The UK All Companies sector is one of the most competitive and well-established of all the Investment Association (IA) categories.

According to IA figures at the end of March 2022, the index consisted of 251 funds, with assets amounting to £164bn. All funds in the sector must invest at least 80% of their assets in UK equities.

For further context, UK All Companies is the second-largest sector. Only the IA Global sector is bigger (£176bn), and they are the only two sectors with assets in excess of £100bn.

Despite this, UK All Companies has been in outflow for a number of years. Indeed it is the sector with the lowest level of retail sales in six of the past 10 years.

Nevertheless, it provides exposure to a number of the UK’s most seasoned managers, many of whom have successfully navigated their way through numerous market cycles.

Having said that, few have experienced a more challenging range of conditions as those of the past three to four years.

Weathering the storm

Having finally seen improved political certainty through the resounding general election victory of the Conservative Party at the end of 2019, and with it an acceptable Brexit deal with the EU, there were plenty of managers who felt the UK equity market was well placed for a strong 2020 and beyond.

Some were particularly positive on the outlook for companies whose businesses are more domestically orientated.

Then came the pandemic, and like most market sell-offs, the one that was experienced in Q1 2020 was very much in the vein of the standard response of ‘act now, think later’, with perceived high-risk assets bearing most of the brunt of the following decline.

The consequence for the UK market was that as lockdowns were introduced, travel and leisure-related companies suffered a large proportion of the pain, resulting in a sharp sell-off in mid- and small-cap stocks.

Although, as the market began to recover over the remainder of 2020 and following the announcement of the Covid vaccine rollout at the end of the year, many of these companies recovered.

That said, 2021 also proved a challenging year for active managers, as aside from further lockdowns, supply chain issues and buoyant demand caused a sharp rise in inflation.

These inflationary concerns were felt across most of the globe and were subsequently met with central bank announcements of interest rate rises, with the Bank of England being no exception.

Therefore, the UK base rate has risen from 0.1% at the end of 2020, to 1.25% following the latest 25 basis point rise in June 2022.

Chop and change

With style and market-cap factors oscillating in and out of favour, the recent period has been very challenging for active managers.

The IA sector average is about 300 basis points behind the mainstream indices on a three-year view to the end of April 2022 (11% versus 14%).

During this time they have also seen a significant rotation from growth companies, where managers were prepared to pay lofty valuations for the perceived certainty of companies being able to grow their earnings, into value businesses that had largely been overlooked in the low interest rate environment.

When we combine this with the appalling events in Ukraine over the past couple of months and the subsequent impact on global energy prices, the spread of performance across the UK market segments has been stark.

For example, for the 12 months to the end of April 2022, the energy sector has risen by over 55%, whereas the consumer discretionary and technology areas have fallen by 13%.

In terms of style over the same time period, value has delivered around 20% and growth about 8%.

Perception gap

From a market-cap perspective, mid-caps have lagged behind both their small- and large-cap peers over the three years to the end of April 2022, which has proven painful for a number of active managers, given this is the element of the market that has historically provided them with a boost for returns.

Aside from their frustrations of posting disappointing returns relative to mainstream UK indices and peers, fund managers have also noted that, operationally, a large number of mid-cap firms are performing well, and their results are beating many analysts’ expectations.

However, this success is largely being overlooked by the market.

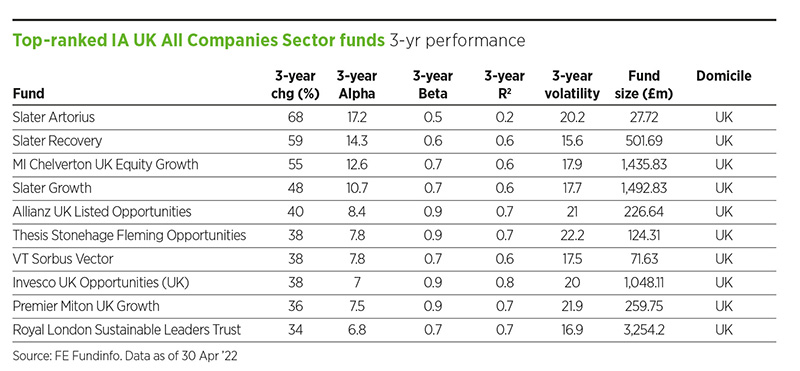

FUND TO WATCH: 3-YEAR PERFORMANCE

1. The Slater Recovery Fund, launched in 2003, invests across the market capitalisation spectrum. As its name suggests it is managed with a focus on companies that are out of favour and, as a result, tend to be lowly valued on a price/earnings basis. However, these businesses have strong cashflows and robust balance sheets.

2. The MI Chelverton UK Equity Growth Fund invests in companies that are listed outside of the FTSE 100 and centres around those that can deliver higher earnings growth than the broader market. The strategy is managed with an unconstrained approach and the portfolio tends to be highly diversified, often investing in more than 150 holdings.

3. In contrast to the Slater Recovery strategy mentioned above, the Slater Growth Fund invests in attractively priced companies that exhibit superior and sustainable growth potential.

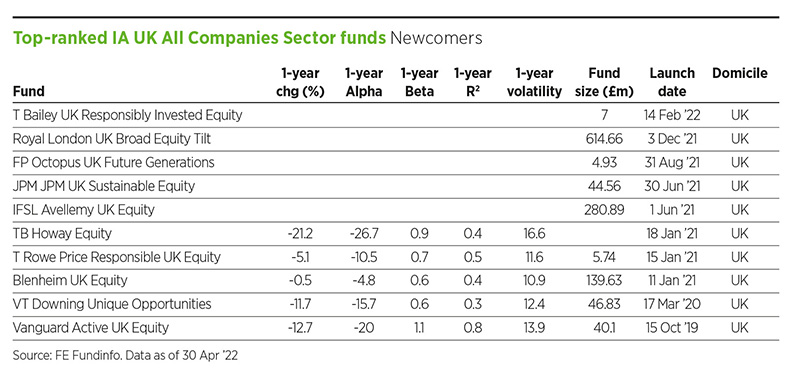

FUNDS TO WATCH: NEWCOMERS

Given the IA’s flow data demonstrates the sector has not been at the forefront of investors’ minds in recent times, it is no surprise that there has been a limited number of new fund launches during the past few years.

1. On the basis that the T Bailey UK Responsibly Invested Equity Fund launched barely three months ago, it is wholly understandable that its current assets are fairly modest (£7m). The managers seek to invest in growing companies, but also those that have a commitment to developing their business with a consideration for ESG factors.

2. Royal London UK Broad Equity Tilt was launched at the end of last year. Essentially, it is an index-tracking product designed to invest in the UK market’s largest 600 companies. The managers seek to achieve carbon intensity that is at least 10% lower than that of the index, while also considering a firm’s willingness to transition to a lower-carbon economy.

3. FP Octopus UK Future Generations is a fund that seeks to capitalise on the growing demand for responsibly orientated strategies. It is run by the firm’s trio of small-cap managers and focuses on delivering three key themes: revitalising healthcare; empowering people; and building a sustainable planet.

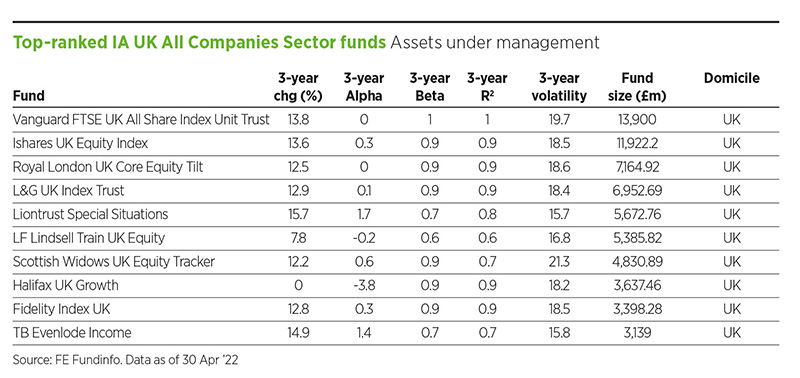

FUNDS TO WATCH: ASSET UNDER MANAGEMENT

At the end of April 2022, the 10 largest funds in the sector – six of which are passive – account for 40% of the assets. At the other end of the scale, there is a long tail of strategies with around 20 funds having assets of less than £20m.

1. Vanguard is one of the world’s largest managers of passive strategies. The Vanguard FTSE UK All Share invests in physical securities to replicate the majority of the index’s components, while using representative exposure for more minor elements via an optimisation strategy.

2. Liontrust Special Situations benefits from a considered process that steers its team towards steady businesses they believe have a competitive edge, are gradually growing and generate high levels of cash. They seek to identify a company’s intangible strengths, which are categorised by three broad buckets: intellectual property; recurring revenue; or strong distribution networks.

3. Lindsell Train’s approach is extremely long term and, as a result, LF Lindsell Train UK Equity’s turnover is very low, with holding periods that are measured in decades. The concentrated nature of the portfolio (about 30 holdings) is reflective of both the limited number of businesses with the characteristics that it seeks and the view that such stocks are fundamentally undervalued.

John Monaghan is research director of Square Mile Investment Consulting and Research

This article first appeared in the June edition of Portfolio Adviser Magazine