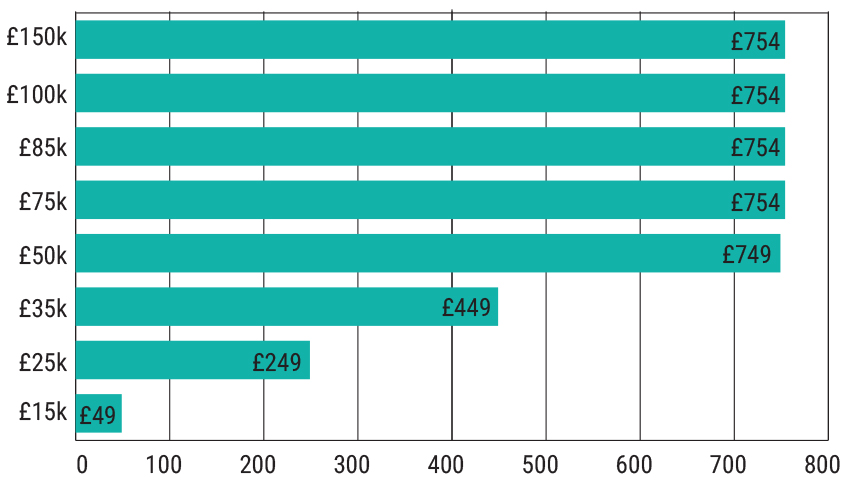

Chancellor of the exchequer Jeremy Hunt has cut National Insurance by 2p in today’s spring budget, which could save the average earner in the UK £450 a year when it comes into effect on 6 April.

It would result in an annual saving of £349 for someone earning £30,000, rising to £749 for those making over £50,000, with higher rate taxpayers earning £60,000 saving £754 a year.

Paired with the other cuts made by Hunt in November’s autumn budget, this could give the average UK earner a combined annual saving of £900. This would drop the main National Insurance rate from 12% at the start of the year to 8%.

National Insurance changes

Hunt said that he was “reducing the penalty on work” by cutting the tax – something he intends to keep on doing, conditions allowing.

“Our long-term ambition is to end this unfairness when it is responsible, when it can be achieved without increasing borrowing, when it can be delivered without compromising high-quality public services,” Hunt said. “We will continue to cut National Insurances as we have done today so we truly make work pay.”

See also: Spring Budget 2024: Inflation to fall faster than expected but debt-to-GDP disappoints

Laura Suter, director of personal finance at AJ Bell, pointed out that this “double-whammy” is targeted solely at saving working people money, as National Insurance is not paid by those over state pension age.

These cuts for working people are likely an effort to win over voters in what could be the final statement made by the Conservatives before the next general election.

Suter said: “The move will also help to quell some of the claims of generational unfairness as those on the state pension are likely to be handed another meaty increase through the triple-lock.

“As Jeremy Hunt has already made cuts to National Insurance, he could also point to the overall tax saving for individuals from the combined cuts – offering up a juicier headline to win over voters.”

Although this move is aimed at winning over some much-needed support from voters, it could ultimately see UK workers paying more taxes, according to Myron Jobson, senior personal finance analyst at interactive investor.

“These savings would ultimately be eroded over time because of the deep freeze of tax thresholds and allowances which, in tandem with wage inflation, means we’ll be paying more in tax in the years to come,” he said.

“It is a sneaky tax grab, as people might not realise they are paying more in taxes simply due to inflation, making it seem less transparent compared to explicit tax increases.”

See also: Spring Budget 2024: Chancellor increases VAT threshold

Hunt also spoke of the double-taxation on UK workers, who have to pay both National Insurance and income tax on any earnings, stating: “The way we tax people’s income is particularly unfair.”

During his time as chancellor, prime minister Rishi Sunak pledged to reduce income tax, but that was reversed by Hunt when he came into the role as he fought to reverse the issues left behind by Kwasi Kwarteng’s mini budget in 2022.

Jobson said: “The cut in National Insurance doesn’t grab the headlines in the same way that a cut in income tax – which is better understood – would. But the tax savings are still significant.

“While cutting income tax would likely prove popular, with a general election around the corner, the worry is it would prove too costly and inflationary.”

While Hunt promised to cut National Insurance, he also said that he intends to maintain public spending at 2% in real terms. He said that public spending remains low, but that he government will “spend it better”.

See also: Spring Budget 2024: Non-dom tax replaced with ‘modern residency system’