Retail investors are outpacing wealth managers when it comes to using investment trusts in their portfolios forcing company boards to rethink their marketing and communications to target a growing source of inflows.

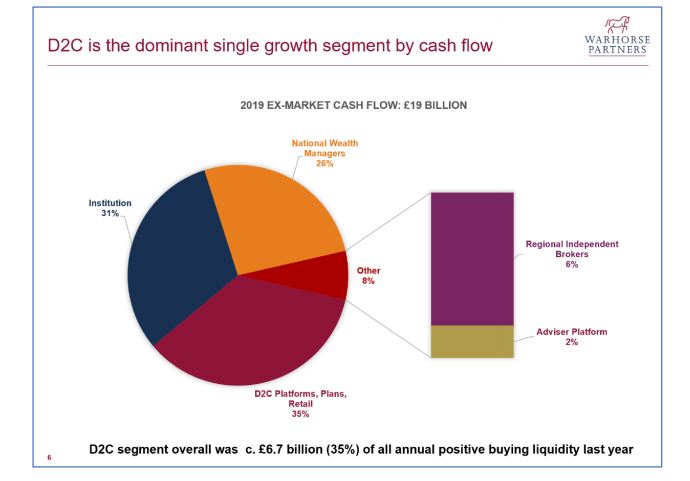

A report entitled Investment Trusts: changing ownership trends 2019, by Richard Davies Investor Relations (RD:IR) and consultancy Warhorse Partners, found that direct to consumer (D2C) investors accounted for £6.7bn of investment trust purchases in 2019, compared with a £1.8bn reduction by wealth managers.

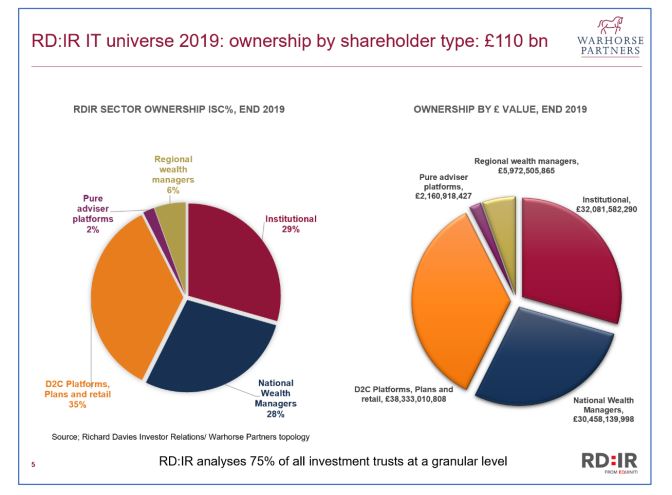

Analysis of share register data for more than 220 UK-listed investment companies with a combined market value of £110bn, representing about 70% of the total market capitalisation of the industry, found D2C investors accounted for 35% of market cap, while institutions represented 29%, wealth managers 28% independent regional brokers 6% and adviser platforms 2%.

Source: Investment Trusts: changing ownership trends 2019 report

The report notes analysis of the five-year share register shows several of the bigger wealth groups have been gradually reducing investment trust exposure over the past five years. Investec Wealth and Brewin Dolphin, for example, have been overall net sellers of trusts for a number of years, it said.

D2C customers now own £38bn of investment trust assets, while national wealth managers remain a “dominant but declining force in the investment trust sector”.

Source: Investment Trusts: changing ownership trends 2019 report

Retail investors are replacing wealth managers

Warhorse Partners founder Piers Currie says the findings refute the idea that the investment trust sector is in decline because of the withdrawal of the some of the larger wealth managers from the sector.

“The shortfall in demand from that source has been more than made up for by the growth of retail demand through platforms,” he says. “The challenge for any investment trust board today is to identify how effectively it is tailoring its marketing and communications to this new audience.”

The study only covers 70% of the industry by market cap, but the AIC says comprehensive data does not exist for the whole industry.

AIC head if intermediary communications Nick Britton (pictured) says many of its member companies are seeing direct investors on consumer platforms move up their share register, while the largest wealth managers are reducing their exposure.

“Direct investors are attracted to investment companies for many different reasons, including their strong long-term performance and income advantages,” he says. “While large wealth managers are still among the biggest holders of investment companies, they have scaled back their holdings in recent years as they are now too large to make meaningful allocations to some of the smaller investment companies.”

The AIC says it would be interesting to know which companies make up the 30% of market cap missing from the study as this could have an impact on the results. For example, from its experience wealth managers have shown a lot of interest in alternative assets.

“The ability of investment companies to offer access to less liquid alternative assets, such as property and infrastructure, has ensured that the structure remains relevant to all investors seeking diversification across asset classes, including wealth managers, financial advisers and private investors,” says Britton.

Growth of platforms brings more retail assets to trusts

The report noted that D2C platforms have been growing in size, flagging Interactive Investor’s acquisitions of TD Waterhouse, Alliance Trust Savings and the Share Centre, which has boosted its customer base of over 300,000 to challenge Hargreaves Lansdown, the market leader by size.

Interactive Investor personal finance campaigner, Myron Jobson says the report’s 2019 stats on investment trusts corroborates with the platform’s own data and reflects a trend seen among its customers in recent history.

Jobson says the volume of investment trust purchases rose 107% between 1 January and 30 June 2020 compared with the same period in 2019. It is a similar story since the Covid-19 lockdown, 23 March to 28 June 2020, with investment trust purchases up 91% year-on-year during the period.

“The allure of investment trusts is easy to see. Investors can get a bargain by snapping up investment trust shares when they are trading at a discount while the ability for investment trust managers to gear can potentially produce a better return on the capital invested – although losses can be exacerbated during periods of underperformance.

“In addition, being closed ended is a key advantage if the fund is invested in illiquid assets, like property, that cannot be bought and sold easily.”

An AJ Bell spokesperson says investment trusts have always been a popular investment option for the platform’s DIY customers who have been attracted by features including strong dividend track records, the discount and premium mechanism, and gearing. This makes trusts slightly more complicated than funds, which explains why more sophisticated retail investors are the heaviest investors in them, they added.

“I think the growing share of the overall market cap of trusts by retail investors is a function of the rapid growth of DIY investing over the past few years,” they say. “Our typical DIY investor has about 15% of their portfolio in investment trusts and if that is reflected across other platforms, as the DIY platform sector grows the proportion of the investment trust market owned by those investors will also grow.”