Targeted absolute return funds suffered net outflows of £491m in April as the rest of the UK funds industry enjoyed a bumper month, according to the latest Investment Association figures.

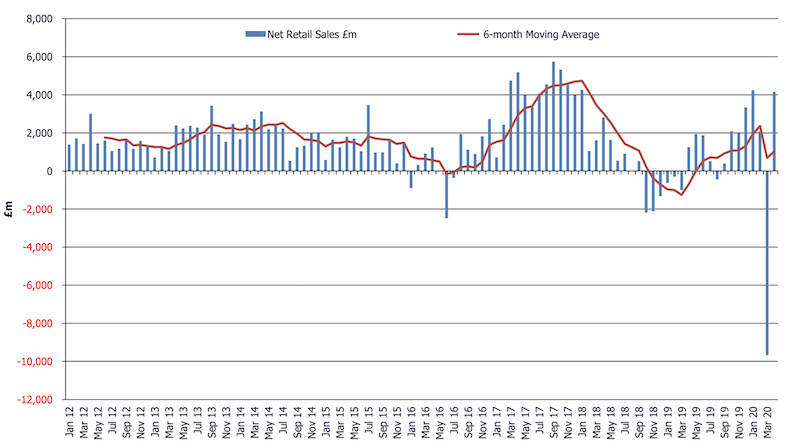

Savers pored £4.2bn back into funds in April, although this represents less than half the net outflows faced by the industry in March, when the coronavirus lockdown began and investors yanked £9.7bn.

Investment Association net retail monthly flow figures

Source: Investment Association

The IA Targeted Absolute Return sector suffered the worst outflows followed by the IA UK Gilts sector, where investors pulled £237m.

In equities, European sectors collectively faced net outflows of £206m, while Japan funds saw net outflows of £77m.

Global funds were the best-selling region with net inflows of £1.2bn followed by UK funds taking in £1bn, £874m of which went into the IA UK All Companies sector.

A good month for active and responsible investments

Investors were almost twice as likely to choose active funds over passives amid the coronavirus uncertainty.

Active funds took in £2.7bn over the month compared to £1.4bn that went into passive funds.

Responsible investment funds also enjoyed record inflows of £969m.

Passives and responsible investment funds had both remained in positive territory in March, while other funds types faced record outflows. They attracted £467m and £123m respectively during the month.

How Investment Association equity sectors performed over April and May

| Sector | Performance |

| IA North American Smaller Companies sector | 29.84% |

| IA Japanese Smaller Companies sector | 26.71% |

| IA European Smaller Companies sector | 25.13% |

| IA North America sector | 23.85% |

| IA UK Smaller Companies sector | 20.46% |

| IA Global sector | 20.04% |

| IA Japan sector | 19.02% |

| IA Europe Excluding UK sector | 18.63% |

| IA UK All Companies sector | 16.39% |

| IA Global Equity Income sector | 15.15% |

| IA UK Equity Income sector | 12.80% |