By Oliver Jones, head of asset allocation at Rathbones

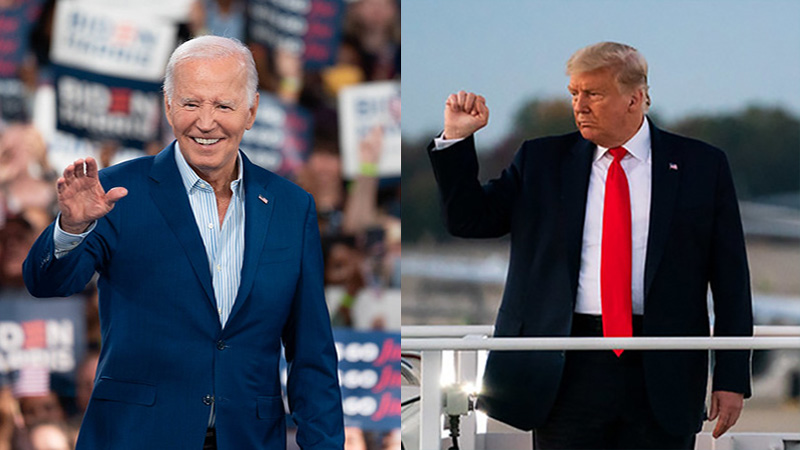

Americans go to the polls on 5 November to vote for their President, a major event in this bumper year of elections. But in contrast with the foregone conclusion of the UK election, the race for the White House is highly uncertain and the contests for the Senate and House are very tight.

There are also big differences between the Republicans and Democrats in consequential policy areas, and no clear view on which outcome markets would prefer — that is likely to vary from issue to issue.

In this context, it doesn’t make sense to premise investment decisions on any single outcome — we need to be prepared for a range of possibilities.

Following President Joe Biden’s faltering performance in his televised debate with former President Donald Trump, his re-election campaign has been in turmoil. Before the debate the two Presidents were within two percentage points of each other in the national polling averages.

His disastrous debate performance may have tipped the scales in Trump’s favour, but so far Biden has survived calls to step aside as the Democratic nominee.

Meanwhile, polls are suggesting a split Congress. The Democrats have a slight edge when it comes to the House of Representatives (an estimated 59% chance of getting a majority), but the Republicans are favourites for the Senate (61% chance).

In the past, markets have tended to prefer a split Congress, which can moderate the extremes in either party, but this outcome is far from guaranteed.

Economic differences

In the run-up to the election, it is worth highlighting the contrast between the two parties’ economic platforms in a couple of areas to illustrate the extent of the uncertainty.

Take corporate tax, which is an issue we know had a major bearing on the stock market during Trump’s original term in office. In this area, markets are likely to prefer what the Republicans have to offer.

Trump has proposed to extend the corporate tax cuts he introduced in the 2017 Tax Cuts and Jobs Act (TCJA), which are otherwise due to expire next year. The TCJA reduced the corporate tax rate significantly, from 35% to 21%, and in turn provided a boost to US equities.

Trump’s campaign has also suggested going even further and cutting the corporate tax rate all the way to 15%. That could increase US firms’ post-tax earnings by around 8%.

In contrast, Biden’s plans include increasing the headline corporate tax rate to 28% (and raising various minimum corporate taxes). This might reduce post-tax earnings by approximately 9%.

The picture is precisely the other way around on trade, with markets likely to be more sympathetic to Biden’s offer.

It is true that both parties broadly favour a tough stance on China and supporting domestic production of strategic goods — Biden has continued and extended the trade war Trump started when he was President.

Radical trade tariffs

Trump’s proposals for next steps are much more radical than Biden’s. He has floated plans to hit all Chinese goods with a 60% tariff and to impose a 10% ‘universal’ tariff on all other imports.

This universal approach would be a dramatic escalation from the targeted measures used to date. It would take average US tariff rates to their highest since the 1940s, which would probably push inflation up and hurt economic growth.

It is possible that Trump plans to use the threat of this universal tariff as a bargaining chip to extract concessions from other countries, given that he used similar negotiating ploys during his first term. So there is a good chance that we never see the full universal tariff.

Yet the threat alone suggests a willingness to go much further than his Democratic rival.

We are only scratching the surface here — we’ll be watching other important areas such as the deficit, immigration and geopolitics.

The most significant point is that the outcome of the US election remains highly uncertain, and neither candidate would be unambiguously positive or negative from an investor’s perspective.

Against this backdrop, a diversified, long-term investment approach makes more sense than one that’s overly dependent on the roll of the election dice.