More than $100bn was wiped off global dividends in the second quarter, marking the worst quarterly drop in value since the end of 2009.

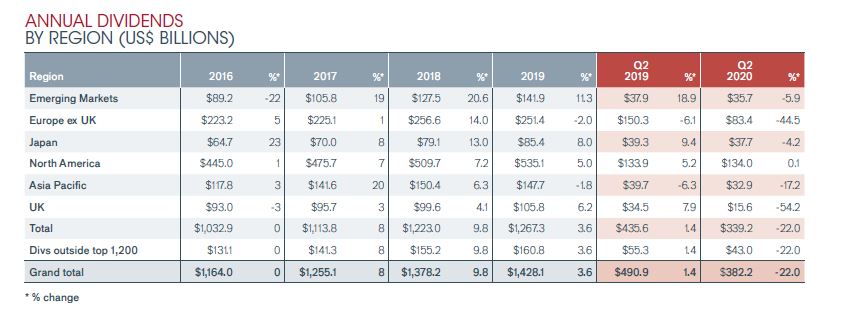

The latest Janus Henderson Global Dividend index revealed global payouts dropped by $108.1bn (£82.4bn) to $382.2bn in the three months to June, representing a 22% drop.

More than a quarter (27%) of global firms cut their payouts in Q2 and more than half of this group cancelled them outright.

Dividends fell in every region of the world, except in North America, thanks to resilience among Canadian companies where dividends grew 4.1%. In the US, payouts fell 0.1% to $123bn with only one tenth of companies cutting or cancelling dividends.

UK and Europe worst affected

Europe and UK were the worst affected with payouts falling by two fifths.

In the UK, dividends dropped 54% during the quarter with more than half of UK companies in the index cutting or cancelling them.

Several high profile UK companies including Shell, BP, Aviva, Lloyds Banking Group, Barclays and RBS, announced dividend cuts this year.

See also: Oil majors ditched from income portfolios as firms divert cash to become ESG friendly

European dividends, meanwhile, fell 45% in Q2, representing a $67bn drop, with France, Spain, Italy and Sweden posting the worst declines.

Europe’s largest dividend payer France was particularly badly affected during the quarter after total dividends reached their lowest level in at least a decade. German payouts only fell by a fifth, while Swiss dividends were flat, year-on-year.

Source: Janus Henderson

Janus Henderson investment director, global equity income, Jane Shoemake (pictured) said: “Most European companies pay just once a year in the second quarter, so a dividend cancellation has a disproportionately large impact on the annual total, but it also means 2021 should show a rebound in Europe.

“For the UK, the rebound will be smaller as several companies, not least oil giants Shell and BP, have taken the opportunity to reset their payouts at a lower level.”

She added: “Some payments were just deferred, and we have already seen some payments returning, albeit with a wide margin of uncertainty. Some of those that have been deferred will be paid in full, some will be paid but at a reduced level, and others will be cancelled outright.”

Worst year for dividends since global financial crisis

Janus Henderson’s best-case scenario for this year is for global dividends to fall 19%, paying $1.18trn, while its worst-case scenario is for a 25% drop, paying $1.1trn.

“Even so, 2020 will be the worst year for dividends since the global financial crisis,” it added.

Shoemake said: “Despite the cuts witnessed so far, we still expect global dividends to exceed $1trn this year and next. A temporary halt in dividends does not change the fundamental value of a company, though it can affect short-term sentiment, and it remains important for income investors to be diversified both by geography and sector”.

Axa IM thinks UK dividends will bounce back by 2022

Fund managers at Axa Investment Managers believe UK dividends will have fully recovered by 2022.

Axa Framlington Monthly Income fund portfolio manager George Luckraft said: “We would not be surprised if UK dividends fall by 40-50% overall when we look back over 2020. We have already seen well-known companies reduce their payments by more than this, for instance Royal Dutch Shell cut its dividend by two-thirds and BP halved its payout.

“Companies who might be facing difficulties are taking a pragmatic approach with their dividend to ensure their balance sheets are strong and that they are concentrating on liquidity.

“We expect that 2021 will be a better year for dividends and it is our view that we will see a fuller recovery in 2022.”