By Christine Dawson

Less than half of the sustainable passive funds domiciled in the UK are likely to opt for a Sustainability Disclosure Requirements (SDR) product label this year, according to research by Morningstar.

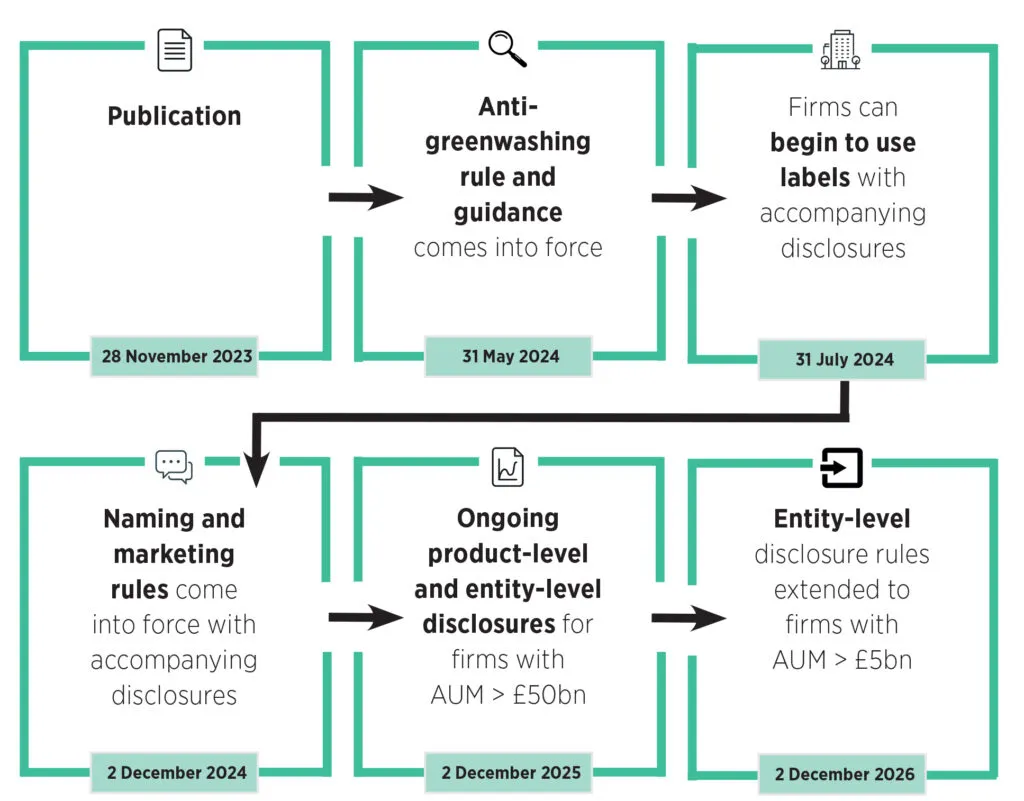

In its research paper UK SDR Through the Looking Glass, Morningstar identified 410 UK-domiciled funds that have sustainability-themed names – including the words climate, diversity or renewable, for example – and then estimated how likely they are to use the regime. Firms can start using the labelling regime on investment products from 31 July 2024.

Morningstar stated 300 of the 410 funds are likely to opt for a label. However, of these there are only around 50 passive products and Morningstar predicted less than half of those are likely to adopt one of the four labels available, leaving them “significantly underrepresented” in the labelling regime.

By the end of 2024, Morningstar predicted, less than 10% of labelled funds will be passive.

Morningstar pointed to the fact most of the 1,960 passives available for sale in the UK are overseas exchange-traded funds and therefore not within the scope of SDR.

“The limited number of labelled passive funds will reduce the choice offered to sustainability-oriented investors in the UK,” it stated.

Most UK-domiciled passives employ only negative screening, Morningstar also noted. Whereas, to qualify for a label, they would need to track an index that includes a sustainability objective. The Financial Conduct Authority (FCA) has stated where a product tracks an index, it must be one with a methodology aligned with the product’s sustainability objective.

Read more:- Regulatory outlook 2024: The year where waiting turns into action – ESG Clarity

Fixed income is also expected to be underrepresented, according to Morningstar, potentially making up 8% of labelled funds. In contrast, they make up 11% of the wider universe of fixed-income funds domiciled in the UK.

Challenges around integrating ESG into fixed-income products were cited as a reason for this, including data availability and quality and issues evidencing sustainability outcomes in sovereign debt.

The FCA published the final version of SDR measures in November last year, including an additional ‘Sustainable Mixed Goals’ fund label to the three which had been proposed previously. From July, funds can be labelled:

- Sustainability Improver

- Sustainability Focus

- Sustainability Impact

- Sustainability Mixed Goals

Morningstar found Sustainability Focus would be the most used label, with 46% of the 300 labelled funds falling into the category. While Mixed Goals will make up 31%, Improvers 12% and Impact 11%. It also said the Focus label had the “best understanding” among fund managers with many confident products meeting Europe’s Sustainable Finance Disclosure Regulation Article 9 criteria are also meeting requirements for the SDR label.

SDR implementation timeline

Hortense Bioy (pictured), global director of sustainability research at Morningstar, said: “The success of the UK labelling regime will lie in the quantity and quality of the products that get labelled. We expect conversations in the next few months and the first wave of implementation later this year to determine how this market will shape up.

“We hope this early analysis will contribute positively to these conversations for the benefit of investors not only in the UK, but also other jurisdictions as they look to implement similar regulatory frameworks.”

This article first appeared in our sister publication, ESG Clarity