An activist investor targeting St James’s Place has been criticised for making apple and orange comparisons between the FTSE 100 wealth manager and platform businesses like AJ Bell.

Primestone Capital, which owns a minority stake in the FTSE 100 wealth manager, went on the offensive on Monday, accusing the firm of fostering a “high-cost culture” that has destroyed shareholder value.

“SJP is fundamentally a strong business that has been delivering great value for clients, partners, employees and even the regulator for many years,” authors Benoit Calos and Damian Hahnloser wrote in the open letter to shareholders.

“The SJP business model has yielded best-in-class growth and retention of advisers, clients and assets. Unfortunately, however, it has failed to deliver meaningful value for shareholders over the last five years.”

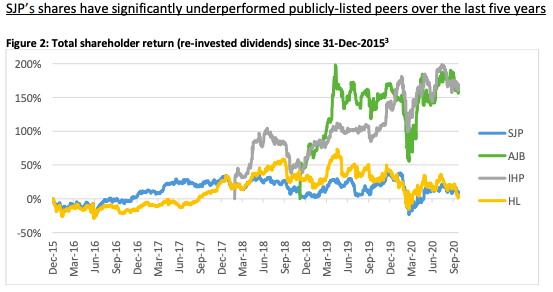

Comparing the firm against the likes of AJ Bell, Hargreaves Lansdown and Integrafin, Primestone noted SJP’s share price has significantly underwhelmed, now 7% lower than five years ago, leaving it trading at a “high and growing discount to peers”.

This is “especially disappointing” considering client assets at the wealth manager have more than doubled over that time, rising from £55bn in August 2015 to £115bn in August 2020, Primestone lamented.

‘AJ Bell and Integrafin are about as similar to SJP as a bank’

But several commentators have taken issue with Primestone contrasting the fortunes of SJP with other listed platform businesses.

“While SJP is in the same broad category as AJ Bell and Integrafin they are about as similar to SJP as a bank,” says Nextwealth CEO Heather Hopkins.

“Anyone that compares their P/E ratio to the buoyant AJ Bell is going to feel grumpy at the moment,” agrees Boring Money CEO Holly Mackay.

Primestone’s analysis shows Integrafin and AJ Bell have generated significantly higher total shareholder returns compared with SJP, with shares up 80% and 90% since their IPOs in March and December 2018 respectively. SJP’s shares have fallen 5.2% by comparison.

Hopkins says Quilter, Rathbones, Brewin Dolphin and even D2C platform Hargreaves Lansdown would be more appropriate comparisons.

Hargreaves’ and SJP‘s share prices have delivered similar performance over the last five years, she notes, with the D2C platform down 4.4% over the period.

Over that time frame SJP’s share price has held up much better than Brewin Dolphin and Rathbones, which are both down in the double digits. Quilter is down 10.6% since listing as a separate entity on 25 June 2018 following its spin-out from parent Old Mutual.

SJP shareholder return versus peers

| Ytd | 5yr | |

| St James’s Place | (22.5%) | (5.2%) |

| AFH Financial Group | (5.7%) | 95.2% |

| Brewin Dolphin | (36.9%) | (12.4%) |

| Quilter | (21.7%) | n/a |

| Rathbones | (31.3%) | (35.4%) |

Vertically integrated businesses will have more complex and higher costs

While Numis senior analyst David McCann thinks comparing SJP against AJ Bell and Hargreaves Lansdown is a “good starting point” to assess the wealth manager’s valuation potential given it has “comparable organic growth rates,” he finds Primestone’s detailed comparison of costs “unreasonable” on the basis the platforms have “fundamentally very different underlying business models” from SJP.

“SJP is a vertically integrated service provider (advice + admin + investment management) and is necessarily much more complex than businesses which primarily focus only on one element (admin),” McCann says.

“This means SJP earns materially more revenue per unit of AUM, but equally has more complex and higher costs, because it is providing more services. Moreover, SJP outsources a number of aspects of the business (directly or indirectly), thus necessarily requires internal controls need to be strong given the number of third-party relationships being managed.”

In its analysis Primestone does perform a total cost benchmarking exercise of SJP versus True Potential and Quilter as well as AFH Financial, which it identifies as “three relevant UK peers” that provide “significant support functions and infrastructure to their advisers” like SJP.

Despite the trio of firms being much smaller than SJP, Primestone found they only incurred 45%-60% of the operating expenses on a per adviser basis.

SJP model is ‘very 1980’s with little focus on cost’

Despite this Fundscape CEO Bella Caridade-Ferreira says there is a “huge amount of merit in Primestone Capital’s letter”.

“Assets and clients have grown strongly, and clients are (inexplicably) loyal despite excessively high charges, demonstrating that service and perceived value for money are fundamentally more important to customers,” she says.

CWC Research managing director Clive Waller also finds Primestone’s criticism of SJP’s high cost base “reasonable”.

Waller describes SJP’s business as reminiscent of the “Abbey/Hambro direct sales model”. Only recently did the wealth manager scrap its controversial “cufflinks and cruises” rewards system for top salespeople, he points out, following “press exposure and embarrassment”.

“It seems to me that the model is very 1980’s with little focus on cost,” Waller says. “They work on expensive looking marketing and high touch on a face-to-face basis.”

Martin Bamford, founder and CEO of Bamford Media, says when a business is growing rapidly cost controls are unlikely to be the biggest priority. “There will be less scrutiny over expenses as long as turnover and assets are rising, albeit still in a profitable way,” he says.

“As sales growth slows, SJP will need to balance cost cutting with customer satisfaction, in order to maintain profitability,” he continues. “Alternatively, they might explore other sales channels or business investments to ensure their growth continues.”

Rising regulatory costs and revenue headwinds beyond SJP’s control

McCann agrees with the “general thrust” of Primestone’s argument that “operational gearing has been suboptimal in recent years” because of cost growth being higher than expected.

By Numis’ estimates from 2014 to 2020 SJP’s cost growth has been around 17.7% per annum, which is higher than the company’s medium-term guidance of 10% pa.

However, McCann says it is important to note some of this cost growth has been regulatory driven like the FSCS levy hike and is beyond the group’s control and also reflects SJP stepping up its investment into the business via its adviser Academy, as well as its Asia, DFM and strategic development businesses.

Revenue headwinds thanks to unsupportive markets and SJP shifting its product mix toward lower-margin pension products also helps explains higher cost growth.