Square Mile and rival research firm FE Fundinfo have teamed up to launch a fund dashboard that helps advisers with the fund selection process and caters to a “click and grab” way of accessing information.

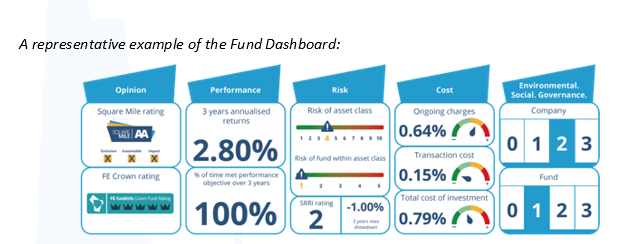

The Fund Dashboard, which is set to go live in Q1 2020, provides advisers with a snapshot of the key elements used in the fund selection process such as cost, performance, risk and ESG credentials.

There will also be an “opinion” section which comprises a qualitative and quantitative assessment of a fund’s ability to meet its objectives measured via Square Miles’ and FE Fundinfo’s ratings.

Source: Square Mile

Fund dashboards will initially be supplied for those firms in Square Mile’s ‘Academy of Funds’ but will be subsequently rolled out to all UK-domiciled active and passive funds. The dashboards will be reviewed on a quarterly basis.

Designed for ‘click and grab society’

Square Mile commercial director Steve Kenny (pictured) said the goal behind the Fund Dashboard is to make things easier for advisers by collating the information they need in one location so they can make decisions quickly for their clients.

“Fund fact sheets are four pages long and the problem in the modern world is people don’t have time to look at that,” said Kenny.

The Fund Dashboard also reflects the fact we are moving toward a “click and grab society” where more people are accessing information on their mobile phones and tablets.

“What we’ll become is a click and grab society whereby we look at stuff and if it peaks our attention where can we get more.

“What we’re trying to do is play to that digital age, whereby this gives you a very broad spread of information. There will be key parts of this dashboard that are more important to certain advisers than others and it enables them to see that really quickly to help them make informed decisions.”

Dual rankings will prompt advisers to ask questions

Each breakdown of the fund will include a fund and ESG ranking from Square Mile (where applicable) and an FE Fundinfo Crown score.

But Kenny said the competing data houses will avoid stepping on one another’s toes because of their different styles of assessing funds. Square Mile is known for providing qualitative assessments of funds, whereas FE bases its ranking system on a quantitative approach, he said.

“We’re not saying one is better than the other, but both are widely utilised. And in some instances, they are used together by IFAs.”

Asked whether two sets of rankings might be confusing for advisers, Kenny said he hopes it will prompt IFAs to ask questions.

He said while a value-based UK equities manager might have a lower FE crown ranking due to their style being out of favour, the same manager might score highly with Square Mile after considering factors like track record and consistency of style.

“Arguably they [IFAs] shouldn’t just be using one lens to make a decision,” said Kenny. “In 2001 that’s what led to everybody piling into tech because they all bought performance. I think the industry has become more sophisticated than that and people do now look to build portfolios with diversification.”