By Quentin Macfarlane, an analyst and portfolio manager at Seilern Investment Management

‘Good things come to those who wait’ was the strapline for a highly successful series of Guinness advertisements at the turn of the century. Arguably the most memorable of these was ‘The Surfer’ – a close-up of a man studying the horizon, while a pounding, rumbling drumbeat builds into a crescendo as he waits for the right moment before he and his fellow surfers dive into the sea to catch the perfect, enormous, Hawaiian wave.

With the S&P 500 index having recently made it back to all-time highs, investors may be wondering whether now is the right time to invest. Will they catch the perfect wave and ride on triumphantly to the safety of dry land? Or is it already too late and jumping in now will only lead to a crashing fall in a few months’ time?

In reality, surfing and investing have little in common. Even the apparent necessity for patience is different – in surfing, patience is required to time your entry to catch the wave; in investing, meanwhile, patience means being comfortable while staying invested. Such patience can be difficult if you are worried about incurring losses but – if your time horizon is long enough – the chance of making a loss is practically zero.

Dangerous game

Market timing is a dangerous game. If you get it wrong and find yourself out of the market on days when the market rallies strongly, it can act as a significant drag on performance. Being patient and staying fully invested avoids this and other pitfalls, enabling the prudent investor to take advantage of compounding.

Patience does not just help the investor in their efforts to accumulate wealth, though – it also helps with capital preservation. This has held true for equity investments in the past – and the case is even stronger for quality growth businesses: the high levels of earnings growth should bail out companies sooner and the high quality means they are less likely to encounter difficulties in the first place.

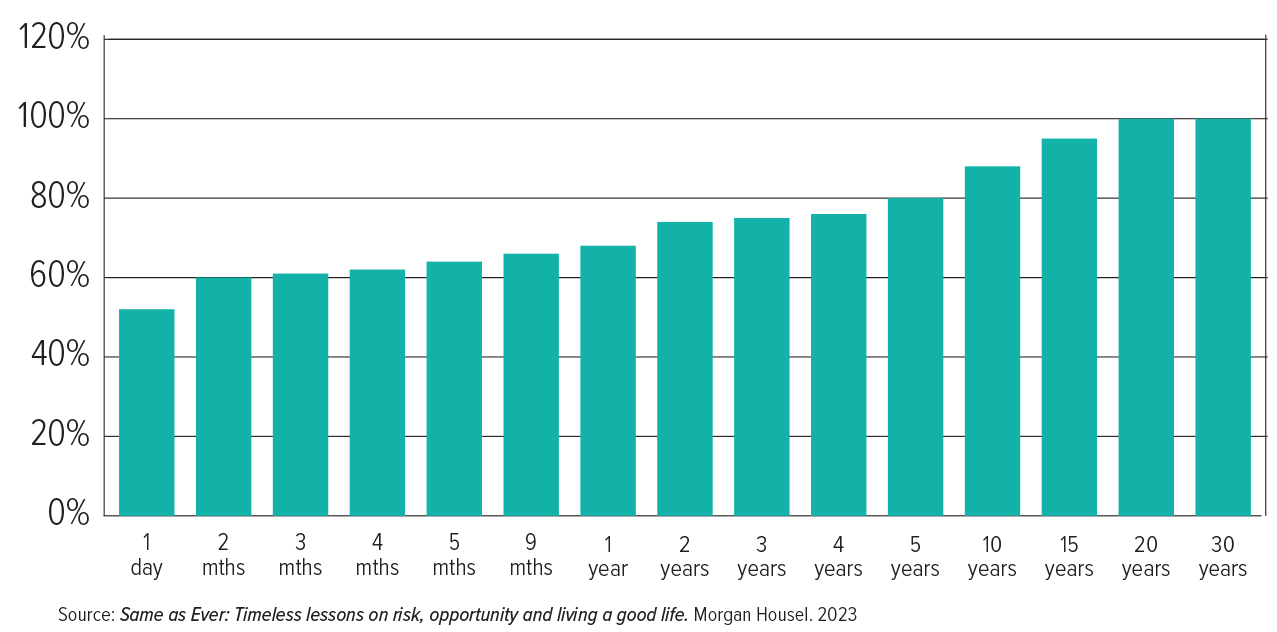

Figure 1 below, which uses stockmarket returns going back to 1871, clearly shows the power of long-term investing. Putting your money to work daily is little better than a coin-toss but, as you extend your time horizon, the odds of a positive return improve.

Indeed, if you can hold out for five years, the odds become stacked in your favour, with a positive return occurring 80% of the time. For some, of course, a 20% chance of making a loss over five years is still not good enough – but the data demonstrates that, if an investor could stand to wait for 20 years, no matter when they invested, they would have essentially guaranteed a positive return.

US stocks: Percent of periods that earned a positive return (1871-2018).

Inflation and dividend adjusted

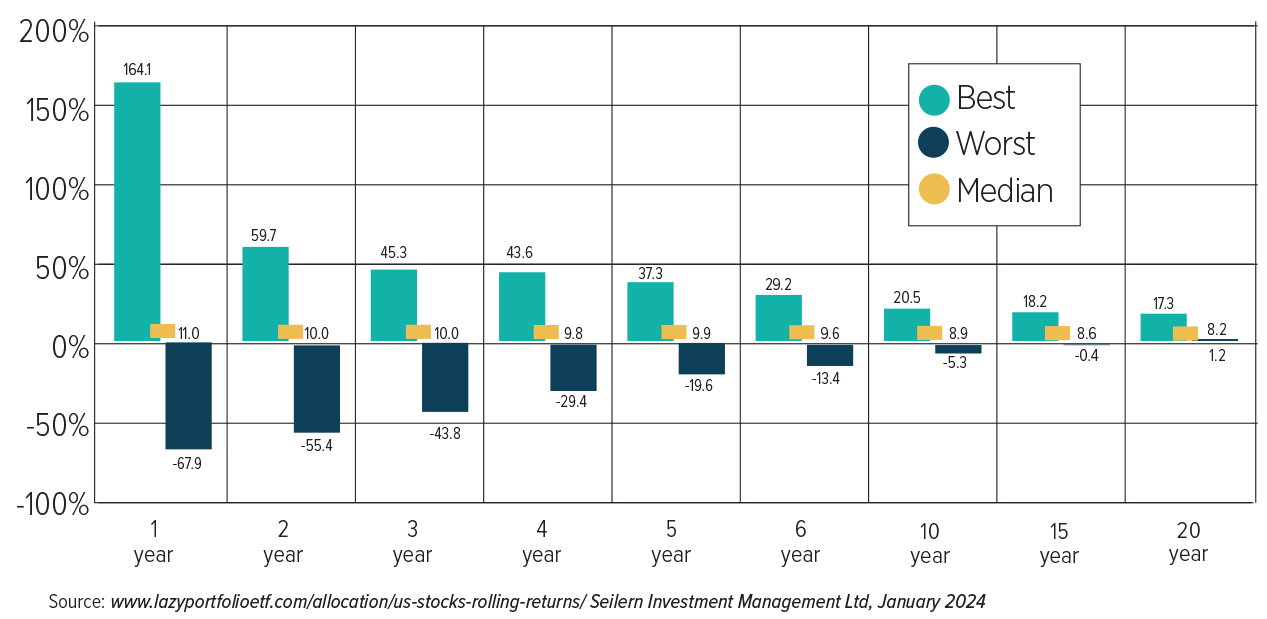

As Figure 2 below illustrates, the worst 20-year return during this period was a positive compound annual growth rate of +1.2%, which translates into a +27% total return. Not great – but not so bad when you consider you would have invested at the peak of the ‘Roaring Twenties’ and that the period included the Wall Street Crash, the Great Depression, and the Second World War.

What is more, the power of patience increases the greater your willpower. There is an amazing statistic that if you can extend your holding period to 30 years, the minimum annualised return would have been +7.8%, for a total return of 850%.

S&P 500 best and worst returns – rolling periods (annualised) since 1871

Of course, here we are merely focusing on ensuring a positive return and therefore the worst possible outcome. The other side of the patient coin is compounding, which means your average and maximum returns are far more than this minimum amount: the median 20-year total return is +384% and the maximum is +2332%.

When it comes to quality growth companies, one would hope the rewards for waiting would be greater still. Such companies have resilient business models that drive sustainable and above-average earnings growth. While we know that macroeconomic events can overtake markets and short-term issues can affect these companies, over the long run it is earnings that drive share prices.

‘He waits. That’s what he does’

In its advertisement, Guinness used the patient surfer as an analogy for the supposed rewards that come with waiting for a pint – but there is a world of difference between delaying gratification by two minutes, against waiting out weeks, months and years for positive performance.

What makes waiting especially hard is not knowing whether you will get anything in the end. A surfer can see waves breaking and a customer can see the progress of the barman. For investors, the track record of the indices and the earnings power of companies should make the wait a little more comfortable even if, sometimes, it takes rather longer than the time it takes to pour a pint of Guinness.

See also: AIC: Institutional investors own half of all trust shares