A minority shareholder in St James’s Place has urged the board to overhaul its cost base and address the wealth manager’s “high-cost culture” which has eaten into profitability and shareholder returns despite client assets surging.

In an open letter to shareholders, Primestone Capital said SJP had failed to deliver “meaningful shareholder value” due to the “suboptimal management” of its cost base which has led to a “bloated organisational structure” and “excessive” hiring and pay.

SJP’s share price has fallen 7% since 2015 despite its funds under management growing by 18%. The total shareholder return has only been 2% on an annualised basis, which is well below the FTSE 100, Primestone noted.

Primestone said it had raised the issues of SJP’s out of control costs during several exchanges with management but was forced to take matters into its own hands after the board refused to address these concerns “head on”.

The Mayfair-based activist was formed by three former partners of the Carlyle Group and currently owns 1.2% of SJP’s issued share capital.

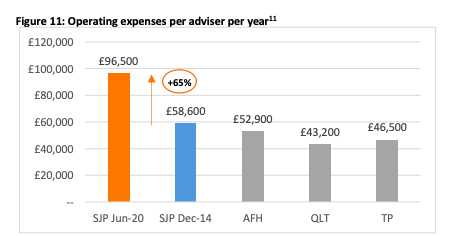

Operating expenses per adviser have risen to £96,500

One of the biggest issues the board needs to remedy is excessive pay at the wealth manager, Primestone stressed.

Analysis by the activist investor found that annual average salary increases at SJP have been 2-3% above the national average.

Excluding advisers, the activist investor said a quarter of SJP employees earn above £89,000 a year placing a “staggering” 600 SJP staffers among the UK’s top 4% earners.

The associated costs with supporting its army of advisers has also “increased markedly” since 2014, Primestone pointed out, despite the number of clients serviced by each adviser remaining stable.

SJP was called out repeatedly last year for its controversial “cufflinks and cruises” rewards system for top performing salespeople, a programme which it has since scrapped.

Annual operating expenses per adviser have risen to £96,500, a 65% increase over five years. This is 45% to 60% higher than True Potential, AFH Financial and Quilter Financial planning, which similarly provide significant support and infrastructure to advisers.

According to Primestone’s estimates only 10% of the 65% increase in annual operating expenses per adviser was due to increased regulatory requirements.

As a result of cost increases Primestone noted SJP’s profitability has declined by over 20% since 2015 compared to rivals AJ Bell, Hargreaves Lansdown and Integrafin, which have increased theirs, despite similarly taking in 2-3% quarterly net inflows.

SJP’s culture of ‘don’t do it yourself, hire someone to do it for you’

Profits have also been squeezed due to SJP’s excessive hiring, Primestone said.

Trolling through SJP staffers’ Linkedin profiles, it found that more than 120 employees currently have a “head of …” job title.

It also drew attention to its bloated team sizes across investment and marketing, noting the former is made up of over 100 professionals who do not actually invest but select and monitor 38 external fund managers on SJP’s segregated mandates. Its marketing team is made up of 80-plus staffers despite SJP claiming that historically half of its new business has come from existing clients with a further 40% from referrals and introductions from them.

“SJP’s culture was reported to us by many stakeholders we interviewed as one of ‘don’t do it yourself, hire someone to do it for you’,” Primestone wrote. “If true, this of course leads to profit leakage.”

Elsewhere it noted SJP had 300 to 400 members in its tech team, double the size of the IT department at Integrafin, which Primestone noted “manages a much broader platform”.

It added that its 200 plus “highly-paid” field management team is considered obsolete by many of SJP’s advisers.

SJP responds to Primestone

Primestone concluded SJP could more than double its share price if the board acts now to lower its cost base.

Among the initiatives it asked the board to consider are an in-depth cost review and a zero-based budgeting exercise as well as setting “ambitious” cost reduction objectives and an appropriate timeline for their communication to shareholders.

SJP confirmed it had received the letter from Primestone in an RNS statement this morning.

“SJP proactively engages with shareholders with regards to group strategy and structure and looks forward to commencing a dialogue with PrimeStone in regard to the views outlined in its letter,” it said.

SJP will publish its Q3 business update on Tuesday.