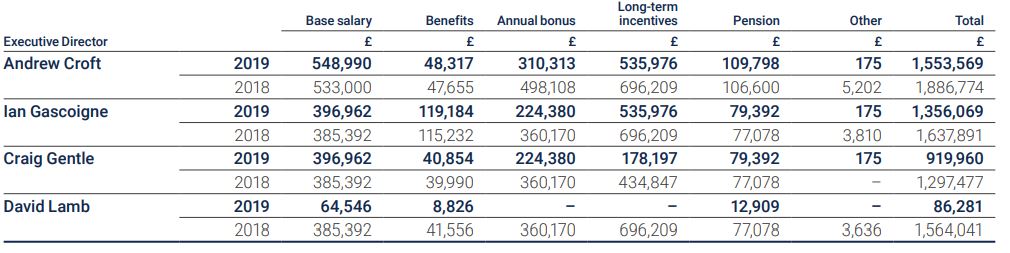

St James’s Place chief executive Andrew Croft took home a smaller £1.5m pay package in 2019 in a year marked by the firm’s exposure to Neil Woodford and accusations of a sales focused culture.

Croft’s (pictured) remuneration was lower than the £1.8m he earned in 2018.

The company’s annual report and accounts revealed his base salary increased to £548,990 for 2019 up from £533,000 in 2018. His annual bonus, however, decreased from £498,108 in 2018 to £310,313 in 2019.

In total, including base salary, benefits, pension, bonus and long-term incentives, he received £1.5m in remuneration in 2019 down from £1.8m in 2018.

Source: SJP annual report and accounts

SJP’s remuneration committee has awarded an increase of 3% in the base salaries of the executive directors for 2020, which it said is in line with the overall increase for the workforce.

“Despite this increase, the base salaries remain below market median for a company of our size both in financial services and general industry,” it added.

The annual fee for the board chairman also increased by 3% this year to £221,707.

SJP’s executive directors currently receive pension contributions of 20% of base salary, which is 5% above the maximum for the wider workforce.

“The committee acknowledges the increasing pressure from investors to see complete alignment between the rate of pension contributions paid to all executive directors and the workforce but also recognises the challenge in balancing investor expectations with the contractual rights of employees,” the report said.

During 2019 SJP reported £146.6m of profit after tax, down from £173.5m in 2018. The underlying cash result for 2019 was £273.1m compared with £309m in 2018.

It said in the short term profit has been impacted by the more modest gross flows relative to the planned higher cost of its investment in the business to underpin future growth.

SJP said its key aim is to grow funds under management and it has a long-term target of increasing its gross inflows by 15% per annum. It saw £9bn of net flows taking its funds under management to £117bn, up from £95.6bn in 2018.

Woodford and sales perk scandals

In 2019, SJP was tarnished by its association with Neil Woodford, who managed one of its segregated mandates at the time his Woodford Equity Income fund suspended. It also faced accusations of an aggressive sales culture, which included lavish perks for top performers, such as cruise holidays and high-end cufflinks.

The report said: “Our segregated mandate with WIM limited the investments to liquid stocks and did not allow investments in unquoted stocks, and consequently our clients continued to have full access to their investments.”

SJP’s discretionary wealth arm Rowan Dartington reported a 24% growth in its AUM to £2.8bn at the end of 2019. Gross flows were £514m for the year, down 1% on 2018.

The company undertook 627 fund manager monitoring meeting in the UK and overseas throughout the year, up from 492 in 2018. This included meeting by Rowan Dartington staff and the investment consultancy firms it draws on for advice, Stamford Associates and Redington.

It conducted 22 investment committee meetings throughout the year, up from 59 in 2018, and the number of investment professionals working exclusively on behalf of SJP clients increased to 63, from 59 the year before.

SJP partnership grows 8%

The St James’s Place Partnership hit 4,271 members in 2019, growth of 8%, while 172 individuals graduated from its Academy and Next Generation Academy. It now has more than 900 advisers with chartered status across the partnership.

In 2019 the SJP Charitable Foundation raised £12.1m which includes the company matching every pound raised. Since 1992, the foundation has raised £93.1m. It said over 80% of partners and employees give monthly to the foundation from their pay or earnings.

Diversity focus as SJP tackles female representation at the board level

The firm also singled out increasing focus on the delivery of its Inclusion and Diversity (I&D) objectives as a key focus for 2020.

It said: “Being an inclusive and diverse employer is not just the right thing to do, it is a strategic priority for us. We understand that our people should reflect the society that we serve and how important it is for us to recruit, develop and retain talent from all walks of life. They treat each other with mutual respect, openness and fairness and are driven by a desire to ‘do the right thing’ by all our stakeholders.”

It comes as Portfolio Adviser highlighted SJP has the fifth worst gender pay gap of the 29 asset and wealth management companies that have so far reported as it rounds off a year in which it faced scrutiny over its alleged aggressive and macho sales culture.

The report added female representation on the board increased to 40% as at 26 February, up from 25% as at 31 December 2019. In December 2019 SJP appointed Elizabeth Kelly to its executive board which followed the appointment of a head of inclusion and diversity in May 2019.

“We recognise how important diversity is in driving creativity, innovation and sound decision making, but achieving diversity without fostering an inclusive environment means we cannot harness these benefits,” it added.

“Achieving true gender equality within the business is a strategic priority for us and we are making progress in this area.”