The Association of Investment Companies (AIC) has named its next generation ‘dividend hero’ investment trusts. These are the 30 trusts that have increased their dividends for 10 or more consecutive years, but less than 20.

Patria Private Equity and Foresight Solar fund have joined the list, having notched up 10 consecutive years of annual dividend increases.

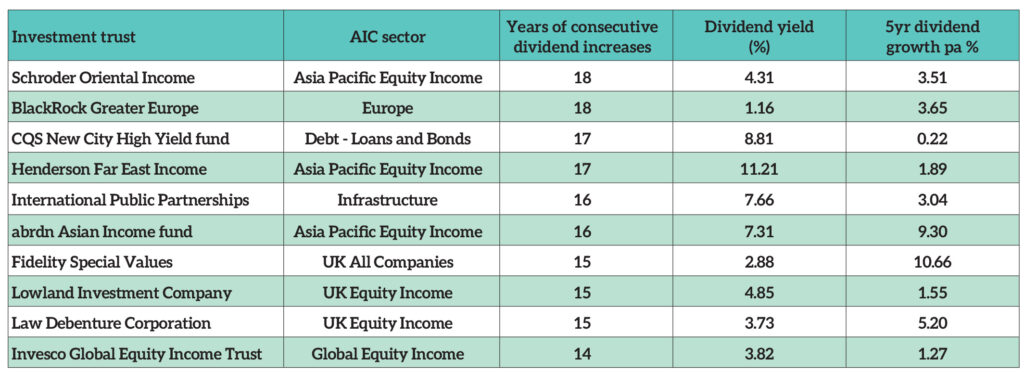

Schroder Oriental Income and BlackRock Greater Europe lead the list, both having increased their annual dividends for 18 consecutive years.

They are closely followed by CQS New City High Yield fund and Henderson Far East Income, which both have an unbroken record of 17 years of dividend increases. Two investment companies have 16 years of dividend increases, International Public Partnerships and abrdn Asian Income fund.

Two of the next generation are subject to corporate activity. A merger between Henderson International Income and JPMorgan Global Growth & Income and a bid for BBGI Global Infrastructure have been proposed. Shareholders will be voting on these proposals later this year.

The next generation of investment trust dividend heroes: Top 10 trusts

Richard Sennitt, manager of Schroder Oriental Income, explained that around 45 stocks contribute to half of the income generated from the region in which the trust invests. This offers diversification compared to the roughly 10 stocks that generate most of the UK’s dividends.

“This diversification reduces the reliance on a limited number of entities for income generation, providing an active manager like us with greater options,” he said. “Although the economic outlook remains uncertain, especially from a Trump policy perspective, payout ratios are reasonable and leverage ratios for Asia are relatively low when compared to other regions. This should provide some resilience for dividend payments if things were to slow down.”

Private equity trust prioritises returning cash to shareholders

Patria Private Equity Trust (PPET)’s senior investment director and lead fund manager, Alan Gauld, said the trust’s board has focused heavily on protecting and growing dividends.

“Historically, there has been a debate over whether private equity trusts should be purely about capital growth or not. However, the board of PPET has consistently prioritised returning cash to shareholders, effectively an ongoing return of capital at NAV, over the long term.”

“PPET has a focused investment strategy of partnering with a small group of leading mid-market private equity managers, through private equity funds and also by directly investing into private companies alongside these managers.

“However, at an underlying company level, PPET’s portfolio is well diversified and generates a consistent cash yield, usually around 20% of opening NAV per year. This allows PPET to comfortably support a growing dividend. The board’s strategy in recent times has been to at least maintain the value of the dividend in real terms. This has resulted in 5% growth in dividend in 2024, and 11% growth in 2023.”

Foresight Solar looks to amplify returns

Foresight Solar’s operational portfolio aims to continue producing steady, reliable income from the sale of electricity to the grid, explained lead fund manager Ross Driver.

“In the past 11 years, we’ve built an experienced team to oversee an excellent portfolio that reliably generates cash. We’re proud to have made every dividend payment and to have increased our payout every year. In that time, our dividend has grown 35% – including the 2025 target,” he said.

“To amplify returns, we’re building a development pipeline of solar and battery storage projects that allows us to deliver an additional element of growth on top of the regular income provided by the operational portfolio – improving performance over time.”

AIC’s next generation list follows publication of its full dividend hero list last week, featuring the 20 investment trusts that have managed to grow their annual dividend consistently for at least 20 years in a row. Half of those 20 dividend heroes have increased their dividend for an impressive 50 or more consecutive years, including City of London, Bankers, Alliance Witan and Caledonia Investments.

Annabel Brodie-Smith, AIC communications director, said: “There are 30 investment trusts that make up our next generation of dividend heroes, having consistently increased their dividends for more than 10 years but less than 20. Over half of these next generation trusts yield more than 4%. They cover a wide range of sectors from equities to debt, infrastructure and property.

“New members of the club are Patria Private Equity and Foresight Solar fund, both celebrating their 10th annual dividend increase – a notable achievement over a turbulent time for markets.”

See also: AIC: UK small-cap trusts join Dividend Heroes club