The Smithson Investment Trust returned more than double its reference benchmark last year as it used the sell-off to add positions in cybersecurity and healthcare which benefited during the pandemic.

In the year to 31 December, the net asset value per share total return was 31.4%, more than double the 12.2% of the MSCI World SMID index. On a share price basis, the total return for the year was 31.7%.

Since the trust’s initial public offering in October 2018, it has recorded a NAV per share total return of 64.9% compared with the benchmark’s 25.4%.

It closed the year trading at a 3.7% premium to NAV with an average premium over the year of 1.9%.

Smithson shares were up 1.3% at midday.

Healthcare names boost performance

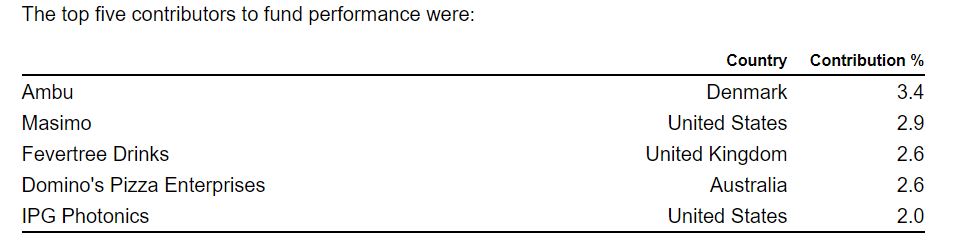

The top contributor to performance during the year was Danish healthcare equipment supplier Ambu, the 29th position in the portfolio, which added 3.4%, followed by US medical technology firm Masimo (2.9%) and UK drinks maker Fevertree (2.6%).

Source: Smithson final results

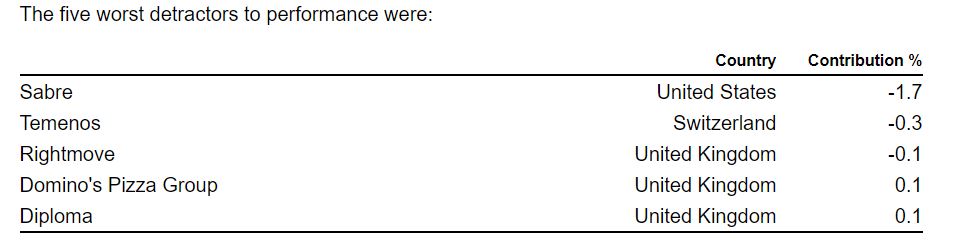

The largest detractor to performance was US travel software supplier Sabre, the second largest position in the portfolio, which contributed -1.7% to performance. This was followed by banking software provider Temenos (-0.3%) and UK real estate platform Rightmove (-0.1%).

Source: Smithson final results

Portfolio manager Simon Barnard (pictured) used the sell-off in February to top up on industrial businesses including Cognex, a manufacturer of automated vision systems used with factory and warehouse robots, as well as technology companies such as Verisign, which manages and protects the .com domain of the internet.

Three new positions

In the middle of March, Barnard trimmed positions in healthcare, which released capital to add to existing travel, leisure and industrial names, as well as initiate three new positions.

One was in Rational, a German producer of automated professional ovens for restaurants and mass catering venues. It also added two companies within the cybersecurity industry: Qualys and Fortinet.

Qualys provides identification, security and vulnerability management across remote devices attached to a corporate network, while Fortinet sells security appliances such as firewalls to corporate and home users, as well as security software.

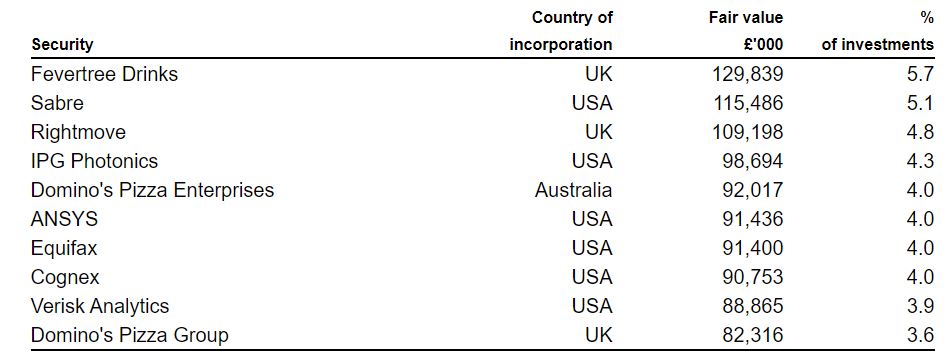

Smithson top 10 holdings at 31 Dec ’20

Source: Smithson final results

One position dropped

To fund the position in Fortinet, the manager sold out of Check Point Software Technologies, which is in the same business. Barnard said Check Point’s growth had gone from a “very acceptable high single-digit rate” to around 4%. “This is somewhat below the rate we expect from our companies.”

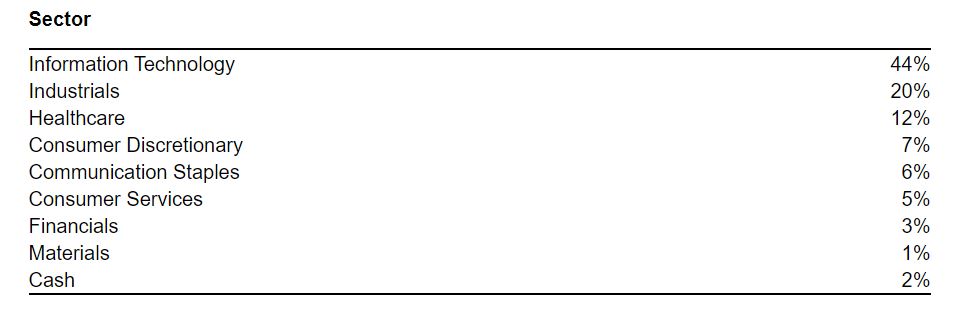

Over the course of the year the weighting in information technology increased by 5%, taking the overall portfolio exposure to 44%.

Sector weightings at 31 Dec ’20

Source: Smithson final results

Further share issuance

During the year, 26.9 million new shares were issued, generating proceeds of £398m, a premium to net asset value of approximately £5.4m net of costs, which were invested in existing holdings and three new positions. It also made one outright divestment.

A further 9,132,000 ordinary shares have been issued during the year to 12 March, raising £150.6m net of costs. This brings the total net funds raised since the company’s IPO to £925m.

Shareholders will be asked at the annual general meeting on 28 April for approval for the company to issue shares up to a further 20% of the issued share capital.

Smithson was floated on the London Stock Exchange on 19 October 2018, breaking the record for the largest IPO of an investment trust in the history of the LSE with funds raised exceeding £822m. It now has a market capitalisation of approximately £2.4bn and is a member of the FTSE 250 index.