In the wake of a damaging year for UK companies, investors are now faced with an economic outlook that is undeniably chequered; one might forgive them for steering clear of high-risk investment vehicles with exposure to nascent, early-stage UK businesses. However, after a bumper year for venture capital trusts (VCTs) in 2021, investors are still piling into the asset class like never before.

Unicorn’s AIM VCT made headlines recently for an astonishing day of fundraising in which it raked in £15m. Having filled its initial £10m allotment in a matter of hours, it opened a further £5m which was duly snapped up by investors.

The Baronsmead VCTs, run by Gresham House, are some of the longest-standing players in the market, and while they could not quite match Unicorn’s funding haul for speed, they still managed to rake in over £17m in their first 10 days of fundraising. The trusts built on a strong performance last year, where they raised £75m in an oversubscribed fundraise.

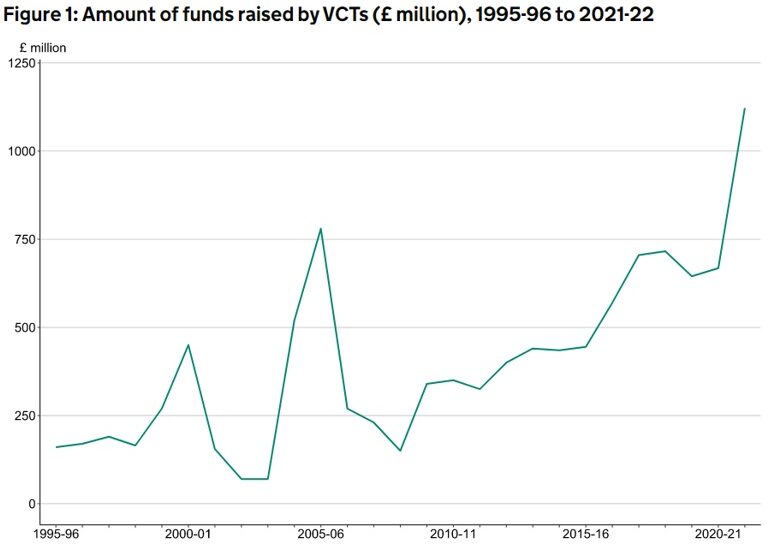

Over the past five years, the assets managed by VCTs have increased from £4.1bn to £6.3bn, and the sector saw record fundraising during the 2021/22 tax year, with £1.13bn invested, according to data from HMRC. The attraction remains strong; all VCTs from the 2022/23 tax year are now open, or already filled, with total capacity this tax year hitting £1.3bn, reports The Wealth Club.

Up to 6 February this year, £662m has been committed by investors, and though it is down on the same period last year, the figure represents a considerable increase on each of the four years before that, despite an economic outlook that is measurably worse.

Poor performance but growing in popularity

It is not as though these investment vehicles have escaped recent market headwinds. Their exposure to early-stage companies leaves them vulnerable to economic volatility, and most endured a rough 2022 along with the entire UK small cap sector. Octopus’ AIM VCTs were both down over 30% last year in terms of NAV total return, tracking close to the FSTE AIM All Share. The first Octopus AIM VCT has seen its share price fall by nearly a quarter in the last year, and 30% in the last five years, while shares in the popular Unicorn AIM VCT are down 34% and 16% over the same timeframes.

This begs the question: why is their popularity growing? Ken Wotton, who covers public equity at Gresham House, notes that, despite the daunting macroeconomic outlook, the current market environment provides an opportunity to invest in structurally attractive and resilient companies at historically cheap valuations.

While this is a valid observation, there can be little doubt that the tax breaks on offer are one of their most attractive features, and a glance at data published by HMRC reveals a strong correlation between the tax incentives applied to the trusts and the yearly changes in funds under management (FUM), as is evidenced in the chart below:

The rate of income tax relief climbed from 20% to 40% in tax year 2004/05, before being pared back to 30% in 2006/07 – the impact of both decisions clearly visible in the table. Since then, the tax rate has not changed and funds had been growing steadily until they shot up once more in 2021/22.

Burdens and allowances

While the tax breaks , the tax burden on the UK consumer has, says Jason Hollands, managing director of Evelyn Partners’ platform Bestinvest. He believes that frozen thresholds, the tapered pension allowance and lifetime allowance have placed added pressure on the consumer.

He adds: “The number of higher rate taxpayers is already estimated to have ballooned to 5.5 million, the highest ever and a 15% increase on the previous year.” With a reduction in the threshold for paying the 45% additional income tax rate coming in April, Hollands says there is no doubt that investor appetite has been influenced strongly by this increasing tax burden.

Alan Sheehan, a director at the tax-efficient research provider Micap, notes that as pensions tax reliefs have been cut, advisers have increasingly looked to VCTs, as well as enterprise investment schemes (EIS), to help reduce their clients’ income tax liabilities.

The Wealth Club CEO Alex Davies says: “Over a decade ago, a high earner could invest up to £255,000 per tax year in a pension and get a significant percentage of that back in tax relief. Those days are gone. Now the annual pension allowance is £40,000 – reduced to a mere £4,000 for some. Meanwhile, the pension lifetime allowance, the total amount most people can put into a pension over a lifetime, stands at £1,073,100 and will stay frozen at that level for years to come.”

Entering the mainstream

In this climate, it is unsurprising that the attraction of VCTs endures, even in the face of an uncertain economic outlook, and several commentators expect their transition towards the mainstream of investing to continue. Matt Currie, an investment director at Seneca Partners, says the rigour with which they are regulated, as listed entities, gives investors comfort, and their track records are also easily comparable.

Compare this, for example, to the EIS space, where Currie says “there is a real lack of transparency, track records are very difficult to navigate and there is a lot of smoke and mirrors”.

VCTs appear to be populating the intermediary space too, with Micap’s Sheehan identifying that adviser clients are becoming increasingly comfortable recommending VCTs, due largely to a better understanding of the products, and an ability to spot the planning opportunities. However, he points out that they are still high-risk investments, and are rarely suitable when more mainstream options, such as Sipps and Isas, are still available.

There some additional questions surrounding the scheme, mostly over whether the tax breaks are reflective of the risks of the investment. Currie adds: “There is certainly an argument to say that [the tax breaks] are generous—potentially overly—for those VCTs still overweight in legacy holdings, which would not be VCT qualifying under the current rules.” He warns that, for the sector to maintain its space in the market and ensure those tax breaks do not come under increased scrutiny, they need to be seen as being reflective of the risks.

Micap’s Sheehan argues that some may deem the current level of relief to be unnecessary given the strength of investor demand. However, he counters this by saying it would seem short-sighted to reduce the tax relief, and risk hampering the country’s young businesses at a time of economic turmoil.

The VCT scheme is not officially set to be reviewed until 2025. However, with chancellor Jeremy Hunt set to take to the despatch box on 15 March, anything and everything will be up for grabs as he endeavours to balance the country’s books as talk of a recession abounds. So should investors be worried?

Currie says: “For a scheme that has worked so well over so many years, I would be surprised if any changes were ground-breaking.”

Clearly there is a balance to be struck between directing enough capital towards young, up-and-coming UK businesses, and not offering overly generous tax breaks, but with a potentially rocky economic path ahead, and a heavy tax burden already sitting on the UK consumer’s shoulders, the merit of the scheme for businesses and investors alike remains clear.