By Michael Nelson

Schroders Greencoat, the renewables and energy transition infrastructure manager of Schroders Capital, has launched a long-term asset fund (LTAF) dedicated to renewable energy and energy transition infrastructure.

The Schroders Greencoat Global Renewables+ LTAF is designed to allow UK pension savers to invest in this asset class while benefiting from “stable, diversifying and inflation-linked investment returns”. It will be managed by Schroders Greencoat alongside its Luxembourg-domiciled sister fund, the Schroders Capital Semi-Liquid Energy Transition fund, launched in January.

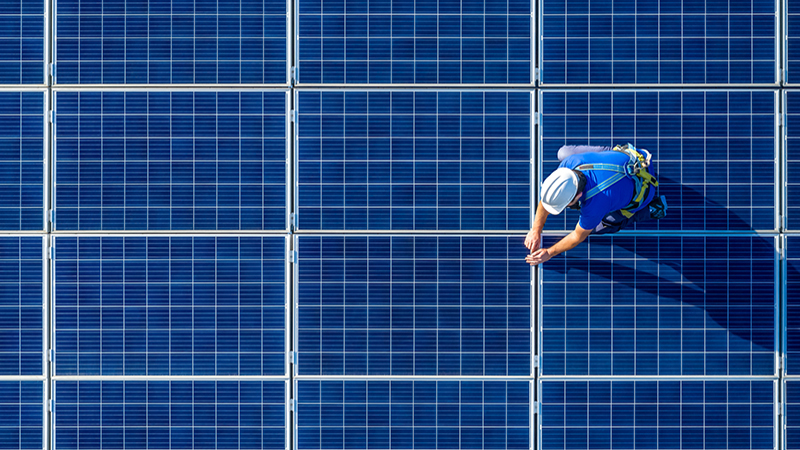

The fund will target infrastructure supporting the energy transition across the UK, US and Europe, providing access to long-term investments in private markets. It will deploy capital across wind and solar assets, as well as a range of energy transition assets including hydrogen, heating and storage.

Duncan Hale, portfolio manager at Schroders Greencoat, said: “We are pleased to be introducing this ground breaking LTAF, which will offer investors a powerful combination of strong returns potential with a unique risk profile, while directing essential capital towards decarbonising and electrifying our energy sources.

“Alongside wind and solar, a dedicated portion of this portfolio also taps into newer technologies associated with energy-transition-related infrastructure, like hydrogen and district heating, which have the potential to generate superior returns across a longer period.”

According to Schroders, LTAFs are particularly suitable for the UK defined contribution and UK charities markets, providing savers with access to a previously untapped opportunity, as well as through defined benefit pension schemes.

This article was first published in our sister publication, ESG Clarity