The IA UK Smaller Companies sector is well established and highly competitive. As at the end of November 2022, it consisted of 51 funds, with assets totalling around £12.3bn.

The sector boasts a number of the UK fund management industry’s investment stalwarts, with managers such as Andy Brough, Anthony Cross and Gervais Williams all still plying their trade. However, it would be remiss of me not to mention Harry Nimmo, who recently retired having been the ever-present manager on the Abrdn UK Smaller Companies Fund since its launch in 1997. It goes without saying we wish Harry all the very best with his future endeavours.

Such longevity of managers is perhaps indicative of how difficult it is for new strategies to make an impression in the sector. Indeed, there have been only three new funds launched since 2018: TM Tellworth UK Smaller Companies in November 2018; TB Whitman UK Small Cap Growth, December 2020; and SVS Dowgate Wealth UK Small Cap Growth in March 2022.

The general shift away from the UK equity market is another reason behind the scarcity of newcomers, with asset allocators and fund selectors believing the sector no longer meets their needs and that a global perspective is required. This is very much in the same vein as other regional sectors, from which there have been similar outflows; in contrast, the IA Global sector seems to be the clear beneficiary.

Nevertheless, it is worth noting that the 10 largest funds account for more than half of the sector’s assets, leading to some strategies being soft-closed, while others have looked to limit capacity by other means, deliberately elevating fees to deter investors and placing a limit on the number of units in issuance, for instance.

Others, meanwhile, remain open, and therefore liquidity is still a vitally important consideration for fund managers and fund selectors alike. As we will see from looking at performance over the course of 2022, there are very few hiding places in this asset class in times of market stress.

How it’s performed

To say last year was a challenging period for the sector is a massive understatement. At time of writing (end of November), the sector average is down 24.8%, with commonly used index comparator the Numis Smaller Companies ex investment companies plus AIM down by 21%.

The first half of 2022 proved the most painful as the war in Ukraine, rising inflation being met with interest rate hikes, the general apathy towards the UK market and the rotation away from ‘growth’ sectors, all combined to provide a particularly stiff headwind for the index.

There was some brief respite in early Q3, but the shenanigans within the Conservative Party and ‘10-minute’ chancellor Kwasi Kwarteng’s mini-budget caused the market to shudder once again resulting in the sector and index falling 7.1% and 9.3%, respectively, over the quarter. During the first nine months of the year, the sector was down 31.1% and index 27%, but following the appointment of Rishi Sunak in October, the political backdrop has improved and so the market underwent a small recovery during Q4.

It is worth noting that the AIM market, which can be a rich hunting ground for many small-cap managers, particularly those looking for businesses with strong growth characteristics, has had a tough period from a performance perspective. While returns during the ‘re-opening trade’ of Q4 2020 resulted in it having a strong year (+22%), it has struggled t–o make any meaningful headway since (+6% in 2021 and -29% year to end of November ’22).

Much of this has been driven by disappointing returns from some of its larger constituents. Fevertree, for example, has fallen by over 50% this year to November.

In line with the market falls, a number of companies have experienced some fairly brutal de-ratings. For example, the five-year average 12-month forward price/earnings of the MSCI UK Small Cap Growth Index is a touch over 20x. It is currently trading at below 14x, having fallen from 25x in the middle of last year.

The issue many managers are now grappling with is related to how secure/reliable companies’ earnings are against a muted outlook for 2023 – especially those in the consumer-facing areas. The consensus view is that a recession is likely – that is not really up for debate – but views differ on how long it will last and/or how deep it will be.

Despite that, a number of managers are now starting to tilt their portfolios towards a more bullish stance, given this is now what they view as an attractive entry point for sizeable parts of their investment universe.

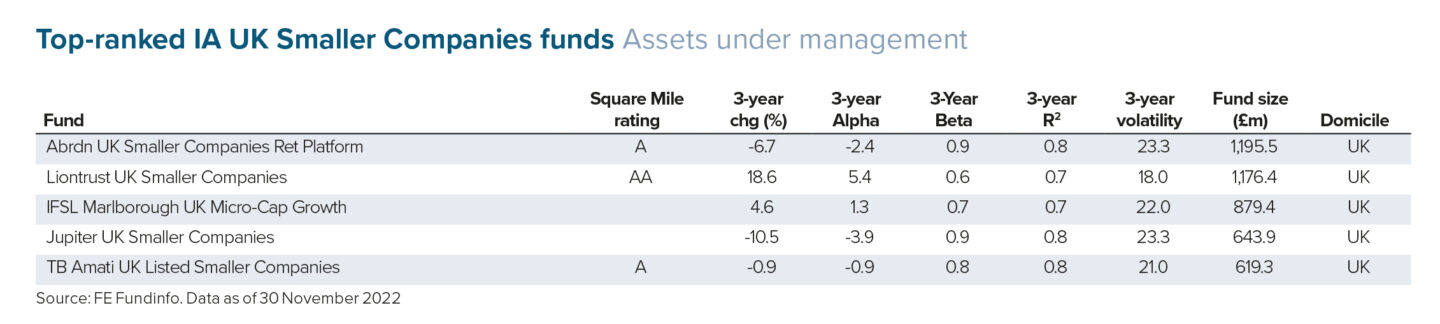

FUNDS TO WATCH: ASSETS UNDER MANAGEMENT

1. Until very recently the ASI UK Smaller Companies Fund was managed by Harry Nimmo, appointed at its launch in 1997. As part of a very well-managed succession plan, Abby Glennie was added as co-manager in November 2020 and going forward will have sole responsibility for the strategy. Glennie is well supported by deputy manager Amanda Yeaman, and the pair work extremely collaboratively with the remainder of Abrdn’s smaller companies team. The approach will continue to be based upon the team’s ‘focus on change’ philosophy, where the basic premise is to uncover and invest in organically growing businesses that have the potential to be tomorrow’s larger companies.

2. Like the team’s micro-cap strategy above, Liontrust UK Smaller Companies benefits from a considered and well-defined investment process. This steers the managers towards relatively steady businesses that they believe have a competitive edge, with the emphasis on seeking to identify a company’s intangible strengths. Shareholder alignment of the underlying investee companies is also critical to the approach.

3. Although not necessarily a household name, Amati has forged a sound reputation as a leading UK smaller companies asset manager. TB Amati UK Smaller Companies is run by a collegiate team of managers who follow an approach that was initially developed by the firm’s CEO Paul Jourdan, which seeks to identify higher-quality companies with robust balance sheets. Jourdan has been involved with the management of the strategy for over 20 years.

FUNDS TO WATCH: 3-YEAR PERFORMANCE

1. Premier Miton UK Smaller Companies has been run by Gervais Williams and Martin Turner since its launch 10 years ago. A key characteristic is its diversification, and it is not uncommon to see a portfolio with more than 100 names. It also has a sizeable level of exposure to companies listed on AIM. Indeed, currently around 60% of the assets are held in AIM-listed companies. The fund has had a troubled 2022 and therefore a rather disappointing short-term track record, but this is outweighed by the strength of returns in years where there is a more constructive backdrop for the asset class.

2. Liontrust UK Micro Cap is managed by Liontrust’s Economic Advantage team, headed by Anthony Cross. The process, which is consistently applied across all of the team’s mandates, seeks to identify companies with a durable competitive advantage that allows them to sustain a higher-than-average level of profitability for longer than the market expects. A key element of the approach for this fund is that management of the underlying companies must own at least 3% of the firm’s equity, and the team will divest from positions if the holding falls below this level.

3. Having launched in February 2019, the LF Gresham House UK Smaller Companies Fund passed its three-year anniversary earlier this year. Ken Wotton has been involved in its management since the outset and has a good track record in successfully identifying companies on or around their time of listing for the first time. (Wotton is perhaps better known for the firm’s micro-cap strategy, which he has managed since 2009.)

John Monaghan is a research director at Square Mile Investment Consulting and Research

This article first appeared in the January edition of Portfolio Adviser Magazine