A year on from the Woodford Equity Income fund suspension and the retail intermediaries that stuck by the fallen star fund manager to the end are still licking their wounds. Hargreaves Lansdown has arguably taken the biggest reputational hit, given its dogged cheerleading of the fund on its buylist in the face of poor performance, liquidity problems and stock specific blow-ups.

It also accessed Neil Woodford via his third-party fund, leaving its multi-manager funds stuck in the suspended fund. But analysis of the segregated mandates employed by Openwork’s asset management arm Omnis and St James’s Place show neither escaped unscathed from Woodford’s problems.

JB Beckett, independent fund board director and former fund selector, says it is possible segregated mandates were slower to take action than wholesale investors that held Woodford via his third-party fund. Beckett says the reasons are twofold: “Firstly the mandates will be priced more keenly than the funds and so the investor cannot simply jump into another fund. Secondly, and more importantly, the transfer is rarely done on a cash out basis. Cashing out the position creates a huge cost to returns and relies on liquidity of the holdings.”

Furthermore, the chasm between Woodford’s portfolios and those of the fund managers that would replace him raises questions about how alert the three investors were to the obvious style drift in his portfolios.

See also: FCA accused of lacking bite as it fails to hold anyone to account for Woodford scandal

How have SJP’s and Omnis’s former Woodford mandates performed?

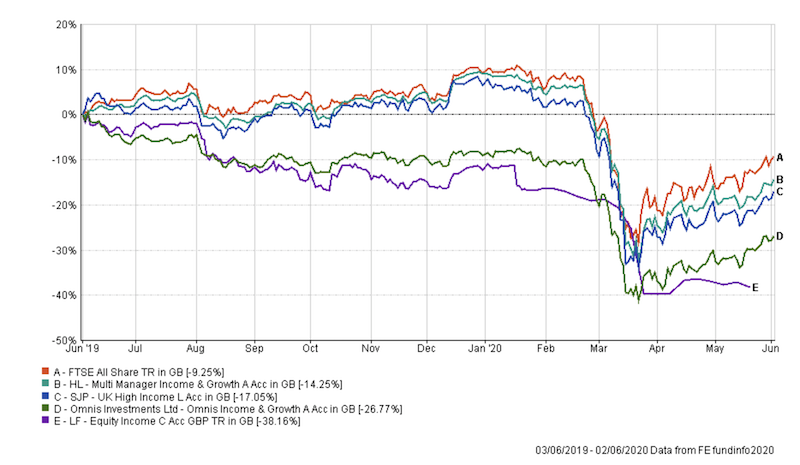

Crunching the performance numbers on the segregated mandates Woodford used to run shows a performance hit even where the fund manager was quickly dropped. In the period since the Woodford Equity Income fund suspended, on 3 June 2019, the SJP UK High Income fund has fallen 17.05%, while Omnis Income & Growth has fallen 26.77%, according to FE Fundinfo figures to 2 June 2020. That’s compared to a 9.25% fall in the FTSE All Share, suggesting that even segregated mandates couldn’t spare the wealth manager and advice network from the fallout from the fund’s demise. SJP had dropped Woodford from the mandate two days after the suspension, while Omnis found a replacement manager a month later.

Performance of portfolios that had been exposed to Neil Woodford before his fund’s suspension

Source: FE Fundinfo

Making a direct comparison with the former Woodford Equity Income fund, which was rebranded LF Equity Income when Neil Woodford was removed from the mandate, is not so straightforward.

By 24 January 2020, the fund had freed up 75.55% for its first distribution to unit holders, including its single biggest investor Hargreaves Lansdown, which invested directly and promoted the fund to retail investors via the Wealth 50. From the period of the fund’s suspension until that date, the fund fell 16.75%. Over the same period, Omnis Income & Growth had fallen 8.21% while SJP UK High Income had eked out positive performance of 5.70%.

SJP was the most reactive of the trio of retail intermediaries to drop Woodford when his Equity Income fund suspended last June. Two days later it had announced Nick Purves, from RWC Partners, and Richard Colwell, from Columbia Threadneedle, would jointly run its SJP UK High Income fund.

Square Mile head of research John Monaghan says SJP has combined complementary value managers in its appointment of Colwell and Purves. “You don’t want them working in completely opposite directions, because then they will cancel each other out. From a UK income perspective, these two should work reasonably well with Richard a more pragmatic interpretation of value whereas the RWC guys are more absolute value.”

See also: David Bellamy: Woodford’s fund drifted widely from his SJP mandate

Transition period between Woodford and his replacements knocks performance

The hit during the transition period is evident in the performance figures. In the period between the Woodford suspension and the first distribution from the fund, Threadneedle UK Equity Income has returned 16.3%, significantly above the 5.7% delivered over the same period by SJP UK High Income. TM RWC UK Equity Income, which is co-managed by Nick Purves and Ian Lance, delivered 8.4%.

Falling returns during a change of manager on a segregated mandate is not confined to Woodford, says Beckett. “The first manager is no longer incentivised to outperform but at least has to best execute. That tends to lead to less portfolio turnover and new ideas that can blunt returns. Secondly in transition with the new manager there tends to be rotation of the portfolio.”

Although Trustnet states RWC and Columbia Threadneedle were the SJP UK High Income managers from 5 June 2019, SJP confirmed it employed third-party transition managers at the beginning of this period. Within 47 days, 95% of assets had been transitioned, a spokesperson says.

Ignoring the transition period brings performance of the SJP UK High Income fund more in line with the third-party funds of Richard Colwell and Nick Purves. Over the last six months, Threadneedle UK Equity Income has fallen 13.3%, while TM RWC UK Equity Income has fallen 21.4%, an average of 17.4%%. Over the same period, the SJP mandate has fallen 19.1%.

The portfolio Woodford left behind would have been particularly challenging to unpick, according to Monaghan. “Broadly speaking, if the previous fund is invested in quite a lot of illiquid stuff, then it’s going to be difficult and probably quite expensive to transition the portfolio into a) the index or b) into the new portfolio. The traders and market makers would have been quite aggressive with their pricing because they know that you’re effectively a full seller.”

Beckett says transition periods between 40 to 100 days are not uncommon and points out the problems of it becoming a “no-man’s land” in terms of performance. “Whilst the transition manager will seek out the best price, it can turn into a firesale during periods of low trading.”

Omnis had more trouble transitioning its mandate than SJP

Homing in on the three months immediately after the Woodford Equity Income suspension, to better understand how the transition affected performance, highlights that SJP’s mandate performed significantly better than Omnis. While SJP UK High Income made a small loss of -1.56% over the period, Omnis Income & Growth fell 11.42%, almost as much as the 12.21% fall in Woodford Equity Income. In fact, over a two-month period the Omnis fund performed worse falling 6.64%, which was double the 3.30% losses in the Woodford Equity Income fund.

Omnis did not wish to comment on the transition arrangements used when it changed managers from Neil Woodford to Ben Whitmore. The asset management arm of Openwork acted slower than SJP, with Jupiter officially taking on the portfolio on 8 July. Compared to SJP, the incoming Jupiter managers had to deal with a less liquid portfolio. While SJP had refused to let Woodford invest in unquoted companies as part of its mandate, the Omnis Income & Growth fund had let him add to the companies that ultimately led to the liquidity problems in his third-party funds. Portfolio Adviser asked Omnis if it had changed the Income & Growth fund’s objectives or fund policies but it did not wish to comment.

At the time it won the mandate, Jupiter issued a statement hinting at the role its small and mid-cap manager Richard Curling would play in repositioning the fund. “Richard will thoroughly analyse and manage the fund’s small and unquoted holdings and, over time, bring this element of the portfolio in line with Ben’s strategy,” said CIO Stephen Pearson. In February, Curling faced the wind-down of his Jupiter UK Alpha fund, but he continues to run the Monthly Alternative Income and Fund of Investment Trusts funds.

Hargreaves Lansdown still comes out worse

Nevertheless, Hargreaves Lansdown suffered a greater hit from its exposure to Neil Woodford than either Omnis or SJP. After eight months of being trapped in the suspended and significantly underperforming fund, Hargreaves Lansdown finally got its hands on the first distribution of cash as part of the wind-down. The figure would have sat somewhere between £298.1m and £362.6m depending on which share classes were held by the multi-manager range, a detail that was not included in its last annual fund report.

Troy Asset Management income manager Francis Brooke was the biggest beneficiary as Hargreaves Lansdown redeployed its Woodford cash. The HL Multi-Manager Income & Growth fund, which had had a significantly larger allocation to Woodford Equity Income than other funds in the range, allocated the payout to a new segregated mandate run by Brooke.

The HL Multi-Manager Special Situations fund received the next largest cash sum from the Woodford distribution, albeit a fifth of the size of that received by the HL Multi-Manager Income & Growth fund. It deployed proceeds into a segregated mandate run by Adrian Frost, while the smaller HL Multi-Manager Balanced fund allocated its distribution to a segregated mandate run by Ben Whitmore. The rest was deployed in third-party funds: Threadneedle UK Equity Alpha Income, Lindsell Train UK Equity, Jupiter UK Special Situations and JO Hambro Equity Income and Axa WF Framlington UK.

While a fair chunk of Hargreaves Lansdown’s trapped money has now been returned, it still has around a fifth of its original investment stuck in the LF Equity Income fund, which is now facing worse market conditions than it was experiencing previously and is trying to sell off the most illiquid parts of the portfolio. Portfolio Adviser questioned Hargreaves Lansdown about whether it was making more use of segregated mandates due to the Woodford situation. It did not respond directly except to say it had been using segregated mandates since November 2018.

See also: FCA scrutinises failings of ‘supertanker’ investors in Woodford suspension

Picks to replace Woodford highlight lack of attention from intermediaries

There is a discrepancy between Woodford and the fund managers that have replaced him, according to holdings-based style analysis conducted by Morningstar for Portfolio Adviser. Third-party funds run by Richard Colwell, Nick Purves, Ben Whitmore and Francis Brooke tilt towards core-value, large-cap in style. In contrast, Neil Woodford’s style, based on his portfolio at the end of April 2019, came up as a core, small-cap fund. Whitmore and Purves had the strongest value tilts being on the cusp of core- and deep-value, while Colwell, sat lowest down the market-cap spectrum, although still on the cusp of mid and large cap.

Morningstar senior manager research analyst Samuel Meakin attributes the discrepancy to style drift in the Woodford Equity Income portfolio. “Over time, Neil Woodford allocated an increasing proportion of the fund to small-cap and unquoted stocks. This meant that the complexion of the portfolio was completely different from: a) how it had looked to begin with; b) from the strategies he ran at Invesco before that; and c) from a typical fund in the Equity Income category. So the replacement funds discussed, while different stylistically from LF Equity Income, make sense in the context of investors seeking UK equity income exposure.”

See also: Seismic drift in Woodford holdings extends beyond liquidity

Seven Investment Management senior portfolio manager Peter Sleep says the fact Woodford is now being replaced by fund managers that differ significantly in a basic style analysis shows not enough due diligence was being done by intermediaries.

“Any due diligence should have spotted what was going on at Woodford, but I do not think they were interested in due diligence, more chasing performance and finding something that was easy to sell.” The fact that SJP and Hargreaves Lansdown responded to concerns over Woodford’s portfolio by pointing to his long-term track record is evidence of their focus on performance chasing, Sleep says.

For Hargreaves Lansdown, its holding in Woodford Equity Income could have become more dire if the timing of the first distribution had taken place during the coronavirus volatility. Monaghan says: “I wouldn’t describe anything about the windup of the Woodford fund as fortuitous but it could have been a lot worse if those transactions were going ahead two months after that point, so heading into March when the markets were most challenged.”

See also: Former Woodford portfolios signal how coronavirus could knock trapped investors

Hargreaves Lansdown is now planning to drop the Wealth 50 and introduce an independent panel to oversee its investment and governance decisions.

Beckett says more independent governance on segregated mandates is probably a good idea. “[The Woodford scenario] will certainly put greater focus on the quality of governance both at fund boards level and within large asset owners. More independent oversight is probably a good idea.”

SJP says it monitors all funds on a daily basis and that internal teams frequently share information with independent consultants and the SJP Investment Committee. The SJP UK High Income fund is no different, the spokesperson said. Omnis did not wish to comment when questioned about oversight on its fund.