Value investing has had an extremely poor run over the last few years – and the coronavirus crisis has only exacerbated this trend. This has raised questions over whether value is structurally impaired or if different measures of value are required for a modern economy.

A loose definition of a value stock is one that is trading on cheaper multiples of its own fundamentals – for example, profits, book value, sales – compared with the rest of the market. This gap in valuation could be present for a number of reasons but, for a value investor, it is there because the market underappreciates the business and is indicative of a potentially significant share price correction once the true value of the company is realised.

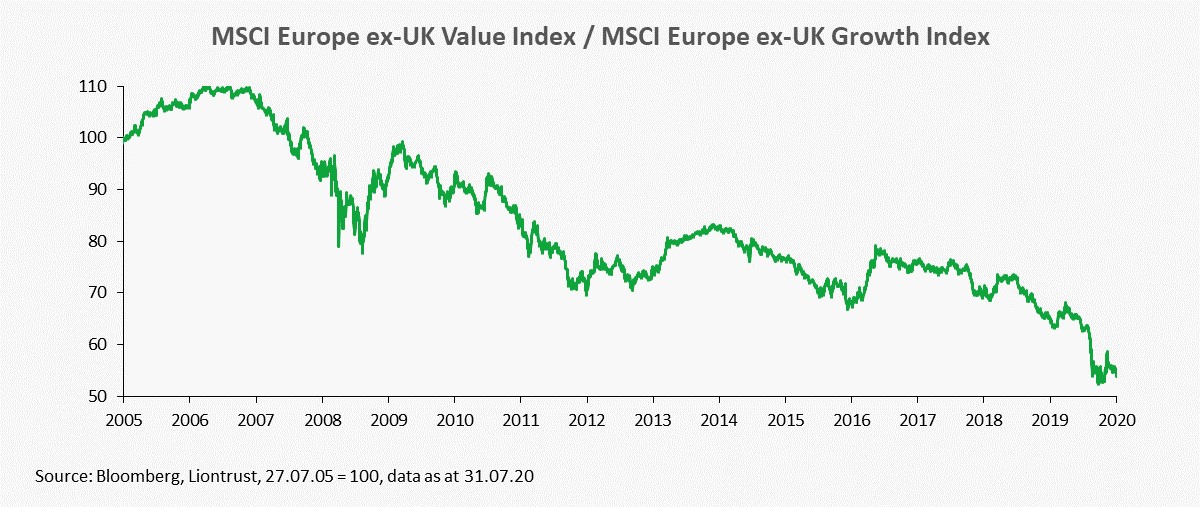

The coronavirus pandemic saw value stocks’ underperformance versus their growth counterparts widen even further. To demonstrate this, the following chart plots the performance of the MSCI Europe ex-UK Value Index relative to the MSCI Europe ex-UK Growth Index over the last 15 years.

Value’s underperformance versus growth – Europe excluding UK

The story is similar for stocks in the UK and US, which has led to arguments suggesting value is structurally impaired, given the extent of central bank stimulus keeping bond yields at all-time lows and the knock-on impact these low yields have for the valuation of companies expected to grow earnings – in short, lower yields mean a lower discount rate in investment models and higher present value for earnings delivered in the future.

Furthermore, the technological revolution may leave traditional valuations based around tangible assets – such as buildings, equipment and land – as obsolete.

Portfolio insights company Style Analytics has argued the measurement of ‘valueness’ should be reconsidered. The price-to-book ratio is the standard measure of used by investors, but this is outdated given the construct of the modern company.

The company argues intangible assets are an important component and looking purely at book value ignores the role they play. Intangible assets are seen as yielding assets, in a similar way to tangible assets, and research and development expenditure should be seen as a way of maintaining the intangible asset base.

To measure the impact of intangibles more accurately, the researchers suggest using free cashflow yields. The idea behind this is that cashflow will more accurately reflect the effectiveness of companies’ assets – both tangible and intangible.

Guide to future profitability

Company cashflow is a more reliable guide to future profitability and stock price valuation in the medium term. For our part, we analyse our investment universe using the cashflow to operating assets and cashflow to market value ratios. These metrics have been developed over a number of years and contain our own proprietary definitions of operating assets and cyclically-adjusted, normalised cashflow.

Others argue, however, that traditional measures of value are not yet dead. A recent paper by research company Research Affiliates – Is Value Investing Structurally Impaired? – which ran a model decomposing the total returns of a value and growth portfolio, found no evidence to suggest value has been structurally impaired.

The paper stated the underperformance of value verses growth since 2007 has been driven almost entirely by changes in relative valuations, which the author claims should revert to zero in the long run. This is an argument supported by renowned hedge fund investor Cliff Asness, who believes value’s poor run has been less to do with a deterioration in fundamentals and is largely just price movements.

Whichever side of this debate you come down on, we would argue investors should be looking to capture the best opportunities in traditional value stocks as well as those that are more typical of the modern economy. While all stocks we hold must score highly on their free cashflow characteristics, we also factor in metrics that attempt to highlight opportunities for different styles and strategies such as growth, cash return, recovering value and contrarian.

Our measures of value spreads currently remain wide and a theme that has appeared in our recent annual review of companies’ report and accounts has been the large number of stocks in the top quintile (Q1) of our cash flow screens with really attractive high free cash flow yields, as you can see in the chart below.

Valuation of factors

Perhaps unsurprisingly, the sectors that have appeared the most attractive are among those that have been among the hardest hit by the pandemic. We have found stocks in the auto sector, retail and banking trading at a particularly high discount when measured using multiples of their adjusted free cashflows. These are areas that could see a significant bounce back in share prices if, as we expect, the valuation gap between value and growth closes.

Samantha Gleave is a fund manager in the Liontrust cashflow solution team