What was already a difficult backdrop in 2019 for UK small-cap investors, with political uncertainty and the Woodford situation, has been overshadowed by the coronavirus outbreak. Despite measures put in place by the government to help small businesses survive the crisis, talk of insolvencies has clouded the horizon for UK smaller companies.

Indeed, many investors have retreated to the safety of larger corporations, where they hope historical strength will be an indication of future survival. Outstanding valuations and the opportunity to re-finance small businesses with considerable recovery potential presents, however, an optimal entry point for medium-term investors prepared to break from market consensus.

By adopting a highly engaged approach and mapping out an exit strategy from the start, investors can uncover hidden gems and help these companies realise their potential for strong profit recovery, above-average growth and attractive dividend outlooks.

Fighting off biases

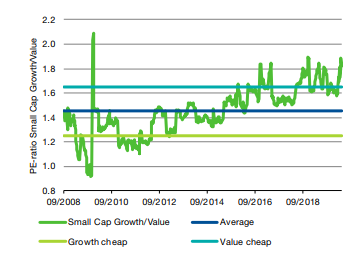

With a recession priced in, UK small caps are particularly cheap compared with their larger counterparts – reminiscent of the post Brexit referendum period, or at the bottom financial crisis more than a decade ago. Within small caps, as the following chart illustrates, value stocks are at their cheapest in a decade when compared with growth. Small cap growth stocks are trading at a 12-month forward price/earnings ratio of 24.4x versus 13.3x for small cap value stocks – a gap only surpassed in December 2009.

Small cap value is at its most attractive for a decade

Source: Liberum, Bloomberg

Periods of risk-off sentiment are, however, characterised by behavioural traits – such as loss aversion, anchoring to prior beliefs and being slow to react to changing information – which are making investors miss these discounts.

In market sell-offs, investors are afraid of straying from consensus and continue buying the same factors that were successful prior to the crisis – in this case, large-cap, growth, tech and US stocks, as well as bond proxies. With many companies needing to borrow money to survive this crisis, investors have also flocked to businesses with strong balance sheets.

This narrow market consensus is stretching the band between extreme levels of valuation. Many investors concerned about capital protection in the short term are willing to pay more for companies with proven success – leaving untested stocks to plummet. This is creating a window of opportunity for medium-term investors willing to write off 2020 performance in favour of returns for the next three to five years.

We expect this opportunity set to last for the next 18 months, as waves of capital-raising succeed each other – first, from companies needing to raise cash immediately, then from those finding themselves in too much debt, followed by companies that did not raise enough in the first instance. When the economy begins to recover, there will be a vast acceleration in activity, where an even wider range of companies will need further capital to enable growth.

Assisting recovery

While companies going through a tough time may seem like too much trouble for many mainstream funds, this is exactly the type of businesses we seek out – and seek us out. We choose to participate in turnaround situations where we can provide companies with capital and support at a critical moment in the business evolution – offering opportunities to buy low and the potential to add value, then sell high.

Even before investing in a company, it is important to identify an exit thesis. This means considering potential acquirers of the business and what needs to be done to ensure the company is attractive to this buyer. For our part, we conduct extensive research and use our on-house resource platform to understand the multiples private equity acquirers pay and what sectors they are active in.

We take large stakes in companies, ranging from 5% and 25%, where the most likely outcome is a buyout, rather than a gradual exit to other investors. As we invest such a large proportion of the portfolio in businesses facing initial difficulties, we stress the importance of due diligence and take an in-depth private equity approach to engaging with company management, end customers and other stakeholders.

Taking advantage of depressed valuations and companies’ need for capital, we made several investments recently into businesses we anticipate will make a strong recovery from the crisis over coming years. As an example, we purchased a stake in ULS Technology, a digital conveyancing platform for housing transactions, in the belief its DigitalMove product has transformative potential.

We also took an initial position in Van Elle, a piling and ground engineering specialist for the construction industry and rail sector. Van Elle ought to benefit from the tsunami of infrastructure spending we expect in years ahead. We also doubled our existing position in Centaur Media, where the new CEO’s strategy to rebuild margins after significant portfolio restructuring is focused on future value creation.

Richard Staveley is investment manager for Gresham House Strategic