Industrial and construction businesses are seeing activity bounce back after the disruption of 2020, but there are structural factors supporting longer term growth too.

The UK has not yet begun to edge out of its third Covid-19 lockdown but economic activity in some sectors is already racing ahead. While consumer-facing services businesses still await a return to “normal”, the industrial manufacturing and construction parts of the economy are recovering strongly.

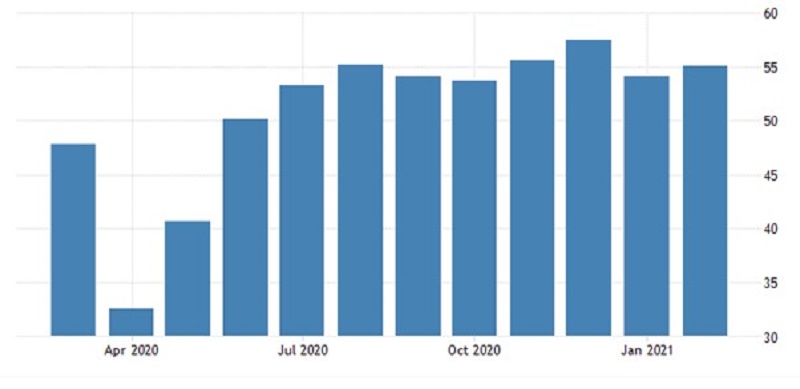

We can see signs of this in the CIPS/Markit manufacturing purchasing managers’ index. The sharp fall from March to April 2020 marks the start of the pandemic in the UK but it’s notable how quickly activity then recovered, with the index clearly above 50 (which separates expansion from contraction) from July onwards.

The dip from December to January can be attributed to the current lockdown but a reading of 55.1 (for February 2021) implies robust activity. By contrast, the equivalent reading for the services sector was below 40 in January and still under 50 in February.

UK manufacturing activity recovered swiftly

Source: CIPS/Markit manufacturing purchasing managers’ index, TradingEconomics, March 2021.

Further evidence of the swift bounce-back can be found in housing starts data. Housing starts reached 35,710 units in the third quarter of 2020, a sharp jump up from the pandemic-depressed level of 15,930 in the second quarter.

It’s not just the lockdown/unlocking cycle that has helped activity rebound; other factors are at play too. Ongoing low interest rates enable borrowing for investment. Further long-term support also comes from government policy, and from the need to repair, maintain and improve the UK’s housing stock and other buildings.

And from an investment perspective, the UK is home to numerous smaller companies who are well placed to benefit from these trends. We can identify several industrial manufacturers and construction businesses who have excellent products, structural growth opportunities, attractive valuations, and strong sustainability profiles.

Government initiatives are tailwind for sector

In terms of government policy, longer-term support for industrial manufacturers and construction businesses is present in the form of ambitious house-building targets.

House-building has fallen behind the formation of new households for many years now, leaving the UK with an increasingly severe shortage of homes. The UK government is targeting construction of one million new homes – meaning 300,000 new homes a year by the mid-2020s – but housing completions are well off this pace.

The imperative to provide new homes means the pace of construction is likely to pick up, providing a tailwind for companies operating in the sector. Most obviously, there will be a requirement for bricks. The UK stock market is home to manufacturers such as Ibstock who have a strong focus on the domestic UK market and an extensive product range, offering over 450 types of bricks. It also has a focus on sustainability, procuring 100% of its electricity from renewable sources. Other examples include Breedon Group, a provider of aggregates, cement and other construction materials, whose operations are focused on the UK and Ireland. Again, sustainability is a focus with local suppliers and services used whenever possible.

See also: The UK needs patient capital but Neil Woodford is not the man to deliver it

As well as the structural growth opportunities, we would also highlight that the construction materials sector is one that is quite fragmented in the UK. Mergers & acquisitions could therefore offer another pillar to the investment case for companies in the sector.

Repair, maintain and improve

It’s not only the construction of new homes that is driving activity in the sector; renovations to existing buildings are an important aspect too.

Repeated lockdowns and consequent prolonged periods of time spent at home are motivating many people to sort out household renovations or building projects. For example, desire for more space is leading many people to build extensions where possible.

Then there are the many improvements that homeowners are looking to make given the UK’s housing stock is relatively old. Improvements to heating, particularly the installation of underfloor heating and energy-efficient systems, are high on many people’s “to-do” lists after a winter spent at home in lockdown.

Ventilation is another area gaining in importance. The Covid-19 crisis has brought home how vital it is to keep rooms ventilated to prevent the spread of viruses. But even before the crisis, British people were spending 90% of their time indoors and therefore the quality of air we breath indoors is hugely important.

The ventilation aspect is even more critical for public buildings – schools, offices, shops, theatres, etc – given the restrictions imposed due to Covid. We could be in for a long period of improvements being made to all kinds of existing buildings.

Indeed, companies operating in the sector are already benefitting from these trends. Ventilation specialist Volution Group, for example, reported organic revenue growth of 7% for the first two months of its current financial year (August and September 2020). Polypipe Group, a provider of sustainable piping for heating and drainage, said recent trading had exceeded expectations, with revenues for November 2020 8% higher than for November 2019.

Fresh equity helps unlock growth potential

Hopefully the argument above demonstrates how the UK’s industrial manufacturers and construction firms are not simply enjoying a rebound after last year’s disruption but also benefit from longer-term drivers of structural growth.

Equity investors have a crucial part to play in supporting this longer-term growth. Numerous companies in these sectors are looking to expand and need fresh equity to help fund this.

Returning to Polypipe as an example, the company recently announced the acquisition of ADEY, a provider of filters and protection products for residential boilers. This is a growing segment of the construction market as heating technologies develop and the UK progresses towards its 2050 net zero carbon target. The acquisition was funded partly by existing debt facilities but also via a share placing.

Such placings offer equity investors the chance to inject fresh capital into companies and enable them to take advantage of growth opportunities. This helps to support innovation and employment in the UK as well as offering investors the chance to share in future growth. We see numerous smaller UK companies that offer such opportunities, both in the industrial manufacturing and construction sectors, and beyond.

Rory Bateman is portfolio manager of the Schroder British Opportunities Trust