Inflation in the United States has fallen back to around the 3% mark, tantalisingly close to the US Federal Reserve’s 2% target.

Annual headline inflation in the US did, however ,tick up slightly last month to 3.7% from 3.2% in July, in a perhaps timely reminder that the battle is not yet won.

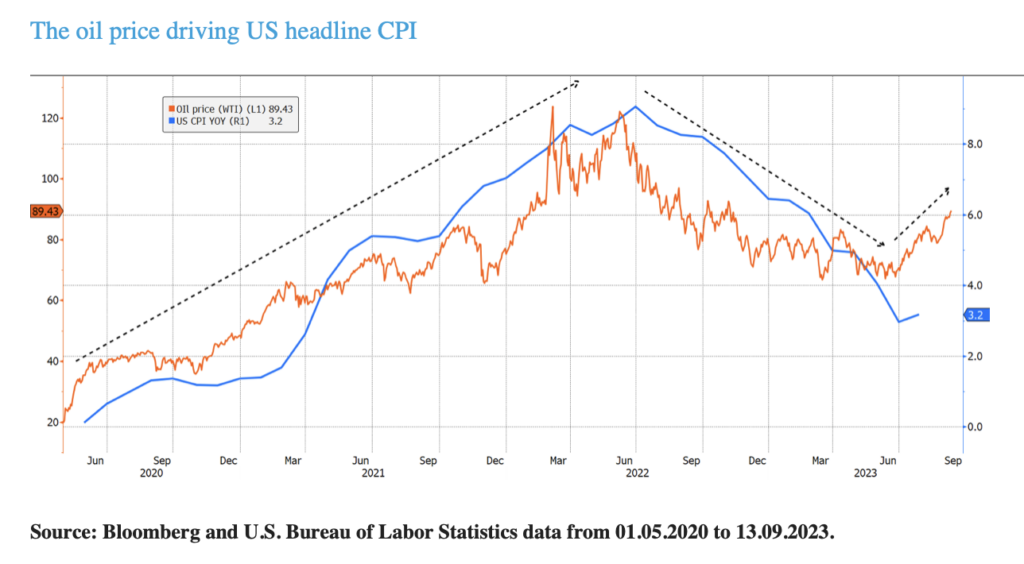

Headline inflation is the number the target applies to, and in one respect it is out of the Fed’s hands. The global oil price feeds directly into fuel costs and can stoke inflation even when monetary conditions are tight and core inflation is falling, because of the supply side pressure.

All-manner of geopolitical manoeuvring plays into the oil price, and if the current climb is sustained it will make the Fed’s job of squeezing the figure down to 2% harder.

The Premier Miton macro thematic multi asset team’s Anthony Rayner has penned a note on exactly this.

“Oil prices have moved sharply higher of late, on the back of tight supply and extended cuts by some of the key oil producers,” he said. “Oil feeds into headline inflation, which central banks officially target, and the degree to which central banks are hawkish or dovish remains a key driver of asset markets.

See also: Weekly outlook: Fed and Bank of England set to make interest rate decisions

“Additionally, even though the oil price doesn’t impact core inflation directly, there are risks of second order effects, where higher energy costs feed through to other components of the consumer basket.

The chart below illustrates the relationship.

Rayner added that in recent months inflation has actually been benefiting from lower year-on-year comparisons, but this is now starting to fall out of the data. He noted that while the move higher in oil prices might be a temporary spike, we should not forget that inflation is still above target.

“This therefore complicates the job of central banks and so feeds into uncertainty for markets,” Rayner said. “In the Eurozone, headline and core inflation both remain elevated, while the economic growth outlook is weakening, so stagflationary pressures are building.

“In the US, inflation has fallen further and growth is stronger so stagflation is less of an issue but, unlike the ECB which just targets inflation, the Fed has dual mandates of price stability and maximum employment. This challenges the dominant narrative that inflation is heading back to central bank targets and detracts from the potential of a subsequent dovish pivot. All in all, this supports our higher for longer base case.”

Turning to what this means for portfolios, Rayner said it is possible that for the third calendar year in a row US treasuries will lose money.

“At the same time, yield curve control in Japan is looking increasingly likely that it will come to an end this year, or early next, assuming prices and wages continue to rise sustainably. In short, bonds remain under pressure.”

See also: Are US equities overvalued, or are valuations just high?

“We remain relatively short duration in bonds, emphasising their income characteristics, rather than their diversifying properties. Instead, we look to a material gold position and a smaller agricultural commodities position as non-equity diversifiers of portfolio risk.”

Rayner added that within equities, he and his team are looking to achieve more diversification than normal. By way of example, Rayner said the firm now has significant exposure to Japan and a smaller position to India, which diversifies global equity risk.

The team has also added material exposure to medium-sized companies, in part to diversify away from the large tech names that dominate the stockmarket.

–

PA EVENT: Autumn Congress, September 27th– 29th | RSVP via email

Hosted at The South Lodge Hotel. Transport and accommodation will be provided for the duration of the event.

Our Autumn Congress will serve as a comprehensive platform for discussing the key trends, challenges, and innovations shaping the wealth management landscape. It will bring together thought leaders and industry professionals for enlightening discussions and networking opportunities. Register link |

Sponsors include Alliance Bernstein, Alger, Boston Partners, Baillie Gifford, CCLA, Janus Henderson, GAM, Jupiter AM and much more! Please see the full line-up on our website: AC2023