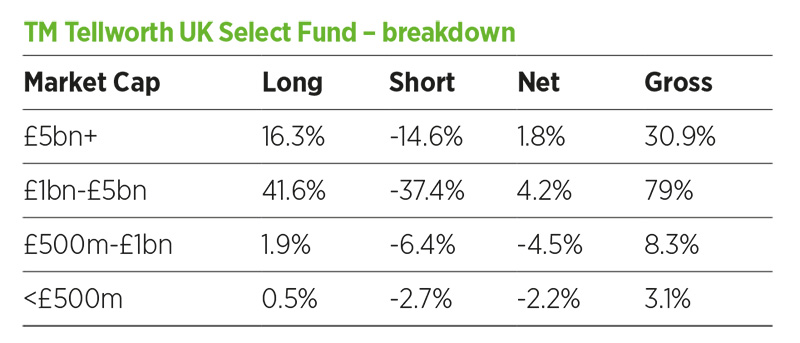

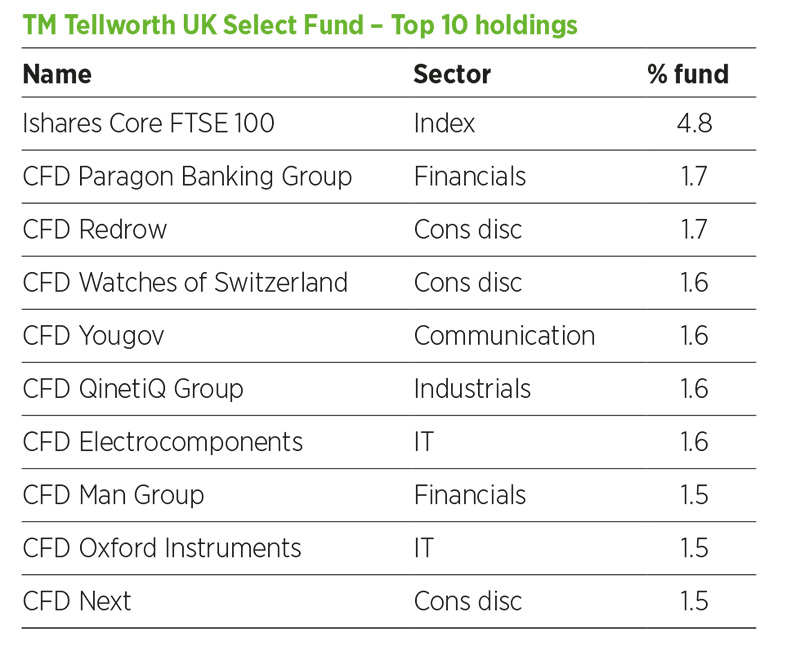

Balance is key to achieving the fund’s objectives. It aims to have 35 longs and 35 shorts that are all roughly around the same size, between 1-3% on the long side and 1-2% on the short side.

Jory and Warren target gross long/short exposure of 120-150% of net asset value. In volatile markets, this can drop to as low as 95% to get the right level of risk.

The pair focus on “nice and liquid” companies around the £2bn-£10bn market cap level so, that if the fund grows, they won’t have to change their process.

“We don’t want the portfolio balance impacted by views on macro inflation, interest rates, or anything,” he explains.

“The whole idea is that we have enough similar stocks that are exposed to similar things on both sides so that if there’s a big change in any commonalities between companies, their cyclicality or the amount consumers spend, the portfolio as a whole should be insulated from that.

“Now that doesn’t mean we don’t have a view, or we don’t think about the backdrop of the economy as being really important to these companies.”

Jory thinks investors have been “right to be quite cautious”. The removal of monetary and fiscal stimulus, commodity shock and cost of living squeeze indicate a “softer patch” for growth ahead.

“In a period of supply chain challenges, and a period of weaker demand, we’ve been thinking about which types of business models are a bit more resilient, even amongst the same sub sectors.”

Taking clothing retailers as an example, Jory would juxtapose a long position in Next, which has one of the strongest supply chains in the sector, against a warehouse-type e-commerce firm, like an Asos or Boohoo, that is facing channel shift challenges, as well as an operating environment they’ve never seen before.

Pricing power is another key debate the managers are having in the higher inflationary environment. Reseller businesses like Computacentre and Bytes Technology, which are top holdings in the fund, are beneficiaries in this environment, despite the fact they’re trading on higher P/E ratios (Bytes is currently on 30.2x).

“Normally you think stay away from a high P/E company when inflation goes up and interest rates go up. But if there’s sufficient pricing power, earnings can benefit more than you should see the P/E fall.”

But for the fund’s strategy to be effective, Jory and Warren cannot take a “cookie cutter approach” of buying only quality businesses for the long book.

“If we get a big change in interest rates or are in a macro recovery, everyone wants to go for the cheapest companies with the most cyclical exposures like a bank or a house builder. Suddenly all quality stocks are left behind by a market rally because they’re a bit more defensive.”

Regaining control

Six months ago, the fund was being driven by shorting opportunities, particularly newly listed businesses in the £1-£2bn market cap range that came onto the market with “an inflated Covid profitability number”, Jory says.

But now, he’s finding more opportunities on the long side, particularly among some of the domestic retail names.

“In some areas like essential clothing or discount retail, the market has marked everything down the same. But if you look at a typical consumption recession, you don’t get the same impact on products in all these different verticals within retail, and I think that’s an opportunity.”

Dealing with indiscriminate market sell-offs over the past three months has been challenging, but, in the long term, it creates good dispersion opportunities for the fund.

“We’ve come out of a very macro driven market and now we’ll probably see – God willing – less of a focus on things that nobody can control, hopefully some more macro tranquillity and then more of a focus on the companies themselves. And that’s when we hope the fund would kick off.”

Against the extraordinary market backdrop of the past two years, turnover in the portfolio has been extremely high. In 2020, it was over 200% and this year he expects to see a similar level of churn.

While investors may not appreciate a bump up in transaction costs, Jory is glad turnover has been higher.

“It means we have been active and finding some good new ideas for investors.”

A slice of the action

Although positions drift in and out of the portfolio quickly, there are a handful of names that have been there since the beginning. On the long side this includes discount airliner Jet2, Next and One Savings Bank.

There’s only one short position he’s held for the entire duration, and that is Domino’s Pizza.

Jory tends to avoid having “campaign shorts” because it gives rise to accusations “the fund manager is obsessed with hating this company”.

“I actually like the pizza, to be honest,” he says, “but the whole problem with Domino’s is the way their franchisee structure is set up.”

Under the agreement, Domino’s PLC charges franchisees to set up their own shops in the UK and Ireland and takes a share of their profits. The amount it skims off the top gave way to a two-year row with disgruntled franchisees.

Though management has made some concessions, including food rebates and higher marketing spend to attract customers, Jory thinks the franchisees are facing more competition from aggregator apps like Deliveroo and Just Eat, which took off during the pandemic.

“What we do in the case of Domino’s, is we look at web traffic, app installs and engagement. We notice there is ongoing market share loss against the incumbents.”

Domino’s is currently only on one of the platform apps (Just Eat), putting it at a disadvantage to rivals on multiple apps. And, like other delivery chains, it is no longer benefiting from a Covid-tailwind of people stuck at home with limited options for dining out.

Sinners and saints

Deciding which companies to bet against is frequently event-driven, which can be an upcoming earnings statement, M&A deals, management changes and the like.

As such, they tend to have a shorter average holding period of four months compared to six months for long positions.

Jory also creates a basket of shorts using ‘Sinners’, a screening tool that picks up 22 accounting red flags in UK stocks.

This includes movements in balance sheet items over time, such as a year-on-year rise in receivables days, the length of time it gives customers to pay for items.

Sinners is proprietary – Jory led the team that developed the screens at Liberum and took them with him to Tellworth – and it has a predictable track record. Since 2013, the 30 ‘sinful’ companies as selected by the tool have underperformed the market each year without fail.

“What we’re looking for here is deterioration,” he explains. “They don’t necessarily need to be all indebted companies in challenged end-markets or have products that aren’t resonating. It just means that the accounts themselves are being run a bit harder than other similar companies that might have a more conservative approach to accounting.

“If something goes wrong, like they actually do have a bit of a problem in one of their businesses, you tend to see more of an impact on the cashflow and on how investors will then see that business.”

BIOGRAPHY

Seb Jory joined Tellworth in 2018. Prior to this, he was head of strategy and stock selection at Liberum, where he led a three-person team publishing strategy pieces and investment lists on UK FTSE 350 equities. In this role, he and the team built several proprietary models and frameworks to help UK equity PMs better forecast UK economic data in the wake of the Brexit vote – a product called ‘UK Thermostat’ – and several factor models to help company analysis, the most prominent being ‘Sinners’. He began his career in 2009 trading distressed debt at RBS.

This article first appeared in the June edition of Portfolio Adviser Magazine