The IA Sterling Strategic Bond sector is home to an array of different fixed income funds that seek to deliver a variety of investment outcomes. The only requirement for inclusion in the sector is a minimum of 80% exposure to sterling-denominated (or hedged back to sterling) fixed income assets.

Funds in the sector can follow diverse investment guidelines. They include different geographical and sector biases, varying interest rate and credit risk exposures, and range from developed government bonds to high yield corporate, and even equities.

Moreover, there is no common index against which the funds can be measured, and as the funds’ asset allocations can significantly change over time, any meaningful comparisons between strategies proves challenging.

A part of the whole

To address this issue, at Square Mile, we have divided the sector into four sub-sectors, so that more meaningful comparisons can be made from both performance and risk perspectives.

The first three of our four categories mark different points along a traditional risk spectrum. As an investor advances from one category to the next, the expectation is that the additional volatility incurred will be rewarded with a higher return over time.

The two categories at the lower end of the risk spectrum, low risk and medium risk, are multi-sector, meaning they can contain a mix of fixed income assets across investment-grade, government debt, high yield, emerging market debt, asset-backed securities and inflation-linked bonds with a moderate overall component of duration risk.

Funds within these two groups are likely to make up the traditional defensive component of a fixed income allocation. The third group, higher risk, comprises funds that are basically credit-focused and have a closer correlation with broader markets.

The fourth category, duration risk, reflects the need for the most traditional component of a fixed income allocation: diversification. Here, the funds take an active asset allocation approach but will generally have meaningful duration risk, thus providing the level of diversification that investors seek from an allocation to fixed income.

When economies are struggling and equity markets are underperforming, central banks typically should be reducing interest rates, resulting in positive returns for duration risk. At this point, these types of strategies generally provide some counterbalance to wider market losses.

In terms of our expected outcomes for each sub-category, the funds in the low-risk group will emphasise capital preservation with some income, medium-risk funds will aim to provide income or a combination of capital accumulation and income, higher-risk funds will be income-oriented, while duration-risk funds should provide a combination of capital accumulation and income.

In essence, our creation of the four sub-categories reflects the need to determine the outcome an investor might expect from a fund within the sector, ascertain its objective and ask what benchmark can be set to demonstrate success.

Limitations may emerge due to the flexibility of the parameters that govern the funds and exposures moving over time, but by establishing the sub-categories, an informed decision on fund selection can be made based on a more reliable like-for-like comparison.

A hard road

The past few months have been one of the worst periods on record for fixed income, with significant negative returns across asset classes, from government bonds to investment-grade corporates, high yield corporates and emerging market debt.

After years of loose monetary and fiscal policies, the west’s leading central banks have pivoted to a tighter monetary stance in response to high levels of inflation. Interest rates have been hiked as the banks have sought to reduce some of the stimulus and liquidity injected into the market after the global financial crisis.

This has been extremely painful for existing government bond assets. Additionally, credit spreads have also suffered from weakening economic data and the uncertainty of the war in Ukraine.

Turning the corner

In such an environment, strategic bond funds have struggled to provide the stable returns and diversification characteristics that investors expect. Significant losses have been the norm and are similar in magnitude across the different sub-asset classes. Only the lowest-risk funds, with an emphasis on capital preservation and structurally lower exposure to interest rate and credit risks, have been able to mitigate the losses.

However, the circumstances now are different, as the world has moved on. First, interest rates have risen considerably, providing a higher cushion to protect capital should we see further upward moves in rates.

Second, if we move into a recessionary scenario, as many fear, central banks would be unlikely to maintain their hawkish interest rate stance. Indeed, many flexible bond managers have already increased their interest rate exposure as they foresee a reversal in the recent increases in yields.

As markets are adapting to the new environment of higher inflation and higher yields, we believe fixed income assets (in general) and strategic bond funds (in particular), given their flexibility to adapt to market conditions, are in fact now in a stronger position to regain their role in diversifying portfolios.

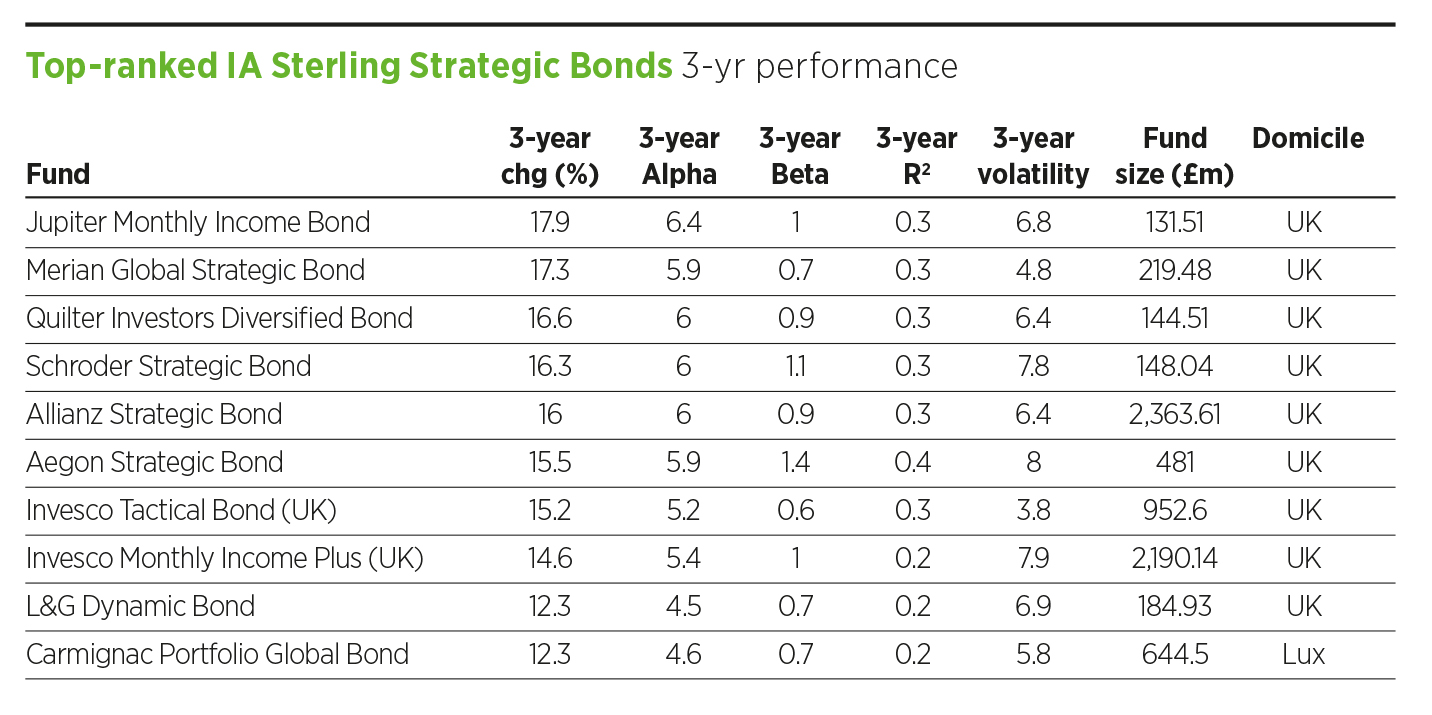

FUNDS TO WATCH: 3-YEAR PERFORMANCE

1. After his co-manager departed last year, Mike Riddell swiftly strengthened the Allianz Strategic Bond team with three senior hires who have brought a wealth of experience. After stellar returns in 2020, the fund was challenged by a short position in UK inflation last year, with returns being more in line with the sector so far during 2022. A major attribute is the fund’s low correlation to equities.

2. Aegon Strategic Bond lead portfolio managers since the end of 2018, Alex Pelteshki and Colin Finlayson bring together complementary credit and macroeconomic skills. While maintaining the fund’s longstanding investment process, they have been more active than previous managers and have taken a higher level of conviction when expressing their views. This, so far, has been rewarded with stronger performance than their forebearers.

3. Despite the retirement of Invesco Tactical Bond managers Paul Read and Paul Causer at the end of 2021, Stewart Edwards and Julien Eberhardt, longstanding members of Invesco’s fixed income team, are continuing with the success of this value-driven, high-conviction, flexible fixed income strategy. This fund has stood out in recent years, thanks to its low volatility and defensive profile focused on downside protection.

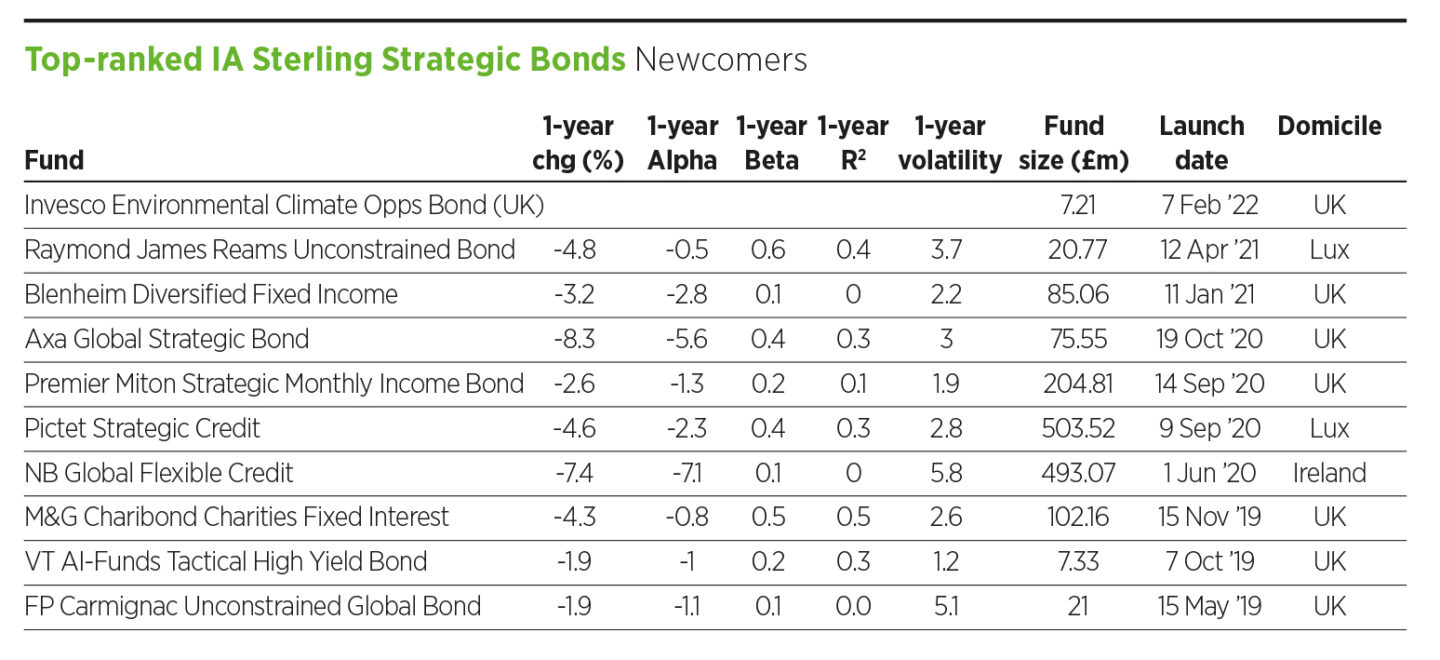

FUNDS TO WATCH: NEWCOMERS

1. Invesco Environmental Climate Opportunities is co-managed by Invesco’s new co-head of fixed interest Mike Matthews and Tom Hemmant, manager of corporate bond strategies. This newly launched strategy has a dual mandate to provide financial returns and support the transition into a low-carbon economy. The portfolio has a focus on credit, combining investment-grade corporates with high yield. During its first months, the fund’s returns have been closely aligned to the Invesco Corporate Bond Fund, managed by the same team.

2. Since joining the firm in 2020, Premier Miton Strategic Monthly Income Bond managers Lloyd Harris and Simon Prior have continued with the high-quality, focused approach they used at their previous house, combining investment-grade, financial and subordinated debt. Their focus on short-dated maturities and delivering income with low volatility is working well in the present environment of rising interest rates.

3. A high-income strategy, NB Global Flexible Credit was launched in Ucits format in January 2020. However, the team has been running the strategy for more than 10 years for institutional accounts, so it has a long track record behind it. The fund invests with a ‘go anywhere’ approach across credit assets, supported by the firm’s global-wide resources.

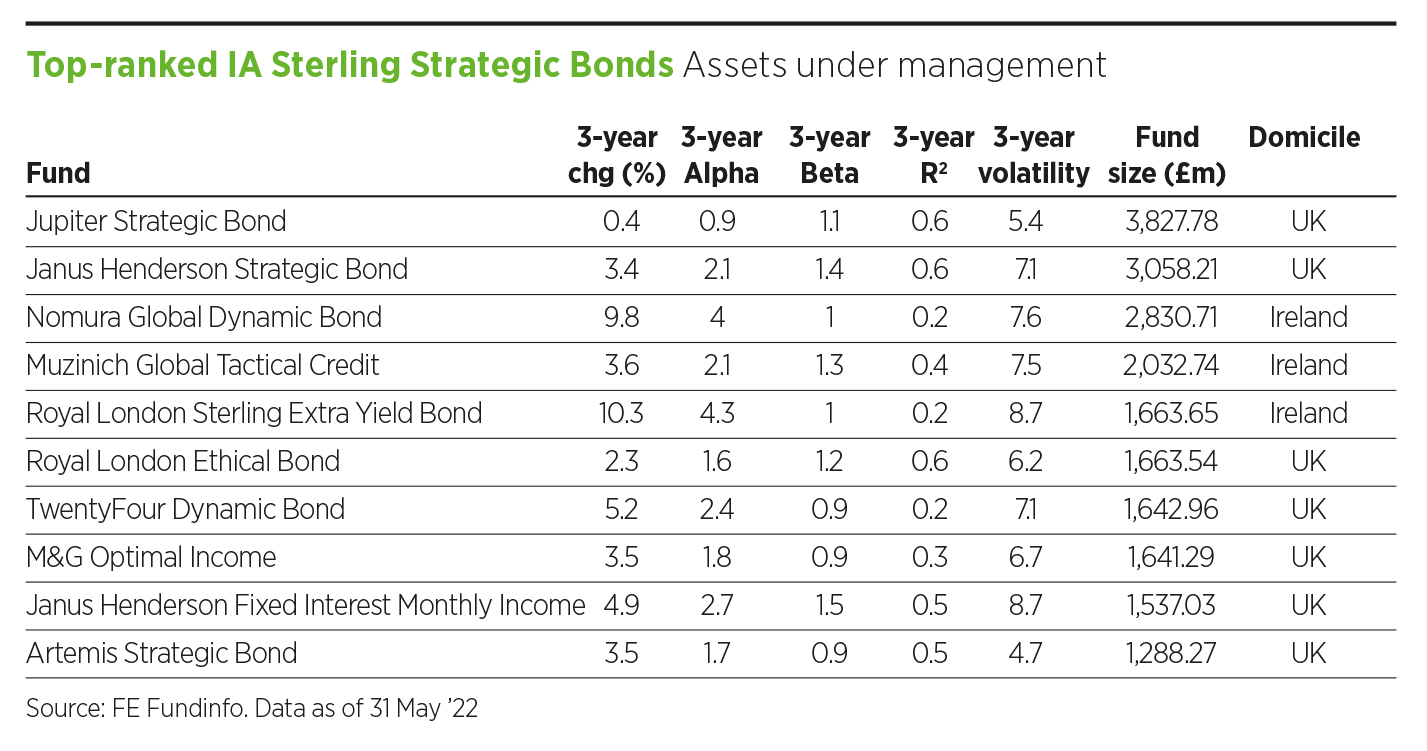

FUND TO WATCH: ASSETS UNDER MANAGEMENT

1. Having managed Janus Henderson Strategic Bond together for nearly 20 years, John Pattullo and Jenna Barnard have shown the market nous and nimbleness required to consistently deliver strong risk-adjusted returns within the sector. Their willingness in recent years to be overweight duration, despite low global interest rates, has been a distinctive feature that has been particularly rewarding for the strategy. However, this has been a headwind for the fund over recent months.

2. The TwentyFour Dynamic Bond is managed by an experienced team supported by the strong credit resources of an investment boutique dedicated to fixed income. Despite the flexible allocation approach, designed to take advantage of opportunities across the fixed income universe, there is a structural bias to financial subordinated debt, where the managers have found attractive opportunities, and it represents a core portion of the portfolio.

3. M&G UK Inflation Linked Corporate Bond is one of the most defensive options within the conservative sub-sector, with the fund providing one of the lowest volatility and drawdown risks. Using three levers to generate returns – inflation, rates and credit – Ben Lord has a focus on capital preservation. This has allowed the fund to stand out as one of the very few to protect capital in the recent environment of rising interest rates.

Eduardo Sanchez is head of fixed income and absolute return at Square Mile Research

This article first appeared in the July edition of Portfolio Adviser Magazine