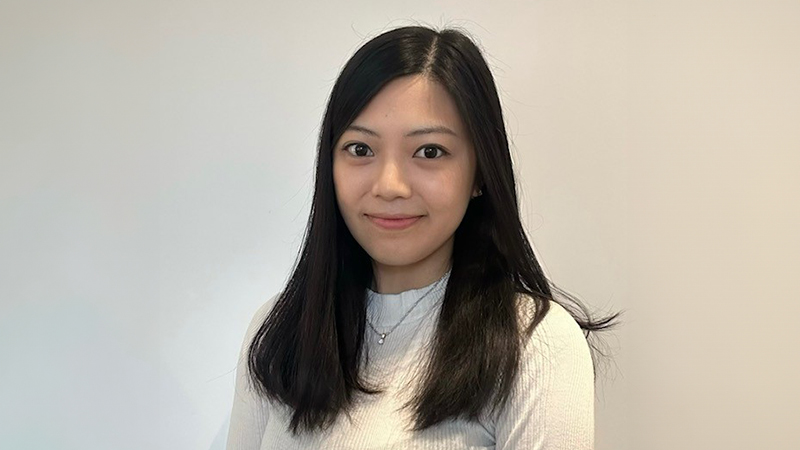

Oxford Risk has appointed Francesco Cocozza as product innovation manager for AI & behavioural finance. as it accelerates its strategy to deliver AI-powered personalisation at scale.

Cocozza has spent much of the past decade working on fintech products, building data and AI capabilities that make behavioural science usable at scale. In recent years, he has led AI strategy and implementation programmes on every Continent across highly regulated financial services and healthcare industries, from early-stage concept through to production and commercialisation.

At Oxford Risk, he will develop AI-powered tools that turn the company’s behavioural intelligence into practical support for advisers and their clients. He will lead the development of AI systems that are both behaviourally intelligent and governance-ready, ensuring outputs remain transparent, auditable, and aligned with regulatory expectations.

See also: WisdomTree launches thematic AI ETF

“Until now, truly personalised client engagement has been prohibitively expensive and reserved for the wealthiest investors. AI changes this – but only when it’s built on the right foundation,” said Marcus Quierin, CEO of Oxford Risk.

“We’ve spent years building the world’s largest behavioural investor database, and Francesco’s appointment marks the next step in turning that intelligence into AI-powered tools that deliver real value at scale.

“Personalisation without behavioural grounding is cosmetic. The real value of AI is when it helps people stick with good decisions, not just make them.”

In addition to the appointment of Cocozza, and to support Oxford Risk’s continued growth in the UK, internal strategic role changes also include Thomas Mitchell moving to head of UK new business and Tom Kelly to client director.

This story was written by our sister-title, PA Adviser