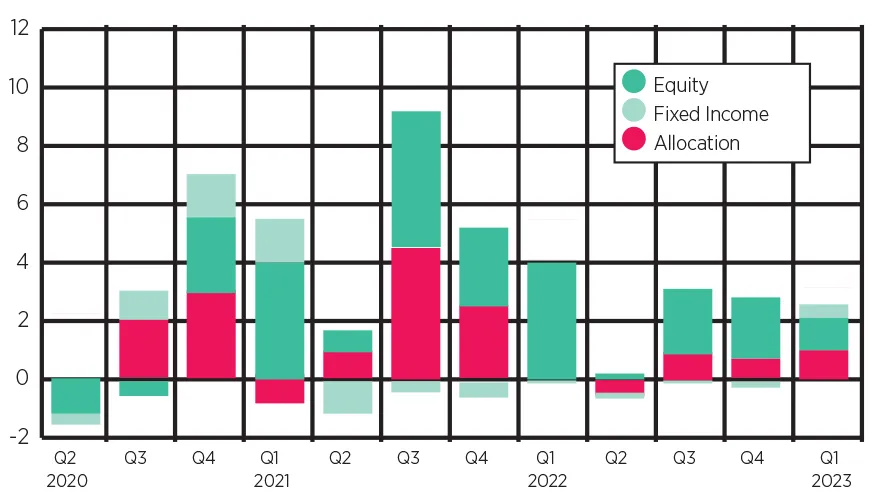

Sustainable funds across Asia continued to see outflows in first quarter of the year with almost $100m (£80m) pulled by investors.

According to Morningstar’s Global Sustainable Fund Flows: Q1 2023 in Review, looking at data excluding China, the Asia region $97m (£77.7m) exit sustainable funds with thematic equity funds investing in secondary batteries and electric car manufacturers driving the outflows. This follows the net outflows of roughly $22m (£17.6m) recorded for the Asia ex-Japan region over the fourth quarter of 2022.

South Korea had the highest outflows of $545m (£436.6m), while Singapore and Hong Kong saw outflows of $157m (£125.8m) and $117m (£93.8m) respectively. By contrast, Taiwan experienced the largest net inflows at $710m (£568.5m), while Malaysia saw the second-most net inflows at $49m (£39.2m).

Akin to the other regions, assets climbed 3.1% to $63bn (£50.4bn) by the end of March. Taiwan and South Korea remain the largest markets accounting for 17% and 11.6% of the region’s assets respectively.

In terms of product development, there were 26 new launches across the Asia region 17 of which were from China. Allocation and equity funds comprised the bulk of new launches.

Asia ex-Japan sustainable fund flows by asset class (US$bn)

Japan also saw net outflows – the third consecutive quarter – of $961m (£769.4m). Morningstar commented: “In Japan, newly launched funds tend to attract inflows, but within a few years after inception, investors take their money out. The decrease in newly launched ESG funds in the first quarter meant that inflows into newer funds couldn’t offset the outflows from older funds. Notably, eight out of top 10 funds in terms of outflows were launched in either 2020 or 2021.” Only two new funds were launched in Q1. Meanwhile, assets increased 3% in the region to $26bn (£20.8bn) due to higher stock prices.

In Australia and New Zealand, sustainable funds flows were dramatically lower than previous periods; inflows amounted to $108m (£86.5m) down from $1.53bn (£1.2bn) in Q4 2023. Assets increased by 7.8% to $30.8bn (£24.7bn).

Global

Looking at the sustainable fund universe from a global perspective, inflows stood at $29bn for the first quarter of 2023, down from $38bn (£30.4bn) the previous quarter. The report said investor sentiment was dampened by “macroeconomic pressures including rising interest rates, inflation and a looming recession”. However, like in Europe, higher valuations meant fund assets rose to $2.74trn (£2.2trn) from the restated $2.55trn (£2trn) in the previous quarter.

“This 7.5% expansion exceeds the overall global fund market growth of 4% in the three months through March 2023,” the report said.

Hortense Bioy (pictured), global director of sustainability at Morningstar, commented: “The first quarter was a continuation of what we saw in 2022. ESG funds are not immune to the challenging macro environment, as reflected by their lower inflows compared with a few quarters ago. But ESG funds are still growing faster than the broader fund market, supported by increased ESG regulation at both company-and fund-level.”

Europe

In Europe, inflows and product development sustainable funds also slowed in Q1 2023 but assets under managements nudged towards historical highs.

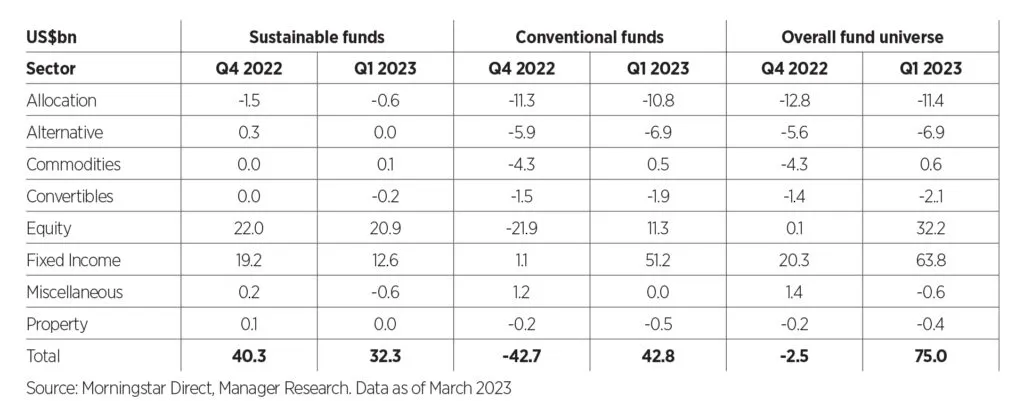

The report showed net flows into the European sustainable fund universe declined to $32.3bn (£25.9bn) in the first quarter of 2023 from the readjusted $40.3bn (£32.3bn) of the previous quarter.

Passives were popular taking three quarters of the new capital. In terms of asset classes, equity strategies took the lion’s share of the inflows with almost $21bn (£16.8bn), while sustainable bond funds gathered only $12.6bn (£10.1bn), which is much less than the $19.2bn (£15.4bn) in the previous quarter.

Sustainable fund flows compared with conventional fund flows by asset class

Despite the lower flows, Morningstar reported assets in strategies rising for the second-consecutive quarter to reach $2.3trn (£1.8trn), up 8.2% from December 2022 due to higher valuations. As a result, the market share of sustainable funds in Europe rose to 22% from 18%.

However, the number of new launches within sustainable funds also slowed to a historical low of 53 – this is compared with 155 in Q4 2022.

“The decline in new products can be partly attributed to the overall market sentiment damped by the challenging macro backdrop but also to greenwashing accusations and the ever-evolving regulatory environment,” the report said.

“A clarification by ESMA last summer led many product manufacturers to downgrade Article 9 funds to Article 8 funds in the second part of the year, while waiting for further guidance on fund classification and how to interpret the definition of a ‘sustainable investment’ provided by Article 2 of the EU’s Sustainable Finance Disclosure Regulation.”

US

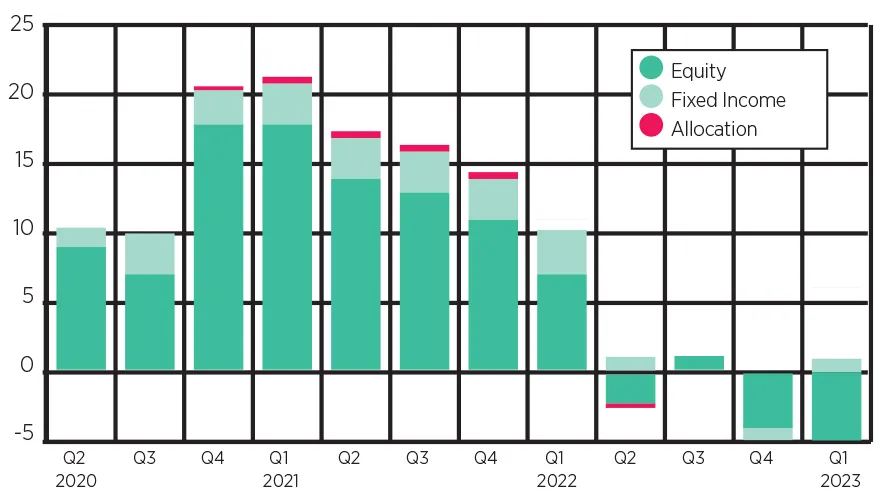

In the US, investors pulled $5.2bn (£4.2bn) from sustainable funds in Q1, the third quarter of outflows in a year. A total of $12.4bn (£9.9bn) exited these funds amid challenging market conditions and growing anti-ESG rhetoric – Republican governors from at least 19 US states have pledged to resist ESG investing over “antitrust, consumer protection and discrimination concerns”, Morningstar noted.

“In the US, besides the challenging market environment, another factor that could have contributed to the third quarterly outflow in a year is the political backlash against sustainable investing. While it’s hard to measure its impact on investor demand for ESG products, it is equally hard to ignore it,” commented Bioy.

Unlike in Europe, active funds were in favour in the US in Q1 breaking a three-quarter streak of outflows; they netted $91m (£72.9m), while passive mandates shed nearly $6.1bn (£4.9bn). However, Morningstar said: “If not for one fund, namely iShares ESG Aware MSCI USA ETF ESGU, which bled nearly $6.5bn (£5.2bn), passive funds would have ended the quarter in the black.”

Bond funds were also popular with $500m (£400.5m) in inflows, compared with equity funds, which lost $5.4bn (£4.3bn) of outflows.

Rising equity and bond markets, however, meant overall assets were higher reaching $296bn (£237.1bn)– their highest point in a year.

In terms of product launches, this also slowed in the US with 17 new funds coming to market – down from 44 in Q4 2022.

US sustainable fund flows by asset class (US$bn)

This story originated on our sister title, ESG Clarity.