Octopus Portfolio Manager (OPM) is to merge with LGT Vestra’s Volare Fund Range on 14 April.

The move has been approved by the FCA and OPM’s authorised corporate director.

Since it was launched 12 years, Octopus said there has been a huge increase in the number of firms offering discretionary management services.

“While we are proud of the returns we have delivered […], we do not believe that OPM is as competitive as other funds available on the market,” it added.

Octopus said it “will receive no financial payment as part of this transaction”.

Ongoing charges figure to rise

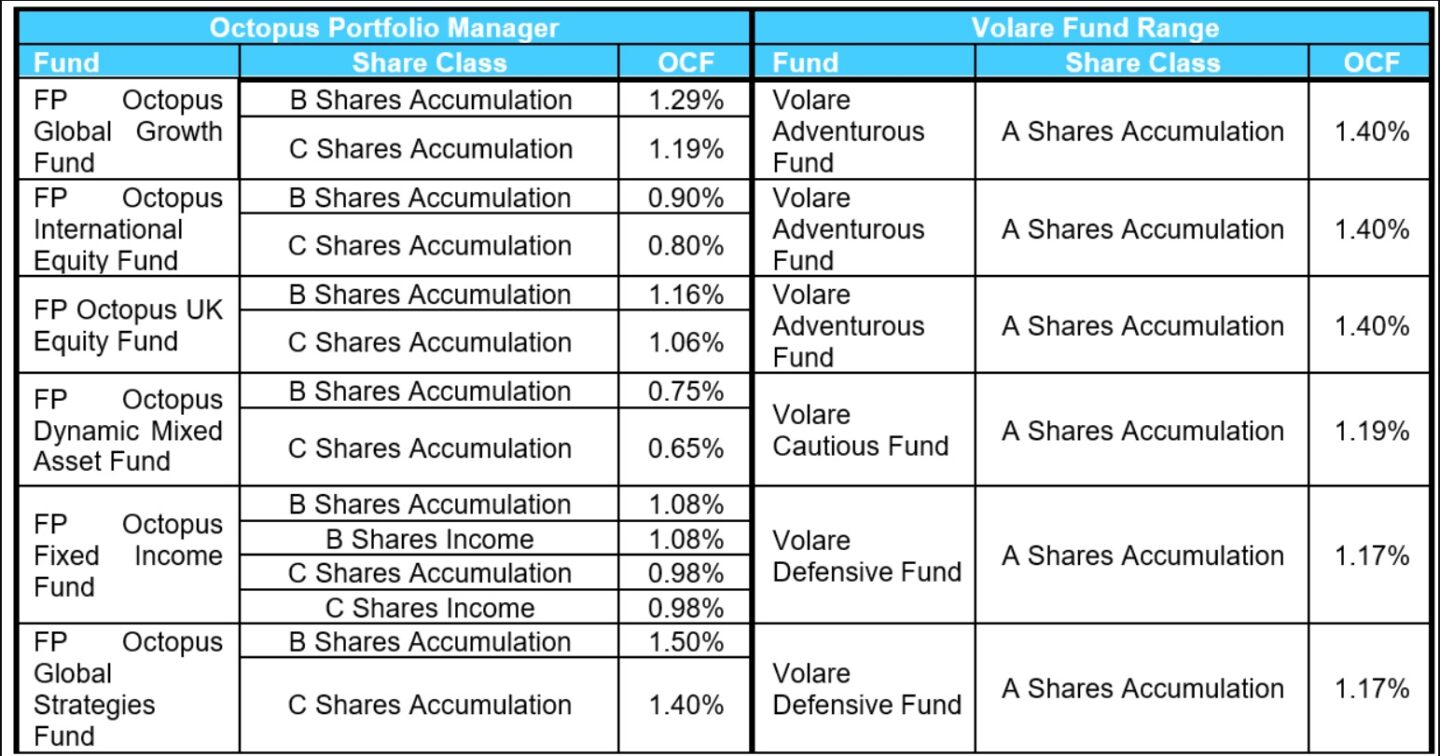

The change will see most OPM customers pay a higher ongoing charges figure (OCF).

Direct shareholders (C shares) and those invested via third-party platforms (B shares) in the Octopus Dynamic Mixed Asset fund, the cheapest in the range, will see charges hiked from 0.65% and 0.75% respectively to 1.19%, for instance.

But those in the more expensive Octopus Global Strategies fund (1.50% for B shares and 1.40% for C shares) will see a lower OCF of 1.17%.

“While the OCF of the Volare funds is higher than the OPM funds,” Octopus added, “they do not attract a discretionary management fee, and include LGT Vestra’s annual management charge of 0.35%.”

LGT Vestra also charges a 0.25% custody fee.

It added that the “charges being applied will vary from client to client” and said LGT Vestra would be in contact with financial advisers.

Broadly aligned strategies

Between 14 April and 28 July 2022, Octopus will continue to hold the Volare funds in its custody, to give advisers time to complete the necessary LGT Vestra paperwork or transfer assets to another provider or liquidate them.

Octopus said it chose the wealth management firm, which has £21bn in assets under management, because it was “confident in the quality of their team and investment approach”.

The Volare Fund Range was launched in 2017 and its volatility bands, asset class, geographical composition and investment objectives are broadly aligned with the OPM funds, the firm added.

You might also like…