The Ruffer Investment Company lagged its benchmark last month as “unfashionable” areas of equity markets suffered, but the managers are optimistic these stocks will perform “handsomely” as the EU’s €750bn recovery fund prompts a rotation into cyclical names.

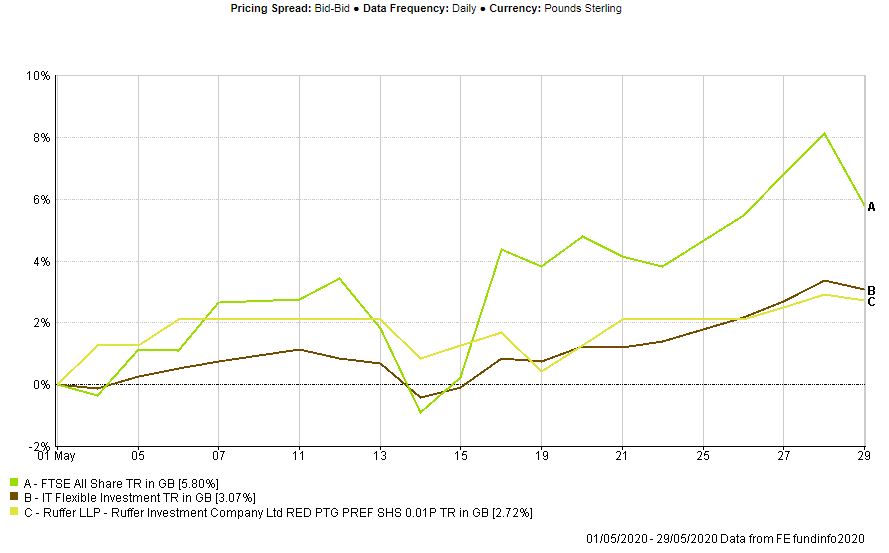

The company’s latest monthly report for May revealed its net asset value rose by 1.3% during the month compared with an increase of 3.4% for the FTSE All-Share index. On a share price basis, the trust was up 2.7% compared with the IT Flexible Investment sector’s 3.1%, according to FE Fundinfo.

Gold mining equities were the largest contributor to returns, as was the case in April. Managers Hamish Baillie (pictured) and Duncan MacInnes noted the gold price only rose by 2.6% during the month, but mining equities rose in some cases by more than 10%. The portfolio has an 11.6% weighting in gold and gold equities.

The company also benefitted from its exposure to technology. Ocado, the seventh largest equity position, accounting for 1.2% of the portfolio, was up 71% for the year to date and eHealth was up 36%. The managers also noted its allocation to US healthcare, which was a relative outperformer.

‘Unfashionable’ stocks have been an uncomfortable place to be

But they said the majority of equity exposure remains in the more “unfashionable” areas of equity markets. The portfolio’s top 10 equity holdings include Tesco (1.9%), Lloyds Banking Group (1.7%) and Walt Disney (1.6%). Year to date Lloyds’ share price is down 45%, Walt Disney is down 16% while Tesco is down 11.4%.

“These companies tend to be more geared into the real economy and this has been an uncomfortable place to be, but the tail end of the month hinted at a possible shift in market favour,” the managers said.

10 largest equity holdings (%)

| Tesco | 1.9 |

| Lloyds Banking Group | 1.7 |

| Walt Disney Company | 1.6 |

| IamGold | 1.2 |

| Centene Corporation | 1.2 |

| Kinross Gold | 1.2 |

| Ocado | 1.2 |

| AngloGold Ashanti | 1.2 |

| Newcrest Mining | 1.1 |

| Cigna Corporation | 1.1 |

Source: Ruffer

EU recovery plan could see rotation into cyclical equities

They added: “If this rotation into cyclical equities as a result of the EU recovery plan and the subsequent strengthening of the euro against the dollar is ‘for real’, and there have been failed attempts in the past, the equity exposure in the company will perform handsomely.

“If this turns out to be another false start, we should continue to see benefits from the inflation-linked bonds and gold.”

But the managers also warned that the “wartime response” from governments in the past three months of huge, debt-funded fiscal spending, aided by central bank liquidity is “dismantling the anti-inflation bias constructed after the 1970s”.

“To us this means we could quite quickly see the inflationary consequences of deep financial repression. Such a change will likely lead to a very different and potentially more dangerous market environment for investors.”