The fund managers behind the Schroder UK Public Private trust have impressed Winterflood Investment Trust despite the “considerable baggage” they face from the investment trust’s ties to Neil Woodford and the hit from Covid-19 which threatens to drag out the portfolio rebalancing.

The research house said it had been impressed with its online meeting with lead managers Tim Creed and Ben Wicks. Creed is Schroders’ head of European private equity, while Wicks is head of data insights and research innovation at the FTSE 100 manager.

Analysts at the firm pointed out the duo, while not in charge of valuing private investments in the trust, had become more confident in valuations of the illiquid holdings over time and had stuck their own money in the fund “so they are personally aligned to its future performance”.

They also noted the arrival of ex-Woodford Investment Management staffers Paul Lamacraft and senior analyst Harry Raikes, who worked on Woodford Patient Capital.

While Winterflood was “encouraged by a number of positive signs” analysts added “there is clearly a lot of work to be done”.

“In our opinion, Schroder UK Public Private remains a work in progress and it will take some time for the portfolio to be reflective of the management team’s approach,” the analysts said.

Woodford baggage weighs on investment trust share price

Winterflood cited ties to Neil Woodford’s legacy, including the “considerable baggage” under its previous incarnation as Woodford Patient Capital, as one of the main reasons the Schroder UK Public Private trust continues to trade at a record discount.

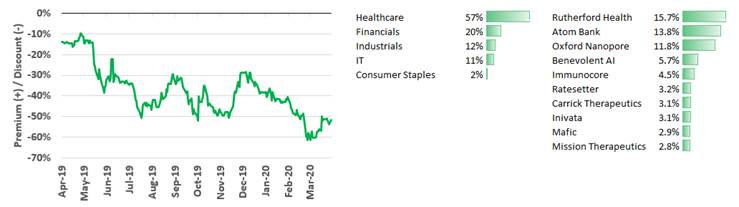

Since Creed and Wicks took the reins on 13 December, the fund’s share price has fallen 29%, worse than the FTSE All Share’s 21% decline. The discount on its net asset value has widened from 38% to 55%.

The trust still has major stakes in companies also held in Woodford Equity Income which are in the process of being sold down by Link.

At the end of February the trust’s top-10 holdings, which comprise 66% of NAV, were all smaller listed and unquoted holdings purchased under Woodford’s management like Rutherford Health, Atom Bank, Oxford Nanopore and Benevolent AI.

Schroder UK Public Private rating over 12 months, sector exposure and top 10 holdings

Source: Morningstar and Schroder UK Public Private as at 29 February 2020

The Woodford Equity Income fund also still owns a direct holding in the trust, equivalent to 7% of its share capital.

Rebalancing will take longer than expected due to coronavirus

The situation at the trust also been “exacerbated by the uncertainty generated by Covid-19“, the investment trust research house said.

Winterflood expects rebalancing the portfolio will “take longer than was originally envisaged” but added “this includes taking profits on successful performers whose resultant size has led to higher portfolio concentration than is seen as ideal.”

“Undoubtedly a number of the portfolio companies will require additional financing, partly as a result of the impact of Covid-19, and participation may be an issue for SUPP given the constraints on its capital,” it added.

Healthcare allocations help during Covid-19 crisis

Winterflood said the trust’s high weighting toward the healthcare sector “has to be seen as a positive factor at present”.

Managers Creed and Wick singled out positive developments at Rutherford Health, Oxford Nanopore and Benevolent AI, some of the trust’s largest holdings, in the last few months, it said.

All three have been in the spotlight for their efforts to tackle the coronavirus crisis.

Rutherford Health, which operates cancer treatment centres across the UK, has said it will provide support to the NHS in maintaining cancer services for patients where treatment is disrupted, while Oxford Nanopore’s DNA sequencing equipment is being used to halt the spread of the virus.

Benevolent AI has identified a potential treatment for Covid-19 with a safety trial in the US due to start at the end of April.

Schroder UK Public Private was one of the biggest share price movers on 23 April, the day the note was published. Its shares jumped 6.4% to 24.3p, behind Lindsell Train IT and AEW UK which recorded gains of 8.4% and 6.6% respectively.