By Natalie Kenway

Green bond and climate transition strategies were the most popular sustainable funds in 2023, according to a Morningstar report, due to investors’ “unwaning demand” to finance decarbonisation projects and regulatory advancements.

The report Investing in Times of Climate Change said despite looming recession risks and continued geopolitical tensions, green bond strategies saw the most significant asset growth expanding by 42% in 2023, while low carbon and climate transition strategies experienced growth of 30% and 24% respectively.

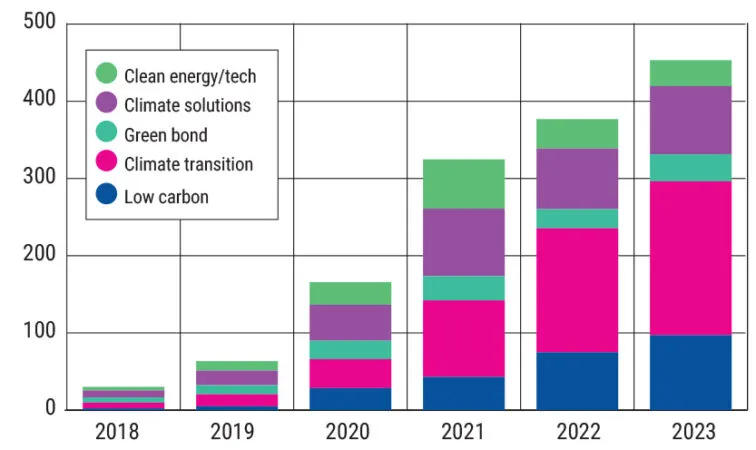

Overall, assets in climate funds grew to a new peak in 2023 reaching $453bn – a 20% increase on the previous year, said the report. However, by contrast clean energy/tech funds stood out as the sole category to see a loss in 2023, declining by 12%.

“Along with the unwaning demand to finance capital-intensive decarbonisation projects, regulatory advancements remained a key driver for the development of green bond strategies,” the report noted.

“In November 2023, the EU Council adopted the European Green Bond Standard, marking the last major step for the establishment of a new European Green Bonds Label, which aims to address greenwashing and helps advance the sustainable finance market in the EU. The new regulation also includes voluntary disclosure guidelines for other environmentally sustainable bonds and sustainability-linked bonds issued in the EU.”

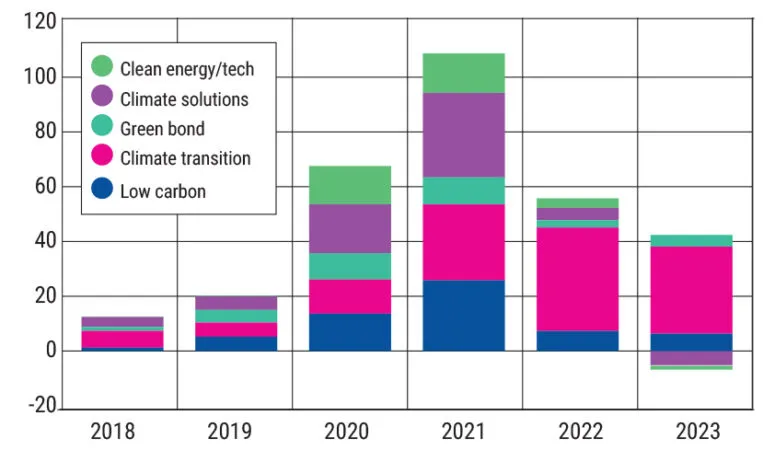

Annual flows of European climate funds in $bn

Assets in European climate funds in $bn

Looking at the wider landscape, Morningstar reported climate funds annual flows declined $35bn, compared with the previous year’s $57bn inflows. However, these still represented almost half of the total inflows into funds in 2023, the report said. By comparison, European sustainable funds collected $74bn last year, while traditional funds registered outflows of $30bn.

The BlackRock Climate Transition World Equity fund was the most popular fund with inflows of $5.3bn. BlackRock’s passive range iShares took three of the other top five spots in the flow leaders table with investors favouring the iShares MSCI USA ESG Enhanced, MSCI Europe ESG Enhanced and MSCI EM ESG Enhanced ETFs.

Morningstar also commented on the “unstoppable rise” in passive climate strategies with index funds and ETFs focused on climate pocketing 91% of the region’s overall climate funds’ inflows in 2023. Climate Transition funds pocketed over $26bn, which took up over four fifths of the entire inflows into the passive European climate strategies.

“Passive funds with a climate flavour totalled $256bn at the end of 2023, expanding by 36% from 2022 and by 113% in the last three years.”

The report explained that the proliferation of passive climate funds has been helped by the continued innovation in indexing, improved ESG and climate data quality, and the 2019 Regulation on the EU Climate Transition Benchmarks.

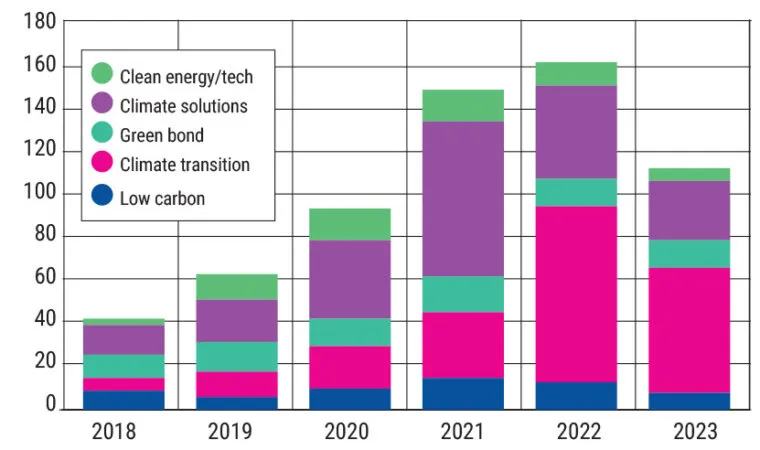

Number of European climate fund launches

In terms of product development, in line with the broader fund universe, European climate funds saw a slowdown in the number of launches recording 115 in 2023 compared to 169 in 2022.

“The deceleration in product development was mostly evident for the climate solution category where new launches almost halved. Climate Transition strategies took up over half of the new launches, followed by Climate Solutions funds and Green Bond funds,” the report said.

Further, rebranding and repurposing activity also subdued after racking up a record high of 66 in 2022, which consisted mostly of passive products converted to Paris-aligned or climate transition strategies.

Hortense Bioy (pictured), global director of sustainability research at Morningstar, commented: “The global landscape of climate funds continued to grow last year despite the challenging macroenvironment of high interest rates and inflation which plagued green sectors, especially renewable energy.

“One area worth monitoring is climate transition and Paris-aligned funds. These strategies have expanded significantly in the past couple of years and can be expected to evolve as investors intensify their scrutiny of companies’ transition plan and demand better management of climate risks.”

This article was originally published by our sister publication, PA Future