Legal & General Investment Management and M&G were the stand-out fund firms in the Pridham Report for the second quarter of 2023.

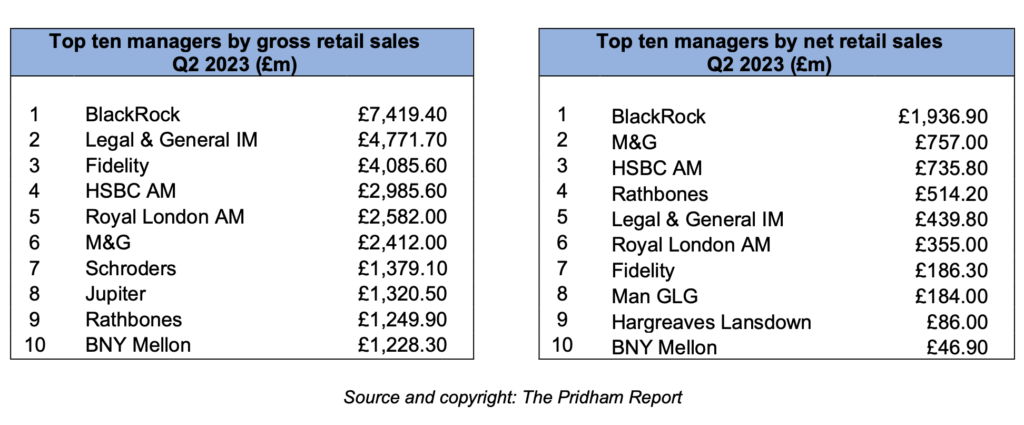

LGIM had its highest ever quarterly gross inflow, taking it to second place in the gross sales rankings with £4.77bn.

The report said that as well as ‘core replacement’ products such as the L&G International Index and the L&G All Stocks Gilt Index, which generated the highest sales, L&G has seen growing demand for thematic propositions such as its Global Technology Index. On the actively managed side, the L&G Strategic Bond Fund has been gaining traction this year, the report noted.

See also: Lipper ETF flows: European equities and financials see largest outflows

M&G continued to ‘go from strength to strength’, the report stated, as the firm booked its best quarter of sales in a decade. This took it to sixth in gross sales with a total of £2.41bn, and a lofty second place in net sales with £757m.

While sales of its fixed income range have historically dominated, its equity fund range has been attracting increasing interest recently, the report said. Gross sales were split evenly between its bond and equity ranges.

Taking top spot in both tables was BlackRock. While somewhat unsurprising given the scale of the firm and popularity of its iShares products, it was the first time the US firm has taken first place in both gross and net sales rankings since the third quarter of 2021.

See also: US Solar Fund tees-up manager switch as it tries to stem slump

At the asset class level, the quarter was notable for the relatively strong performance of fixed income funds. Fixed income saw the highest net sales, according to the Investment Association’s figures. Equity funds as a whole suffered a sixth consecutive quarter of net outflows.

“There were mixed results in the second quarter,” the report’s editor Anna Pridham said. “Among the top ten leading fund groups, roughly half saw their sales decline, while of those that reported a rise in new business, two experienced their highest quarterly gross sales on record.”

The full top ten lists for gross and net sales can be viewed below:

–

PA EVENT: Fixed Income, September 14th | RSVP HERE

Hosted at Pan Pacific Hotel

Join us for an in-depth exploration of the fixed-income market, where industry experts will delve into the current landscape, emerging opportunities, and strategies for optimizing fixed-income portfolios.

Sponsors include Alliance Bernstein, J Safra Sarasin, Premier Miton, RBC Bluebay, Vontobel and 1 more to be announced.