Real wages are being squeezed although consumers still have the cushion of accumulated savings. The current account deficit remains a concern, but public finances have improved quickly.

In contrast to the US, there is little upward pressure on UK wages. Indeed, wage growth this year looks set to lag well behind consumer price inflation, as Graph 1 below illustrates.

Graph 1: UK wages and prices

Coupled with higher taxes, the UK’s Office for Budget Responsibility recently estimated that 2022 will see the biggest fall in real household disposable income since the 1950s. That pressure, however, can be offset by running down the stock of accumulated savings, which stands at around £200bn.

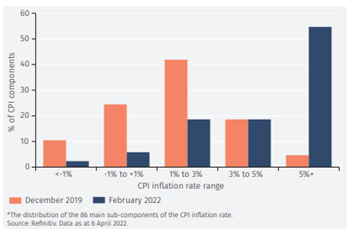

The headline consumer price inflation rate reached 7% in March. In itself, that is a concern – but even more disturbing is the distribution of price increases. Pre-pandemic, the individual components of CPI inflation were centred around 2%, as Graph 2 illustrates below; now the majority of components are registering price increases above 5%. Fuel prices are 50% higher than a year ago.

UK CPI inflation rate distribution*

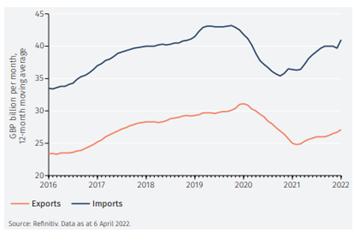

Two deficits – on trade and public finances – have long been weak spots for the UK and they remain so still. The UK has become a less open economy since Brexit but, whereas exports remain subdued, imports have regained – in nominal terms – their pre-pandemic level as Graph 3 shows below. The current account deficit looks set to exceed 3% of GDP in 2022, making the UK still reliant on ‘the kindness of strangers’ for its financing.

Graph 3: UK exports and imports

Public finances are in better shape but remain vulnerable. The reduction in the deficit in the last fiscal year was due to lower-than-expected spending and resilient tax receipts – especially from high earners. An increase in the tax burden in coming years means the deficit is expected to continue falling.

Fiscal plans can, of course, quickly be derailed by unforeseen events; and there is a concern that the planned tax increases are potentially unsustainable in the face of pressure on household finances.

Oisin O’Leary is co-manager of the New Capital Dynamic UK Equity fund