Emerging market (EM) debt funds have not historically been favoured by the conventional UK investor, who prefers to dedicate their fixed-income allocation to more core strategies, mainly sterling-denominated bonds, such as gilts and investment-grade corporate bonds.

The combination of political, default, liquidity and – in some cases – currency risk, makes EM debt a volatile asset class, and therefore outside the consideration of the defensive characteristics typically required for fixed-income allocations.

The asset class remains therefore a specialist sector, home to more sophisticated clients such as institutional investors, family offices and the like.

Negative consequences

This year has sadly provided a prime example of the geopolitical risk that befalls the asset class, as Russia’s invasion of Ukraine led to sanctions on Russia and its exclusion from the investable universe, resulting in its debt becoming near worthless for foreign investors.

Due to the small size of Russian debt relative to the market, the negative consequences were generally minor. However, there have been some casualties for those strategies with significant overweights to Russian debt, with at least one case of a fund being forced to suspend redemptions and eventually liquidate the portfolio.

Nevertheless, the number of EM debt strategies coming to the UK market has continued to grow in recent years, reaching 118 funds in the IA sector as of the end of July, when only two years ago there were barely 70 funds.

It was only in 2020 when the Investment Association split its Global Emerging Market Bond sector into three separate categories to recognise the different features of emerging market bonds denominated in USD (Global Emerging Markets Bond-Hard Currency), in local currency (Global Emerging Markets Bond-Local Currency) and funds that allocate across both (Global Emerging Markets Bond-Blended).

Much of the growth in assets under management in the sectors has been driven by the inclusion of exchange-traded funds, which attract large investments from institutional investors as a quick way to allocate to the different sub-asset classes without the research effort and additional costs of delegating a mandate to active managers.

Like all fixed-income strategies, EM debt funds are having an extremely challenging 2022. During the past few months, we have seen something of a perfect storm for the market, with generationally high inflation, sharply rising interest rates, an extremely strong US dollar, war in Ukraine and continued disruption to economic activity in China – with the persistently strict lockdowns aimed at curbing the spread of coronavirus.

The pullback in EM bond markets has been fairly consistent over the year, outside of a particularly sharp fall at the outbreak of war in Ukraine and a couple of shortlived rallies, one in the month following the invasion.

Temperature check

Over the first eight months of the year, a currency hedged composite index split equally across external government, external corporate and local government bonds is down by around 15% (in US dollars). Losses in GBP unhedged funds have been minimal, around 1.5%, thanks to the strength of the US dollar.

Hard currency bonds sold off more than local currency bonds, with the predominantly local investor base of the latter proving stickier than in external markets. Energy importers have struggled relative to energy exporters given rising fuel prices, while smaller, higher-beta countries have also tended to underperform given their higher vulnerability to imported inflation.

At the end of March, Russia had its bonds excluded from EM benchmarks (valued to zero) due to international sanctions. Many funds continue to own some of these bonds and are valuing them at, or close to, zero. Should there be a resolution to the war, this could lead to future (above-index) returns for these assets.

While cognisant of the continued economic headwinds for emerging markets, managers continue to stress that on a long-term view the asset class is under-owned and undervalued. That said, few are comfortable enough to be meaningfully increasing risk at this point.

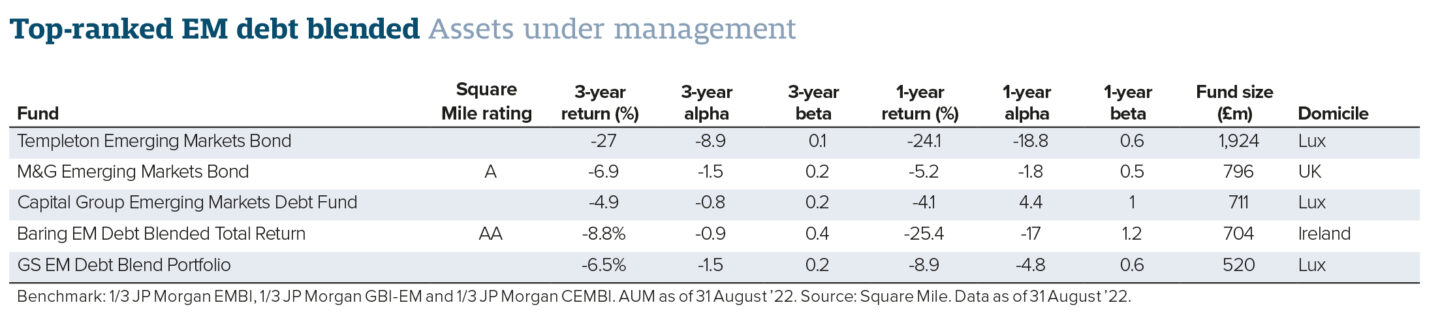

FUND TO WATCH: ASSETS UNDER MANAGEMENT

1. The Baring Emerging Market Debt Blended Total Return Fund, run by Ricardo Adrogué and his team, follows a high-conviction approach, which pulls the managers’ best ideas from hard currency, corporates, local bonds and FX. Despite delivering superior returns over the long term, in periods of market turbulence, as is the case in 2022, the fund experiences higher volatility and drawdowns than its peers.

2. The M&G Emerging Markets Bond Fund’s lead portfolio manager Claudia Calich has a wealth of experience managing emerging market debt and has built an excellent track record, outperforming her composite index each calendar year since 2014, barring 2018. As assets under management have grown over recent years, we are pleased to see how the team has expanded with the addition of four senior investment professionals.

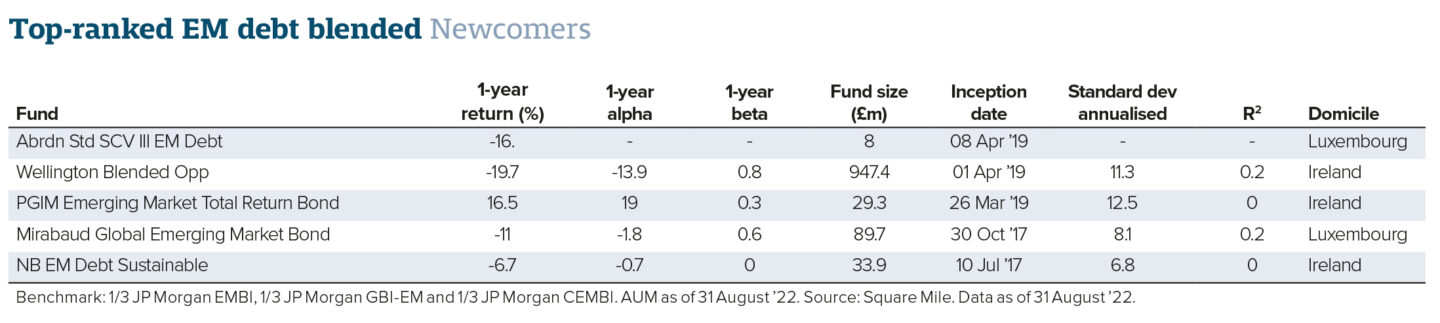

FUNDS TO WATCH: NEWCOMERS

1. The Wellington Blended Opportunistic Emerging Markets Debt Fund was launched in 2009. The success this strategy brought to the Ucits space in 2019 continues, based on an unconstrained, best-ideas approach. Experienced lead managers Kevin Murphy, Michael Henry and Gillian Edgeworth are supported by an extensive team of sovereign and credit analysts, quantitative analysts and traders.

2. The PGIM Emerging Market Total Return Bond Fund is a go-anywhere, flexible strategy, based on the best ideas across the different emerging market segments, provided by one of the largest investors in emerging market debt globally. Led by Cathy Hepworth, since inception in May 2019, the fund has delivered top returns within its sector, thanks to its absolute return approach, combining long and short positions across markets.

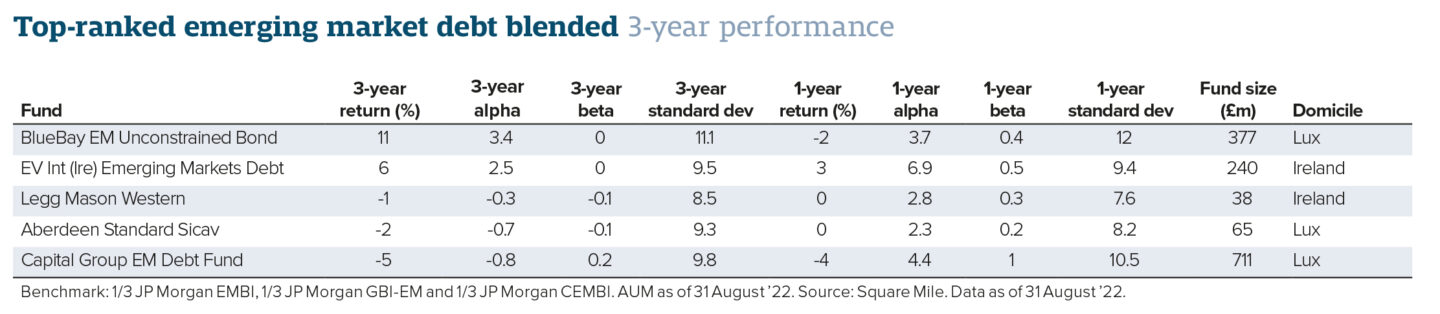

FUNDS TO WATCH: 3-YEAR PERFORMANCE

1. The BlueBay Emerging Market Unconstrained Fund is managed by Polina Kurdyavko, head of emerging markets at BlueBay, alongside Anthony Kettle and Brent David. The fund has delivered a strong track record, thanks to the high-conviction, active approach to portfolio construction employed by the team.

2. Despite the departure of certain managers following the acquisition by Morgan Stanley, the EV Int (Ire) Emerging Markets Debt Opportunities Fund’s remaining team members have maintained the strong relative performance, based on their breadth of country analysis, focus on structural change in policy and politics and access to markets through their large team of traders.

Eduard Sánchez is head of fixed income and absolute return research at Square Mile Investment Consulting and Research

This article first appeared in the October edition of Portfolio Adviser Magazine