By Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity Fund

Numerous economic indicators have now been warning investors of an upcoming US recession for more than a year. Whenever it materialises, it will be the most anticipated recession in over 50 years, according to BCA research.

While investors have been braced for negative earnings surprises for the upcoming second quarter results, we believe there are good reasons to not be overly concerned.

Technology

Earlier this year many technology businesses, and especially the large ones, made record headcount cuts to address the slowing growth in demand for their services – specifically in cloud spending as clients rationalised their needs. Both the rationalisation and staff cuts are now done, while the recent spurt in AI services put demand for cloud services back on track. Some of these cost-saving and new-demand benefits may already start reflecting in some technology firm results, such as Alphabet (Google) and Microsoft. Of more importance, a renewed structural growth trend in this fourth industrial revolution is now starting and can benefit technology firms’ profitability for time to come.

Healthcare

While waiting lists for procedures have grown materially since the pandemic, many medical equipment companies’ operations have been held back by a lack of staff support in hospitals. These staffing levels have started to normalise over recent months and, with the continuing strong demand for their services, investors can now look forward to a prolonged earnings recovery trajectory. This reporting season may deliver the early signs of that in companies such as Edwards Lifesciences and Stryker.

China

The reopening of the Chinese economy has slowly started to benefit many global operators already, particularly in the luxury goods and consumer discretionary sectors. These benefits come through in different phases in the form of normalising demand (such as with LVMH, L’Oréal), normalising production and inventory issues (for example, Nike) and normalising international travelling (which Estee Lauder is benefiting from, among others). We could begin to see the positive impact of renewed structural growth in the Chinese consumer market in Q2 earnings.

Currency

The strong dollar has been a headwind to many US corporates’ earnings for a long time, due to their large international earnings component. While the currency’s most recent peak occurred in September last year on a year-over-year basis, according to data from Bloomberg, these headwinds have only recently turned into tailwinds. These benefits are now expected to start coming through in the results of companies such as McDonald’s, Accenture and Visa.

Earnings excluding energy

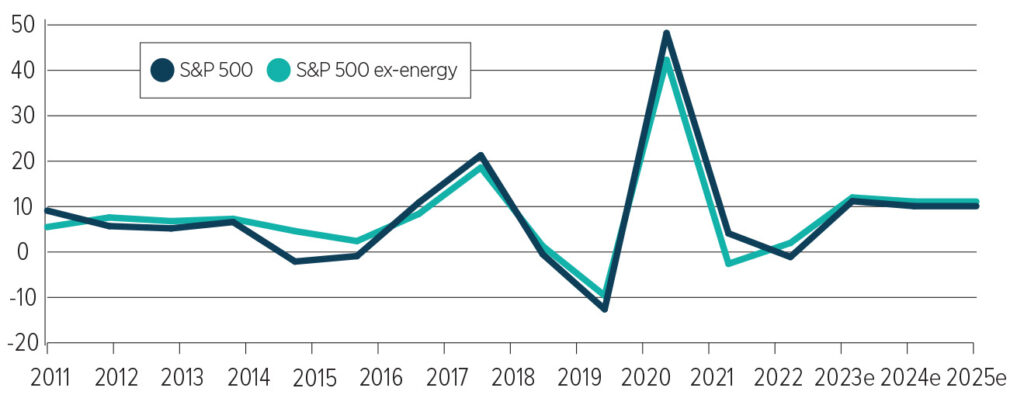

Investors often consider the S&P 500 index’s earnings when making judgements on upcoming earnings seasons.

The energy sector last year boosted the overall index earnings hugely because of high energy prices at the time. This is now working in reverse, with energy earnings dropping materially and dragging down the overall index earnings. We prefer to consider the S&P 500’s earnings without the energy component as this is a better reflection of real experiences. Consensus expectations for this component have already turned for the better.

Total return of S&P 500 versus S&P 500 ex-energy (%)

Chart: Bloomberg. Stonehage Fleming Investment Management. July 2023.

As reflected in the above chart, normal index earnings had positive growth last year. This hid the fact that non-energy earnings actually dropped. This picture is expected to turn around this year, with a good level of growth expected from next year. This suggests investors should not become obsessed with the current earnings season, and rather look beyond it to utilise the opportunities that may soon be offered to them.

–

PA event: Autumn Congress, September 27th– 29th | RSVP via email

Hosted at The South lodge Hotel. Transport and accommodation will be provided for the duration of the event.

Our Autumn Congress will serve as a comprehensive platform for discussing the key trends, challenges, and innovations shaping the wealth management landscape. It will bring together thought leaders and industry professionals for enlightening discussions and networking opportunities.

Sponsors include Alliance Bernstein, Alger, Boston Partners, Baillie Gifford, CCLA, Janus Henderson, GAM, Jupiter AM and many more. Please see the full line-up on our website: AC2023