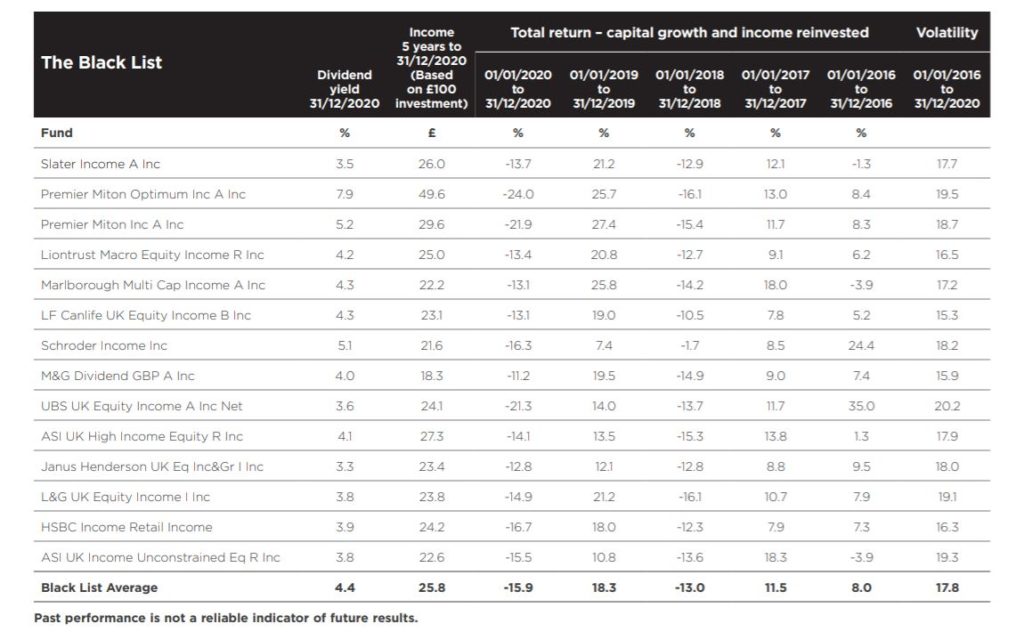

Thomas Moore’s ASI UK Income Unconstrained Equity fund has come bottom and Robin Geffen has been knocked off the top spot in Sanlam’s latest ranking of UK equity income funds.

Moore’s fund has been ranked bottom of Sanlam’s black list of equity income funds, a collection of strategies Sanlam terms as “consistent underperformers” that may require “remedial action”.

It is fourth quartile over one, three and five years, although its shorter-term performance puts it top quartile over three and six months, according to FE Fundinfo.

Last week the £800m fund was stripped of its A rating in Square Mile’s January ratings round-up.

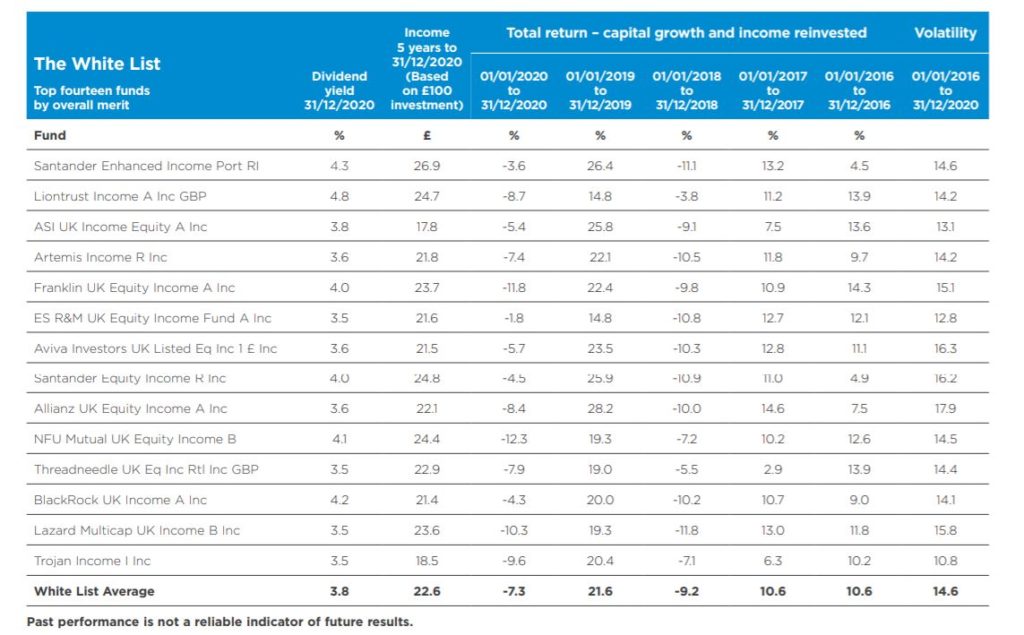

Sanlam’s bi-annual study reviews the 58 funds in the Investment Association UK Equity Income sector over a five-year period, judging them on seven criteria, including performance, volatility and income paid out, with the most recent period of performance receiving a greater weighting.

It then puts funds in one of three lists: white, grey and black.

Marlborough UK Multicap Income and Canlife UK Equity Income slide

Also on the black list was the Marlborough UK Multicap Income after dropping 10 places. Sanlam noted its poor selection in small and mid-cap equities had detracted performance returns and increased volatility against peers.

Similarly, the Canlife UK Equity Income dropped five places in the study.

Slater Income remained in the black list having slid 25 places in July’s ranking. Sanlam said the fund’s position remained static due to its poor performance and fourth quartile volatility versus peers.

Santander Enhanced Income ousts Robin Geffen from top spot

At the top end of the white list, which contains funds that have established their ability over five years to produce superior total returns, Santander Enhanced Income knocked Robin Geffen’s (pictured) Liontrust Income fund off the number one spot.

Sanlam said following a tough period in 2016, the Santander managers, Graham Ashby and Duncan Green, “have proved their worth in recent periods while delivering alpha against peers in 2020 following a good return profile in 2019”.

The biggest climber in the white list was Moore’s ASI colleague Charles Luke whose ASI UK Income Equity fund jumped 13 places to rank number three. The pair have been in charge of Neil Woodford’s Income Focus fund for the past year.

Sanlam said the fund had been driven up due to top decile performance numbers and low volatility profile, despite the low dividend paid over the period under consideration.

See also: ASI Income Focus sheds 30% of its assets a year on from Woodford after Covid beat down

Threadneedle UK Equity Income, Lazard multi-cap UK Income and the Allianz UK Equity Income all climbed into the white list.

List needs context otherwise it’s ‘one dimensional’

AJ Bell head of active portfolios Ryan Hughes said the rankings have to be put into context otherwise they are “one dimensional”.

He said when assessing managers, it is vital to understand how they invest, what their style is and how this is likely to influence the shape of the performance profile. His portfolio contains names from both the white and black lists.

“While the categorisation of funds into certain buckets is nice and easy, it doesn’t tell the story as to why a certain fund is there and therefore, anyone relying on it needs to do more work to understand the philosophy and process underpinning it.

“For example, it’s no surprise that the deep value of Schroder Income puts it on the black list given how value as a style has done in recent years, but I wouldn’t expect to find it anywhere else. Likewise, the high-quality approach from Troy Trojan Income puts it on the white list which, again, comes as no surprise given how 2020 panned out.

“However, we rate both funds highly and are not concerned by Schroder Income scoring badly as we understand the approach and therefore how it performs and actually combine it with Troy in some of our portfolios. Without this context, the list is one dimensional.”

Fairview Investing founder and consultant Ben Yearsley said: “I don’t think these lists are particularly useful as they are purely backward-looking performance measures, telling you what has done well or badly.”