By Oliver Jones, head of asset allocation at Rathbones Investment Management

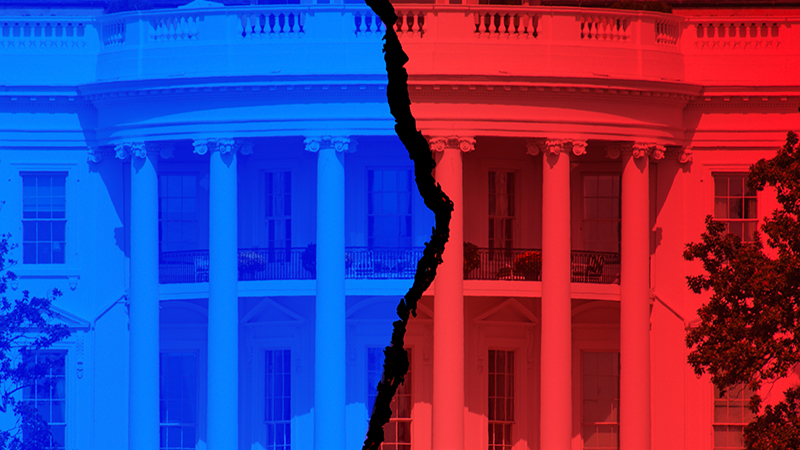

As we head into what is perhaps the most uncertain US election in living memory, Republicans and Democrats are poles apart on significant areas of policy. These include corporate tax, energy policy, immigration and much more. That’s a key reason why this election looks more consequential for investors than the typical contests of the past few decades.

The gap between the parties’ offerings has grown, and the breakdown of the previous economic consensus has expanded the options they’re willing to consider in implementing their plans. At the highest level, former president Donald Trump’s proposals appear more inflationary than those of his rival, Democratic vice president Kamala Harris.

The government’s budget deficit would probably be larger than otherwise given Trump’s tax plans. Labour supply would be restricted as his ‘America First’ agenda restricts immigration.

See also: The 15% of US funds that beat the S&P 500 over the past decade

Much more aggressive action on trade is possible, even if his proposed ‘universal tariff’ isn’t implemented in full. Trump’s suggestions on the dollar and the makeup of the Federal Reserve (Fed) would also add to inflation risks, but they are likely to prove hardest to implement. This inflation risk is another reason why this election matters, given the context of how strong price pressures have been recently. It is also a risk to US government bonds.

Otherwise, Trump’s platform contains a very significant positive offset for the US stock market in the form of corporate tax cuts. He’s also proposing deregulation for certain sectors, though the effects of these proposals on stocks are more ambiguous and probably smaller.

However, the risks to equities outside the US, which generally won’t benefit from these changes, appear greater. They may be more vulnerable to Trump’s proposed changes on the trade front.

Uncertainty runs through it

A key thread running through our analysis is the immense uncertainty which still surrounds the election. Given the likelihood that a Harris victory would largely maintain the status quo, this report will focus mainly on what a Trump presidency could mean for your investments.

First, there’s uncertainty about the result. Harris was the favourite at the time of writing, but only just. Her average lead in the polls is much smaller than Biden’s lead in 2020. It’s smaller than Hilary Clinton’s was in 2016 too.

The contests for the House and Senate are extremely close too, and may not go the same way. The results there will have a huge bearing on what the new president is able to implement. Second, even once the result is clear, there are more question marks than usual about how campaign-trail rhetoric will translate into policy.

See also: Is there any point investing in the US actively?

In areas like trade, it can be hard to distinguish negotiating ploys from genuine policy proposals. This makes it hard to gauge investors’ response to the result, particularly as their preference between the parties is likely to vary from issue to issue. It’s vital that we’re aware of the risks. But we must also be realistic about our ability to foresee precisely what will happen.

As always when it comes to elections, we should not forget the bigger picture either — the trends in the global economy and markets beyond the direct control of any individual politician. The election isn’t everything. All of this suggests we should take care not to premise our portfolios too heavily on any single election outcome.

What the polls say

The situation in the US is nothing like the recent UK election, where Labour maintained a huge polling lead throughout the campaign. The polls are extremely tight, and the lead has changed hands. There’s also a significant chance that the winner of the presidential race fails to take both the Senate and House with them, limiting their ability to enact their agenda.

Prediction and betting markets had moved in Trump’s favour after Biden’s struggles in the first debate, and again after the attempted assassination of Trump. But they have swung back since Biden dropped out, leaving Kamala Harris his replacement.

Room for manoeuvre

A big caveat is needed here – the polls are far from conclusive given their tendency to move as election day approaches, and their typical margin of error. In post Second World War elections, the average state poll has shifted by more than eight percentage points in the four months before the vote, more than enough to wipe out either candidate’s advantages in key ‘battleground’ states — where party allegiances are evenly divided.

Harris replacing Biden arguably adds to the possibility of the polls moving (in either direction) this time around, as voters become more familiar with the new candidate. The polls themselves are far from perfect. Differences of more than 2 percentgae points between the final polls and election result are routine.