As economies around the world take the first tentative steps to re-opening following the initial peak of the Covid-19 crisis investors are now turning their attentions to which asset classes and sectors stand to benefit.

Among the developed equity markets US stocks offer an interesting, if unpredictable, opportunity for investors. While we have seen similar trends in the US that match other regions’ performance throughout the sell-off, for example: large caps outperforming small caps; growth funds outperforming value funds; and health care and information technology stocks outperforming energy and financials, the US is unique as it has a fragmented political system that makes predicting the behaviour of its equity markets more difficult.

While some states are getting back to a ‘new normal’, others remain in a state of lockdown. Each US state governor has the power to introduce or remove lockdown measures. This has led to a huge dispersion across the US at a time where consistency is key. Throw in the prospect of the presidential election this year, predicting the performance of US equities, which are often sensitive to political events, becomes difficult. Normally in the run up to a US election we would see strong performance from US equities (a key signal that the current president will be re-elected) however nothing about this year is normal.

At a national level the US government introduced the $2.2tn CARES (Coronavirus Aid Relief and Economic Support) Act to keep businesses operating. The Federal Reserve cut rates to a range of 0-0.25% and provided liquidity and support for bond markets.

Some US stocks have benefitted from the ‘Great Lockdown’. As consumers have become used to working from home and conducting much of their social and non-working lives online, many technology names have boomed. Their performance has even bred a new group of ‘stay at home’ stocks. Businesses including Amazon, Nvidia, Activision Blizzard and Zoom have had an incredibly strong 2020 so far.

See also: UK funds industry slowly dials up exposure to the Zoom explosion

Another strong area of the market has been health care, particularly pharmaceutical and biotech companies. The former typically protects well during a downturn given the need for health care is unchanging. Given the nature of the current crisis health care stocks have become even more attractive to investors, particularly those promising a vaccine, think names like Gilead that have been driving the S&P 500 recently.

See also: Healthcare fund managers caution against getting caught up in Covid-19 vaccine hype

Unsurprisingly those funds holding these stocks have largely been a good investment throughout the crisis. One such fund is the Brown Advisory US Sustainable Growth fund. The fund, which is on the FE Approved Responsible list, entered the downturn with significant holdings in Amazon, Microsoft, Visa and a number of health care companies. Many of which have performed well over the past few months and thrived in the current economic environment. As the chart below shows recent performance relative to the S&P 500 has been particularly strong.

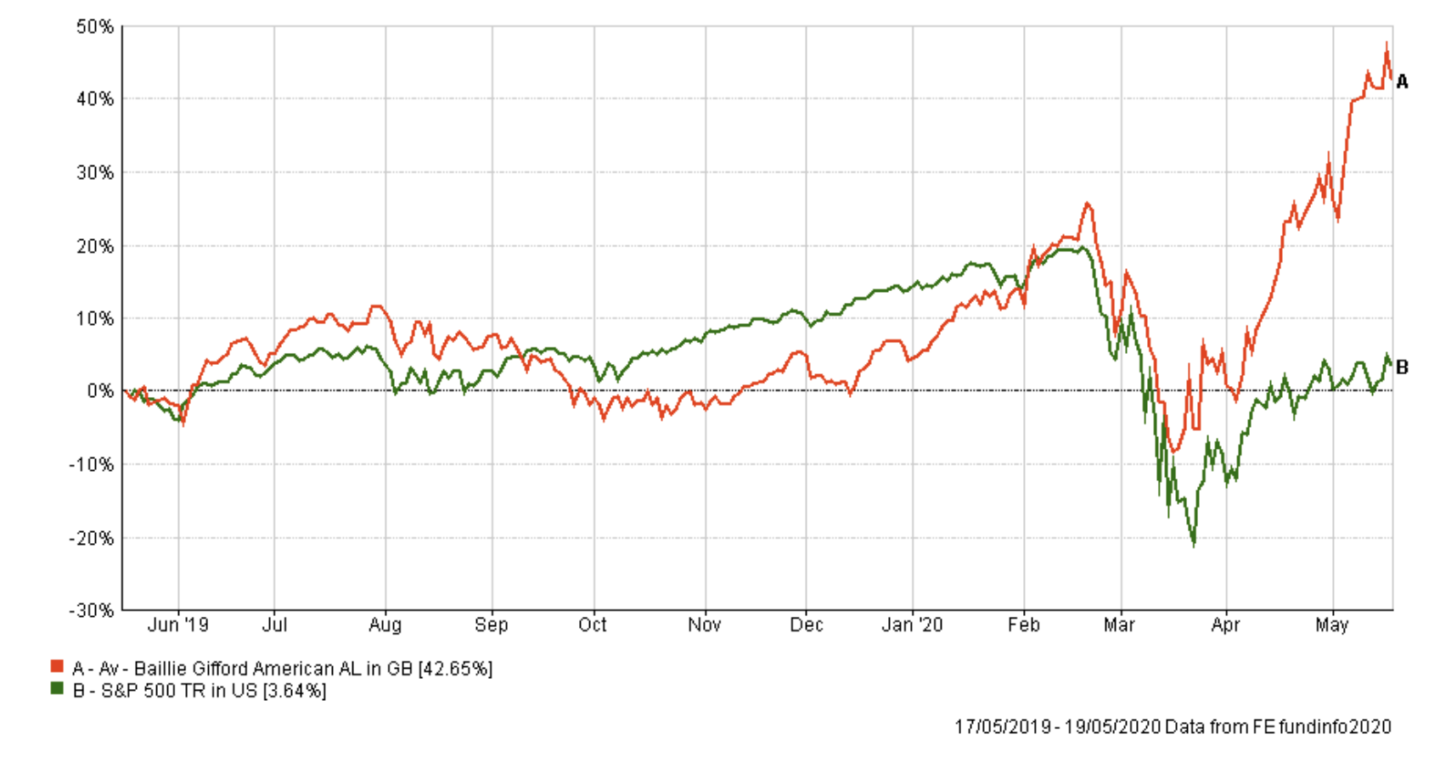

Another example of a fund performing well having long adopted a growth approach is the Baillie Gifford American fund. The team will only invest in businesses that meet their 2.5 times return business case, and they look to hold investments for the long-term. The success of this approach is again seen in the chart below. The fund’s performance has been staggering – returning 50% in just under two months. It is important to note that these are very short periods of performance and the sell-off has been very different to previous downturns in terms of the ‘winners’ and the ‘losers’.

The fund has significant exposure to platform technology stocks like Amazon and Netflix. Its largest holding is in the online retailer Shopify which has climbed almost 100% since the start of April. The name has enjoyed a considerable boom in business since physical retailers closed their operations. Yet another ‘strong pick is its holding in video conferencing software Zoom. The stock is up 150% since the start of the year as businesses have moved their operations online and consumers find new ways to reach out to friends and family.

The one lesson that investors will have learned in recent weeks is that there are few certainties when sudden volatility hits the markets. If those countries coming out of lockdown do not experience a second wave of coronavirus infections and relax their restrictions further will there be such a strong demand for video and virtual conferencing? Will consumers, tired of being stuck at home continue to shop online as much if high-street stores open again? It is possible that the markets will correct themselves as quickly as they changed. But it seems likely that when the world emerges from this crisis new ways of working and living will emerge. What this looks like is anyone’s guess, but for now I expect further volatility for US equities as the news flow surrounding the various possible vaccines heavily influence the S&P 500’s performance.

Sophie Meatyard is a fund analyst at FE Investments