The coronavirus surge in yields across the UK Equity Income sector looks set to come tumbling back to earth as dividend cuts surpass £3bn and the number of companies introducing such measures grows daily.

More than £1bn of UK dividends were cut on Wednesday alone bringing the total number of cuts to £3.3bn in the year to date, according to data compiled by AJ Bell. Persimmon accounted for the largest of those cuts shaving of £751.8m when its special dividend was cut. Its ordinary dividend has been suspended.

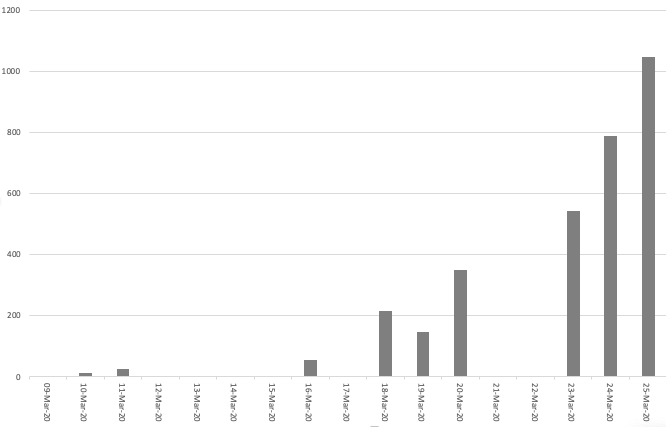

UK company dividend cuts due to coronavirus (£ millions)

Source: Compiled by AJ Bell using company accounts

But those figures are yet to feed through to fund yields, which have surged in the year to date as coronavirus knocks stock prices.

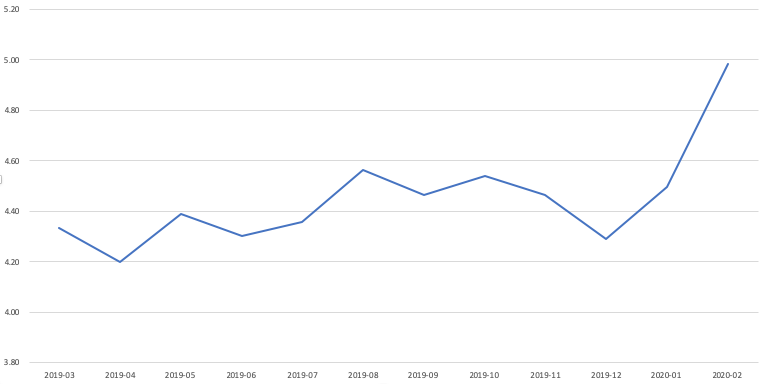

The average yield in the EAA UK Equity Income sector jumped 16% in the year to the end of February with the average yield 4.3% at the close of 2019. Two months later this had hit 5%.

“While this optically looks attractive, with a large number of UK-listed companies already having reduced or foregone their dividend and many more expected to do so, in reality it could be markedly lower,” says Morningstar associate director of equity manager research Peter Brunt.

UK equity income fund yields over the last 12 months

Source: Morningstar, based on the EAA UK Equity Income category

The AIC UK Equity Income sector also saw yields jump 16% over the same period from 3.87% at the end of 2019 to 4.49% at the end of February. Yields jumped further still between then and now with the sector yielding 6.1% at close of play Tuesday.

Some investment trusts have already amended their dividends.

Nick Train’s Finsbury Growth & Income portfolio put its track record of rising dividends on hold last week keeping its first interim dividend at 8p per share. Several days later SQN Asset Finance Income, which sits in the AIC Leasing sector, revealed it would be suspending dividends to conserve liquidity.

Equity income distributions could fall by a fifth

Square Mile head of research John Monaghan says UK equity managers the research agency has spoken to recently expect the market to see at least a 20% fall in income.

That could mean some funds struggle to meet their objectives.

“If a fund has a commitment to grow its distribution on a year-on-year basis, then clearly any reduction in distribution will result in this commitment not being met,” Monaghan says.

But funds with a yield target are not entirely safe either even as underlying stock prices adjust, he says. “The risk here is that if the company has to cut its dividend, then the yield could fall from say 5% to zero at the blink of an eye.”

What type of income funds are most challenged?

Within the equity income universe, enhanced income funds and barbell strategies could face the most pressure from scrapped dividends, says Monaghan.

In the case of enhanced income, the covered call strategies used to increase yield could prove problematic. “The risk here is that with volatility currently very high the price of these options are likely to be considerably higher than they have been in the past few years.”

In the case of a barbell approach, Monaghan says reliable blue-chip companies would have paired with higher yielding, cyclical names that may be more vulnerable to seeing their yields fall to zero.

“Those funds with a greater emphasis on dividend sustainability and/or those that are more conservatively managed have held up well and have, in some cases, fallen by far less than the FTSE All Share over the recent period.”

Architas may rotate exposure if dividend cuts start to bite

Architas is not yet aware of any major effect on its six income portfolios from dividend cuts, according to senior investment manager Solomon Nevins.

But if that changes, Nevins says exposure may need to rotate to meet expectations.

“A combination of corporate bonds, emerging market debt, equities and alternatives will be needed. This is a great opportunity for active managers to justify their fees by navigating this challenging environment to ensure income generation is steady,” Nevins says.

Within equity income, he points to small-caps as the sector likely to face the most challenges. “Small-cap companies generally have less good access to capital and more narrowly focused business models that are domestically focused so likely to suffer as consumers stay indoors and generally activity slows.”

US and UK have been at the centre of dividend cuts

Fidelity International is taking comfort in the fact it is not overly concentrated in the US and UK large-cap dividend equity stalwarts that have been at the centre of the recent announcements, says client portfolio manager Elia Soutou (pictured), who works on the £931m Fidelity Multi Asset Income fund.

Soutou points to their diversification in Asia.

She says: “Asia high yield remains an area of relative conviction compared to other high yield markets, Chinese government bonds are offering a more attractive proposition than developed market government bonds, and while still in its infancy relative to the dividend equity culture in developed markets, Asian equity dividend strategies are an important allocation in our income portfolios.”

Reserves set to benefit investment trusts over open-ended counterparts

For open-ended funds, the effects of dividend cuts will feed through to unit holders in the current financial year, says Monaghan.

“The fund could hold back income received in March and distribute it in December’s payment, so that the payments are broadly equal, but the fund cannot withhold any income received from one year to another,” he says.

In contrast, investment trusts can hold back income across multiple years in order to smooth distributions. “So in theory underlying companies that have cut their dividends could have less of an impact in the closed-ended fund world.”

But highly-geared trusts may have loan covenants requiring them to cut dividends to service debt, Nevins points out.

The AIC says around half of investment trusts use gearing and that those using derivatives will also not be affected by covenants. The AIC UK Equity Income and Global Equity Income sectors both have average gearing of 13%.