The private equity market is predicted to double over the next five years as more companies shun public listings, but many investment trusts specialising in the asset class continue to trade at steep discounts.

Despite offering the attractive prospect of tapping into the private market, the average trust in the Association of Investment Companies Private Equity sector was on a discount of 13.4% in April.

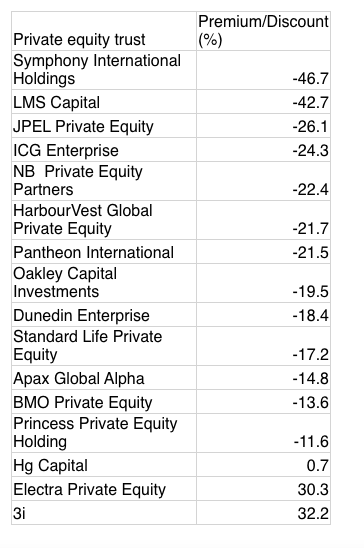

While this has swung in the opposite direction with the average trust now trading at an 11% premium, this is down to two trusts, 3i Group and Electra Private Equity, trading at sizeable premiums of 32.2% and 30.3% respectively.

Only four trusts in the 17-strong sector are currently trading at a premium, with the rest languishing on double-digit discounts. The worst of the lot is Symphony International with its shares currently trading at a colossal 46.7% discount to net asset value (NAV).

Scottish Mortgage has demonstrated pull of unquoteds

“Private equity is seemingly an area that got hit hard in 2020 with investors worried about the impact on illiquid companies and as a result their discounts moved out sharply,” says Ryan Hughes, head of active portfolios at AJ Bell.

Though Hughes notes discounts have “come in a little from their 12-month average” many remain “sizeable” despite the outlook for the global economy looking more positive.

Behind Symphony International, LMS Capital is sitting on the second highest discount of 42.7%, while JPEL Private Equity is on 26.1%. A handful of other trusts, including Harbourvest Global Private Equity and Pantheon International have seen discounts slump to 20%.

“The reasons for this are not entirely clear as the attraction of private assets has grown over the last few years helped by the likes of Scottish Mortgage demonstrating the value that can be delivered by investing outside of listed markets,” Hughes says.

Private equity doesn’t fit into an asset allocation bucket

Independent wealth expert Adrian Lowcock thinks investors are discounting the greater risk associated with private equity, which typically targets companies at the early stages of their lifecycle.

Though he admits this is slightly odd given “risk appetite has generally been quite strong”.

Hughes thinks the fact that more advisers are moving toward risk targeted models could be another factor weighing on private equity trust discounts.

“Private equity doesn’t fit neatly into an asset allocation bucket,” he says. “There is also complicating factors like the lack of transparency in some cases and the lag on updating the underlying valuations, given these are unlisted businesses.”

Strong Q1 valuations and uptick in realisations are not baked into current discounts

However, Jefferies notes that the sector’s “good set of Q1 NAVs” have not been priced into all discounts yet, meaning listed private equity vehicles could benefit from further upside.

Analysts are banking on positive Q1 data judging from the positive performance of the Russell 2000 Value Index and Stoxx Europe 600 Index, the two most relevant benchmark indices for most listed private equity portfolios, over the first three months of the year, as well as stronger figures from the US listed general partners (GPs) like Ares, Blackstone and Carlyle.

More importantly share prices do not reflect a “substantial increase in realisation activity,” according to Jefferies.

“We continue to see the potential for strong levels of exit activity, with the flat level of industry exits for 2020, compared to 2019, indicative that there is some catching up to do following the Covid-induced pause in activity during Q2 last year,” it said in an analyst note.

“Any reform of US capital gains tax could also provide an additional boon for realisations, as GPs would likely bring forward exits to help protect post-tax returns.”

PE could take off as more companies stay private for longer

Looking ahead the asset class could be on more investors’ radars as companies that choose to stay private for longer thrive. The number of unicorn companies in the UK hit 80 in 2020, according to a report by Tech Nation, which is more than Germany and France combined.

“In recent years, we have seen a trend of de-equitisation with fewer companies coming to listed markets and many proving that you can become a huge global player without resorting to the demand of quarterly updates to the market,” Hughes says.

“As a result, the attraction of private equity could easily grow over the coming years and therefore it may be a space that warrants closer attention.”

Pantheon International investment principal Tanu Chita says the actual supply of investment opportunities in the public space has decreased year-on-year since the dotcom bubble.

In particular the trust is weighing up opportunities in the tech space, which accounts for 29% of the portfolio. Holdings include J Frog, which helps companies keep track of and integrate software versions, as well as Polish e-commerce company Allegro, which saw accelerated growth during the pandemic.

“Technology is no longer vertical, it’s horizontal so it’s impacting all sectors and helping to transform individual companies and individual sector offerings,” Chita says.

In healthcare, the trust is looking at the rising prevalence of chronic disease and companies that are focused on the developments of specialised products and treatments, as well as a company called Connect Your Care, a US-based provider of digital administrators and administration services for health accounts.