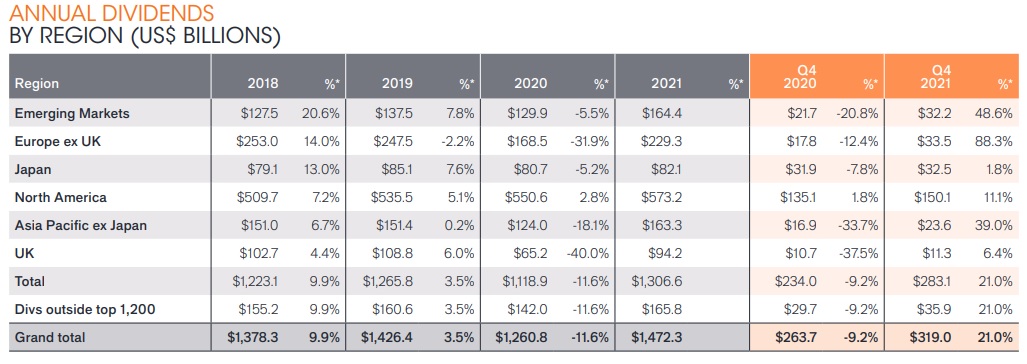

Dividend records were broken in the US, China and Sweden in 2021, which helped push global payments to $1.47trn (£1.09trn), according to the latest Janus Henderson Global Dividend Index.

Compared with 2020, an additional $212bn was paid out, a quarter of which came from companies restarting payments after putting them on ice amid the pandemic.

Excluding one-off payments, year-on-year underlying growth was 14.7%. Headline growth, including special dividends, was 16.8%.

Almost a third of the $63.4bn paid out in special dividends came from the mining sector in the UK, Australia and South Africa.

“2020 saw global dividends recovery very strongly, more than making up for the cuts made during the worst of the pandemic,” the report stated.

The biggest growth was seen in countries that recorded particularly sharp declines during the first year of the pandemic, namely Europe, the UK and Australia.

Recovery was driven by mining and banking

The Janus Henderson report said the world’s banks and miners delivered three-fifths of the $212bn increase in payouts in 2021.

The 10 largest payers, which collectively forked out $149.1bn, were:

| 1. BHP Group | 6. Exxon Mobil Corp. |

| 2. Microsoft Corporation | 7. Apple Inc |

| 3. Rio Tinto plc | 8. Vale S.A. |

| 4. Samsung Electronics | 9. China Construction Bank Corp. |

| 5. AT&T, Inc | 10. Fortescue Metals Group LTd |

For the banks, Janus Henderson said it was about returning to more normal levels given that regulators had curbed distributions in many parts of the world in 2020 – payments returned to nine-tenths of their pre-pandemic high in 2021.

Record payments from the miners, meanwhile, reflected the strength of their profits. The mining sector distributed $96.6bn over the year, almost double the previous record set in 2019 and 10 times more than during the slump in 2015-16.

However, as a highly cyclical sector, distributions will return to more normal levels when the commodity cycle turns.

See also: UK dividends rebound to £94.1bn but ‘recovery is not complete’

The big unknown for 2022 is the mining sector

Jane Shoemake, client portfolio manager, global equity income at Janus Henderson, said: “A large part of the 2021 dividend recovery came from a narrow range of companies and sectors in a few parts of the world.

“But beneath these big numbers, there was broad based growth both geographically and by sector. In the context of the dramatic rebound seen in the banking sector, and the exceptional cyclical surge from mining companies, it would be easy to overlook the encouraging growth seen from those sectors that have delivered consistent increases in recent years, like the technology sector.

“The same applies to geographical trends. The US, for example, is often ahead of its peers but saw slower dividend growth than the rest of the world in 2021. This was because it proved to be resilient in 2020 so there was limited scope for a large rebound. We expect many of the longer-term dividend growth trends witnessed since the index was launched in 2009 to reassert themselves in 2022 and beyond.

“The big unknown for 2022 is what happens in the mining sector, but it is reasonable to assume that dividends here will be lower than the record levels achieved in 2021 given the significant correction in iron ore. Having underperformed other equity markets in recent years, the UK equity market looks very attractively valued on both an earnings and dividend yield basis and we have exposure to a number of UK companies that are trading at a significant valuation discount to their international peers.”