UK equity income managers are ditching dividend paying stalwarts like Royal Dutch Shell after a raft of deferred or cancelled shareholder payouts on the back of Covid-19. But it’s not just due to economic reasons that oil majors have cut dividends and their shares are unloved – it’s also down to their move to become more ESG friendly.

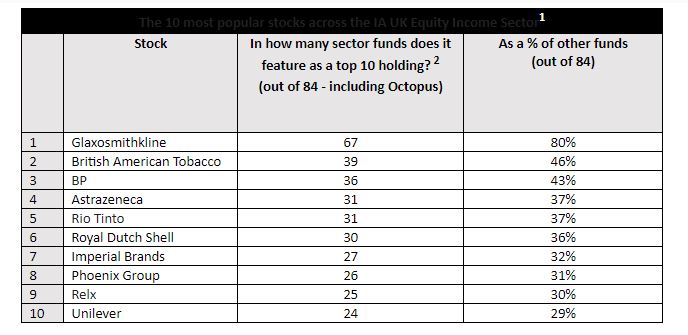

According to research by Octopus Investments, the number of managers in the IA UK Equity Income sector who have Royal Dutch Shell in their top 10 portfolio holdings has dropped from 65% in January to 36% at the end of May.

The proportion featuring BP, which is yet to cut its dividend, has fallen from 61% to 43%, although it remains the third most popular stock in the sector.

Shell, which in April cut its dividend for the first time since World War Two, is among a raft of FTSE 100 companies including Aviva, Lloyds Banking Group, Barclays and RBS to announce dividend cuts this year.

According to latest data from AJ Bell, British firms have cut or deferred £32.7bn in dividends so far this year. The forecast dividend payout for the FTSE 100 this year has fallen from £91bn to £62bn, it said – a 17% drop compared with 2019.

Octopus Investments’ analysis also revealed Lloyds, HSBC and Legal and General have fallen out of equity income managers’ 10 most popular stocks, replaced by Imperial Brands, Relx and Phoenix Group (see table).

The 10 most popular stocks across the IA UK Equity Income sector

Source: Octopus Investments using Lipper data, 1 Jul ’20

Octopus observes despite the changes, a large portion of funds still rely on the same stocks to generate income. It found Glaxosmithkline is now the most popular stock, featuring in the top 10 of 80% (67) of all funds in the sector, up from 76% in January.

FP Octopus UK Multi Cap Income fund manager Chris McVey says: “As you would expect, income fund managers have had to adapt to the new environment, and many have rebalanced their portfolio in response. Yet as these figures show, the overall picture remains very similar, with significant concentration risk across the traditional UK equity income sector.

“Given how important this income is for the millions who use it to supplement their pensions, the dividend cuts of recent months should demonstrate the need for genuine diversification. However, as this data shows, simply investing in different income funds won’t necessarily give you diversification. This makes it crucial to look closely at the underlying holdings.”

Concentration becomes an issue among income funds

AJ Bell’s Dividend Dashboard report for Q2 also reveals dividend concentration remains high. It found 20 firms expect to generate 74% of the FTSE 100 total payout in 2020 while just 10 stocks are forecast to pay out 55% of this year’s total, worth £34.1bn.

BP is one of the few FTSE 100 firms to have paid a dividend in Q1 2020 of about £1.7bn and is estimated to pay £6.7bn for the year. But AJ Bell says its status as the index’s largest single payer presents investors with a conundrum – will it cut in the future?

“Sector rival Shell has already cut its dividend and BP has form in this respect, having slashed its pay-out in 1992 and then again after the Gulf of Mexico oil rig disaster in 2010,” the report says. “Falling oil and gas prices are pressuring its cash flow, new boss Bernard Looney wished to reinvent the firm so it is ready for a low carbon future and net debt is way higher than a decade ago.

“A cut would not be the biggest surprise in the world and were that to come to pass – despite Mr Looney’s public recognition of the importance of the divided to shareholders – that would be the latest example of a double-digit dividend yield that proved too much for a company to sustain.”

ESG factors have driven dividend cuts

BP is the top holding in the Gam UK Equity Income portfolio at 4.5% of the fund. Co-manager Adrian Gosden (pictured) says of the Octopus findings: “It is quite notable how oil and banks are absent from most portfolios’ top 10. Rightly so, as they have been poor performers with the likes of Lloyds down 50% and BP down 40% in 2020 year to date.”

Gosden notes the likes of Shell and BP have been sold from portfolios as the oil price has fallen from about $60 WTI at the start of 2020 to $40 currently. “Shell cutting the dividend for the first time since the Second World War was notable, but for me it was the how aggressively they did it that caught my eye,” he adds.

But he says it’s for more than just economic reasons that oil majors have cut dividends and their shares are unloved; it’s also down to their move to become more ESG friendly.

“They need to get green and this is the reason behind the dividend cut,” he says. “They need to buy renewables. Building renewables is fine but they need to accelerate this progress by buying assets. Shell has reduced the cost of issuing shares markedly by reducing the dividend so drastically. Now watch as they issue equity, as they did for BG Group, and buy ‘green’.”

Gosden says BP has been disposing well, citing its sale last month of its petrochemicals business to Ineos and talk of offloading its stake in Russia’s state-backed oil firm Rosneft, but he expects it will also “reshape”, or cut, its dividend and buy more renewables. “It is going to be a busy few years at BP,” he says.

That said, Gosden also notes that ESG has not held back the mining sector with Rio Tinto’s share price having gone from £30 in March to close to £50 in July despite its announcement to power a new copper mine in Mongolia using coal.

Let’s hope oil majors don’t meet the same fate as tobacco firms

“The question for most investors is: do I need to own them? They are old school and cutting dividends. When all you read about is Tesla’s meteoric rise – up 57% in the last month – it is hard to envisage any future that is not electric,” says Gosden.

“I feel they have been caught in a perfect storm of an economic downturn caused by a pandemic and the rise of ESG and all things technology. However, they generate cash and they are on a journey to diversify their income streams.

“Others have done that but let’s hope they don’t meet the same fate as tobacco and become excluded from portfolios for ethical reasons.”